2405 Grant Ct Unit 2405 Norristown, PA 19403

West Norriton Township NeighborhoodEstimated Value: $422,837 - $438,000

4

Beds

3

Baths

2,236

Sq Ft

$192/Sq Ft

Est. Value

About This Home

This home is located at 2405 Grant Ct Unit 2405, Norristown, PA 19403 and is currently estimated at $429,959, approximately $192 per square foot. 2405 Grant Ct Unit 2405 is a home located in Montgomery County with nearby schools including Charles Blockson Middle School, Paul V Fly Elementary School, and East Norriton Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 4, 2021

Sold by

Marley Cheryl L

Bought by

Marley Michael H and Marley Cheryl L

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$252,000

Outstanding Balance

$227,657

Interest Rate

2.9%

Mortgage Type

New Conventional

Estimated Equity

$202,302

Purchase Details

Closed on

Jul 27, 2011

Sold by

Marley Cheryl Lynn and Andrews Cheryl Lynn

Bought by

Marley Cheryl Lynn

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$253,500

Interest Rate

4.51%

Purchase Details

Closed on

Mar 22, 2001

Sold by

Male Theron J and Male Tracy A

Bought by

Andrews Cheryl Lynn

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Marley Michael H | -- | None Available | |

| Marley Cheryl Lynn | -- | None Available | |

| Andrews Cheryl Lynn | $169,900 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Marley Michael H | $252,000 | |

| Closed | Marley Cheryl Lynn | $253,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,649 | $136,090 | $24,850 | $111,240 |

| 2024 | $6,649 | $136,090 | $24,850 | $111,240 |

| 2023 | $6,574 | $136,090 | $24,850 | $111,240 |

| 2022 | $6,531 | $136,090 | $24,850 | $111,240 |

| 2021 | $6,492 | $136,090 | $24,850 | $111,240 |

| 2020 | $6,298 | $136,090 | $24,850 | $111,240 |

| 2019 | $6,157 | $136,090 | $24,850 | $111,240 |

| 2018 | $4,778 | $136,090 | $24,850 | $111,240 |

| 2017 | $5,813 | $136,090 | $24,850 | $111,240 |

| 2016 | $5,760 | $136,090 | $24,850 | $111,240 |

| 2015 | $5,337 | $136,090 | $24,850 | $111,240 |

| 2014 | $5,337 | $136,090 | $24,850 | $111,240 |

Source: Public Records

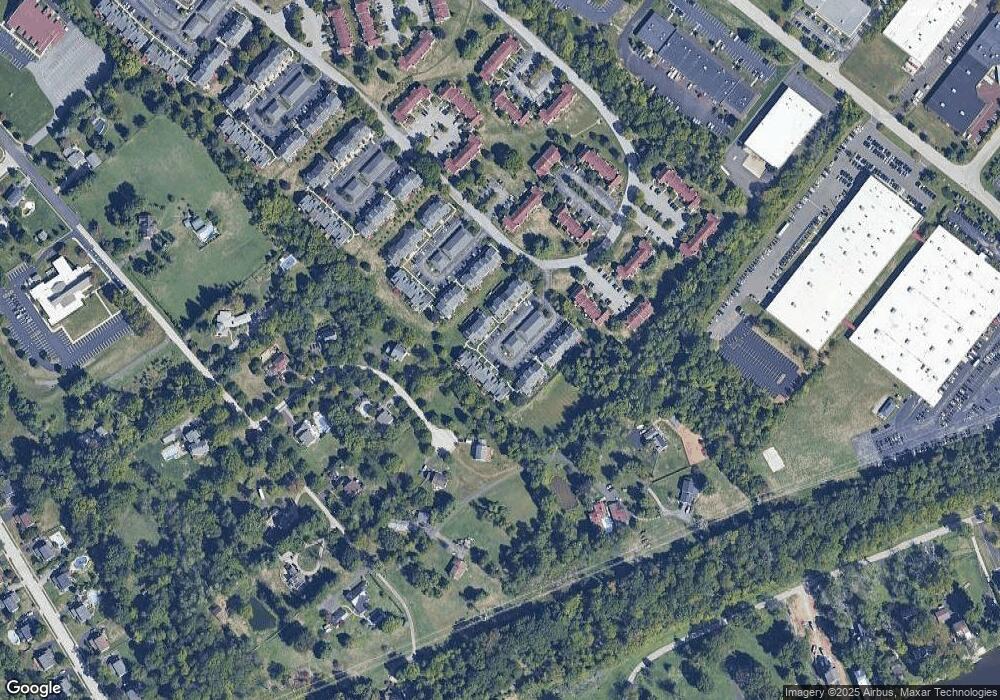

Map

Nearby Homes

- 2504 Grant Ct

- 1503 Reagan Ct

- 365 Norris Hall Ln

- 0 Roosevelt Blvd

- 2447 Hillside Dr

- 2017 Yorktown S

- 2012 Yorktown S

- 526 Bassett Ln

- 548 Susan Dr

- 1914 Yorktown S

- 735 Champlain Dr

- 213 River Trail Cir

- 254 River Trail Cir

- Shannon Plan at River Trail at Valley Forge

- Harper Grand Plan at River Trail at Valley Forge

- Finely II Plan at River Trail at Valley Forge

- 115 River Trail Cir

- 117 River Trail Cir

- 110 Lizabetta Ln Unit 82

- 1905 Yorktown N

- 2406 Grant Ct

- 2404 Grant Ct Unit 2404

- 2403 Grant Ct

- 2407 Grant Ct

- 2402 Grant Ct Unit 2402

- 2408 Grant Ct

- 2401 Grant Ct Unit 2401

- 2501 Grant Ct Unit 2501

- 2502 Grant Ct

- 2304 Grant Ct Unit 2304

- 2303 Grant Ct

- 2503 Grant Ct Unit 2503

- 2301 Grant Ct

- 2601 Grant Ct Unit 2601

- 2206 Grant Ct Unit 2206

- 2602 Grant Ct

- 2205 Grant Ct Unit 22

- 2001 Harrison Ct

- 2603 Grant Ct

- 2002 Harrison Ct