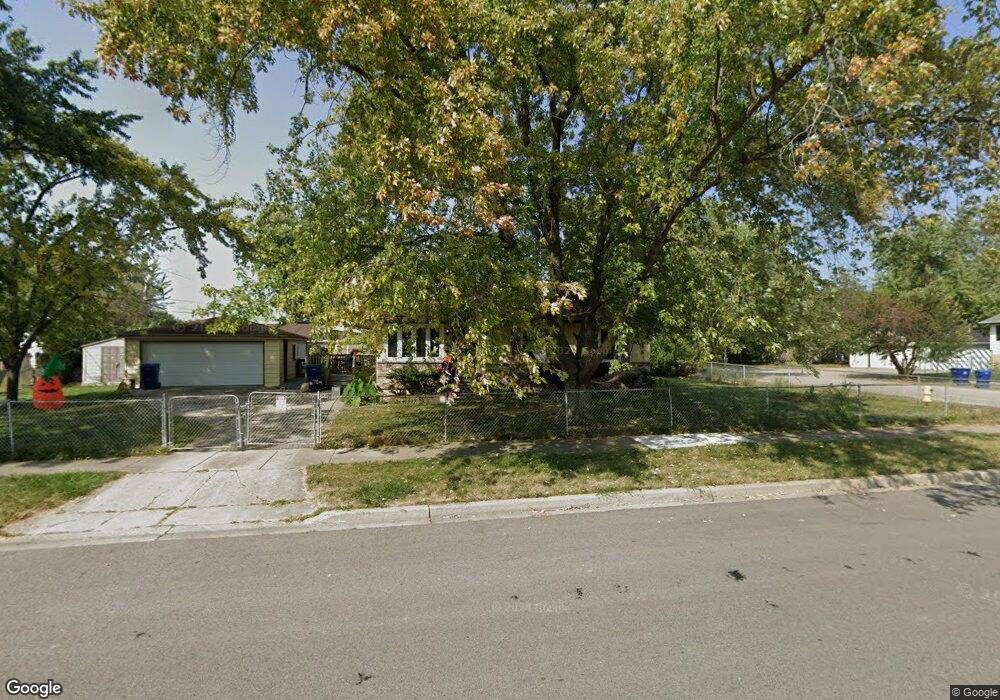

2410 Edgewood Rd Waukegan, IL 60087

Estimated Value: $172,000 - $243,000

3

Beds

1

Bath

1,008

Sq Ft

$203/Sq Ft

Est. Value

About This Home

This home is located at 2410 Edgewood Rd, Waukegan, IL 60087 and is currently estimated at $205,021, approximately $203 per square foot. 2410 Edgewood Rd is a home located in Lake County with nearby schools including H R McCall Elementary School, Jack Benny Middle School, and Waukegan High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 16, 2025

Sold by

Lewis Ashley and Lewis Richard

Bought by

Coon Stephen W

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$151,098

Outstanding Balance

$150,135

Interest Rate

7.25%

Mortgage Type

FHA

Estimated Equity

$54,886

Purchase Details

Closed on

Dec 22, 2022

Sold by

Lewis Ashley

Bought by

Lewis Ashley and Lewis Richard

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$99,563

Interest Rate

6.63%

Mortgage Type

FHA

Purchase Details

Closed on

May 10, 2018

Sold by

Henson Mackie D and Henson Ruth G

Bought by

Henson Mackie D and Henson Ruth G

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Coon Stephen W | $165,000 | Chicago Title | |

| Lewis Ashley | -- | -- | |

| Lewis Ashley | $101,500 | Proper Title | |

| Henson Mackie D | -- | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Coon Stephen W | $151,098 | |

| Previous Owner | Lewis Ashley | $99,563 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $4,491 | $63,837 | $5,891 | $57,946 |

| 2023 | $3,646 | $56,181 | $5,687 | $50,494 |

| 2022 | $3,646 | $43,743 | $5,555 | $38,188 |

| 2021 | $3,770 | $42,631 | $5,414 | $37,217 |

| 2020 | $3,877 | $40,683 | $5,167 | $35,516 |

| 2019 | $4,010 | $38,598 | $4,902 | $33,696 |

| 2018 | $2,878 | $33,025 | $5,843 | $27,182 |

| 2017 | $2,806 | $31,068 | $5,497 | $25,571 |

| 2016 | $2,818 | $29,577 | $5,233 | $24,344 |

| 2015 | $2,673 | $27,125 | $4,799 | $22,326 |

| 2014 | $3,359 | $31,707 | $9,134 | $22,573 |

| 2012 | $4,168 | $32,949 | $9,492 | $23,457 |

Source: Public Records

Map

Nearby Homes

- 3211 Rugby Ct

- 3101 Country Club Ln

- 3411 N Lewis Ave

- 37966 N Cornell Rd

- 1730 W Beach Rd

- 38683 N Lewis Ave

- 12582 W Beach Rd

- 1636 Rice St

- 12312 W Audrey Ave

- 38127 N Shore Ave

- 38362 N Manor Ave

- 1612 Whitney St

- 38859 N Green Bay Rd

- 2613 N Lewis Ave

- 11345 W Carnahan Ave

- 37905 N Loyola Ave

- 11342-11364 W Wadsworth Rd

- 38697 N Cedar Ave

- 2708 Dana Ave

- 2705 Dana Ave

- 3404 Winhaven Dr

- 3401 Chatham Rd

- 3408 Winhaven Dr

- 3405 Chatham Rd

- 3405 Winhaven Dr

- 2415 Edgewood Rd

- 3412 Winhaven Dr

- 3334 Winhaven Dr

- 2312 Edgewood Rd

- 3415 Winhaven Dr

- 3333 Chatham Rd

- 3335 Winhaven Dr

- 3330 Winhaven Dr

- 2313 Herbert Dr

- 2308 Edgewood Rd

- 3400 Chatham Rd

- 2313 Edgewood Rd

- 3404 Chatham Rd

- 3329 Chatham Rd