2406 Midway Ave Grants Pass, OR 97527

Estimated Value: $741,589 - $768,000

4

Beds

2

Baths

2,320

Sq Ft

$325/Sq Ft

Est. Value

About This Home

This home is located at 2406 Midway Ave, Grants Pass, OR 97527 and is currently estimated at $754,795, approximately $325 per square foot. 2406 Midway Ave is a home located in Josephine County with nearby schools including Ft. Vannoy Elementary School, Lincoln Savage Middle School, and Hidden Valley High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 19, 2006

Sold by

Johnson Randall and Johnson Johnna

Bought by

King David L and King Margaret J

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$260,000

Outstanding Balance

$150,789

Interest Rate

6.52%

Mortgage Type

Fannie Mae Freddie Mac

Estimated Equity

$604,006

Purchase Details

Closed on

Apr 21, 2005

Sold by

Faszer Herbert and Faszer Dwayne

Bought by

Johnson Randall and Johnson Johnna

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$320,000

Interest Rate

5.37%

Mortgage Type

Fannie Mae Freddie Mac

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| King David L | $459,000 | First American | |

| Johnson Randall | $400,000 | First American |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | King David L | $260,000 | |

| Previous Owner | Johnson Randall | $320,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,534 | $492,420 | -- | -- |

| 2024 | $3,534 | $478,080 | -- | -- |

| 2023 | $2,974 | $464,160 | $0 | $0 |

| 2022 | $2,913 | $450,650 | -- | -- |

| 2021 | $2,730 | $437,530 | $0 | $0 |

| 2020 | $2,848 | $424,790 | $0 | $0 |

| 2019 | $2,733 | $412,420 | $0 | $0 |

| 2018 | $2,771 | $400,410 | $0 | $0 |

| 2017 | $2,770 | $388,750 | $0 | $0 |

| 2016 | $2,344 | $377,430 | $0 | $0 |

| 2015 | $2,203 | $356,610 | $0 | $0 |

| 2014 | $2,147 | $346,230 | $0 | $0 |

Source: Public Records

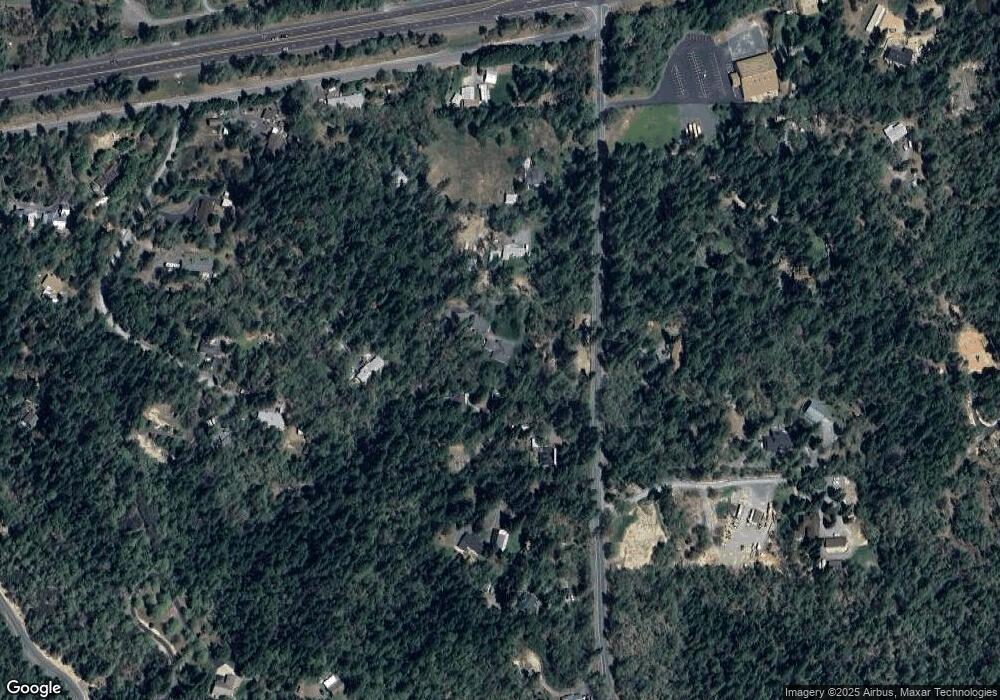

Map

Nearby Homes

- 0 Redwood Hwy Unit 220200455

- 0 Redwood Hwy Unit 677188456

- 1900 Midway Ave

- 1752 Rounds Ave

- 3601 Campus View Dr

- 2593 Midway Ave

- 3615 Redwood Hwy

- 3340 Redwood Hwy Unit 601

- 2957 Woodland Park Rd

- 1780 Southgate Way

- 2868 Woodland Park Rd

- 2100 Robinson Rd

- 2424 Robinson Rd

- 2709 Jerome Prairie Rd

- 0 Woodland Park Rd

- 3313 Redwood Ave

- 5076 Leonard Rd Unit 69

- 5076 Leonard Rd Unit 117

- 1885 Hubbard Ln

- 3597 Leonard Rd

- 2366 Midway Ave

- 2424 Midway Ave

- 2336 Midway Ave

- 2450 Midway Ave

- 2388 Midway Ave

- 2413 Midway Ave

- 2300 Midway Ave

- 2498 Midway Ave

- 2299 Midway Ave

- 2318 Midway Ave

- 177 Timberridge Rd

- 2500 Midway Ave

- 300 Firwood Dr

- 2443 Midway Ave

- 2255 Midway Ave

- 265 Timberridge Rd

- 2497 Midway Ave

- 247 Firwood Dr

- 301 Timberridge Rd

- 189 Firwood Dr