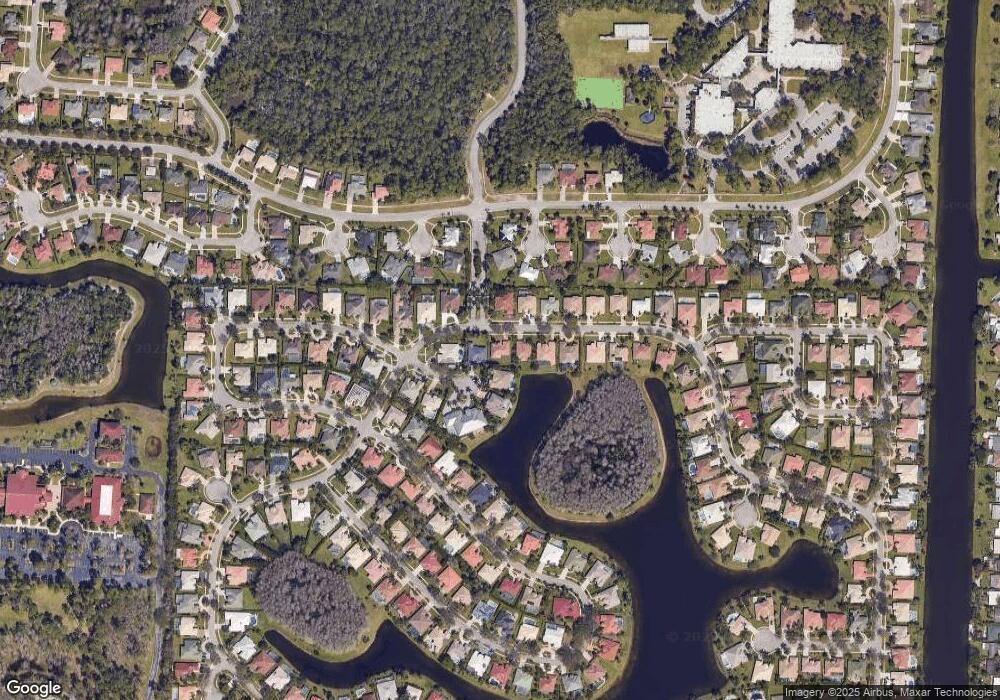

241 Cypress Trace Royal Palm Beach, FL 33411

Crestwood NeighborhoodEstimated Value: $552,062 - $637,000

4

Beds

2

Baths

1,997

Sq Ft

$302/Sq Ft

Est. Value

About This Home

This home is located at 241 Cypress Trace, Royal Palm Beach, FL 33411 and is currently estimated at $602,516, approximately $301 per square foot. 241 Cypress Trace is a home located in Palm Beach County with nearby schools including Cypress Trails Elementary School, Crestwood Community Middle School, and Royal Palm Beach High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 25, 2013

Sold by

Korasadowicz Elzbieta and Korasadowicz Elizabeth M

Bought by

Korasadowicz Elzbieta M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$202,150

Outstanding Balance

$151,349

Interest Rate

4.33%

Mortgage Type

New Conventional

Estimated Equity

$451,167

Purchase Details

Closed on

Jul 10, 2009

Sold by

Howard Rudolph and Rudolph Elzbieta M

Bought by

Korasadowicz Elizabeth M

Purchase Details

Closed on

May 30, 2001

Sold by

Royal Professional Builders

Bought by

Rudolph Howard M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$110,000

Interest Rate

7.11%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jan 3, 2001

Sold by

Urbandale Royal P B Inc

Bought by

Royal Professional Builders Inc

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Korasadowicz Elzbieta M | -- | None Available | |

| Korasadowicz Elizabeth M | -- | Attorney | |

| Rudolph Howard M | $168,900 | -- | |

| Royal Professional Builders Inc | $40,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Korasadowicz Elzbieta M | $202,150 | |

| Closed | Royal Professional Builders Inc | $110,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,404 | $217,711 | -- | -- |

| 2023 | $3,309 | $211,370 | $0 | $0 |

| 2022 | $3,259 | $205,214 | $0 | $0 |

| 2021 | $3,229 | $199,237 | $0 | $0 |

| 2020 | $3,199 | $196,486 | $0 | $0 |

| 2019 | $3,149 | $192,068 | $0 | $0 |

| 2018 | $2,989 | $188,487 | $0 | $0 |

| 2017 | $2,955 | $184,610 | $0 | $0 |

| 2016 | $2,950 | $180,813 | $0 | $0 |

| 2015 | $3,015 | $179,556 | $0 | $0 |

| 2014 | $3,020 | $178,131 | $0 | $0 |

Source: Public Records

Map

Nearby Homes

- 244 Cypress Trace

- 221 Cypress Trace

- 225 Park Rd N

- 130 Pepper Tree Crescent

- 110 Jacaranda Ct

- 114 Sycamore Dr

- 103 Cypress Trace

- 126 Chestnut Cir

- 12022 W Greenway 206 Dr Unit 206

- 165 Cypress Trace

- 12025 W Greenway Dr Unit 104

- 12022 W Greenway Dr Unit 204

- 12021 W Greenway Dr Unit 206

- 12026 Greenway Cir S Unit 102

- 12016 Greenway Cir S Unit 204

- 12016 Greenway Cir S Unit 108

- 12014 Greenway Cir S Unit 109

- 12019 W Greenway Dr Unit 203

- 12019 W Greenway Dr Unit 205

- 12003 Poinciana Blvd Unit 205

- 239 Cypress Trace

- 247 Ponderosa Ct

- 249 Ponderosa Ct

- 237 Cypress Trace

- 242 Cypress Trace

- 245 Ponderosa Ct

- 251 Ponderosa Ct

- 240 Cypress Trace

- 238 Cypress Trace

- 235 Cypress Trace

- 236 Cypress Trace

- 255 Ponderosa Ct

- 206 Park Rd N

- 246 Cypress Trace

- 257 Ponderosa Ct

- 204 Park Rd N

- 214 Park Rd N

- 259 Ponderosa Ct

- 248 Cypress Trace

- 234 Cypress Trace