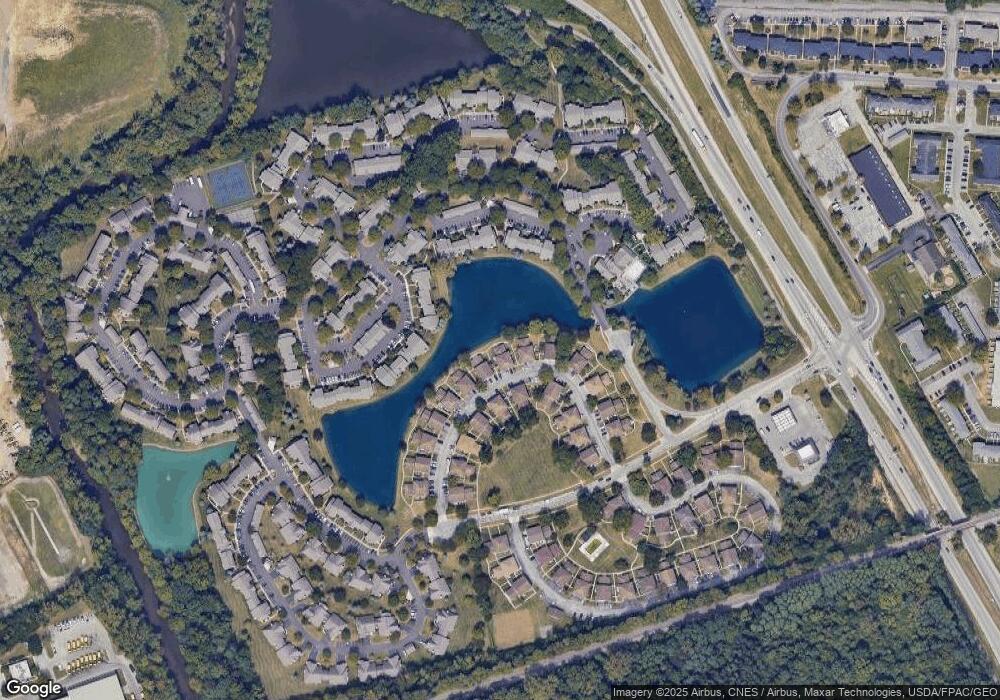

2412 Briers Dr Unit 51A Columbus, OH 43209

Estimated Value: $102,000 - $122,000

2

Beds

1

Bath

837

Sq Ft

$134/Sq Ft

Est. Value

About This Home

This home is located at 2412 Briers Dr Unit 51A, Columbus, OH 43209 and is currently estimated at $112,215, approximately $134 per square foot. 2412 Briers Dr Unit 51A is a home located in Franklin County with nearby schools including Easthaven Elementary School, Yorktown Middle School, and Independence High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 14, 2016

Sold by

Moyeer Joseph T

Bought by

Heintz Ryan D

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$36,800

Outstanding Balance

$29,340

Interest Rate

3.54%

Mortgage Type

New Conventional

Estimated Equity

$82,875

Purchase Details

Closed on

Dec 16, 2013

Sold by

Wehausen Fred A and Wehausen Judith

Bought by

Moyer Joseph T

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$40,325

Interest Rate

3.25%

Mortgage Type

Adjustable Rate Mortgage/ARM

Purchase Details

Closed on

Mar 5, 2008

Sold by

Garriott Tina M and Garriott Jack

Bought by

Wehausen Fred A and Wehausen Judith

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$40,000

Interest Rate

5.74%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Nov 26, 1996

Sold by

Schrickel Phillip B

Bought by

Garriott Tina M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$31,800

Interest Rate

7.94%

Mortgage Type

New Conventional

Purchase Details

Closed on

Aug 13, 1992

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Heintz Ryan D | $46,000 | None Available | |

| Moyer Joseph T | $42,500 | None Available | |

| Wehausen Fred A | $51,500 | Amerititle | |

| Garriott Tina M | $33,500 | -- | |

| -- | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Heintz Ryan D | $36,800 | |

| Previous Owner | Moyer Joseph T | $40,325 | |

| Previous Owner | Wehausen Fred A | $40,000 | |

| Previous Owner | Garriott Tina M | $31,800 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,114 | $24,820 | $5,250 | $19,570 |

| 2023 | $1,100 | $24,815 | $5,250 | $19,565 |

| 2022 | $732 | $14,110 | $2,210 | $11,900 |

| 2021 | $733 | $14,110 | $2,210 | $11,900 |

| 2020 | $734 | $14,110 | $2,210 | $11,900 |

| 2019 | $684 | $11,270 | $1,750 | $9,520 |

| 2018 | $702 | $11,270 | $1,750 | $9,520 |

| 2017 | $739 | $11,270 | $1,750 | $9,520 |

| 2016 | $796 | $12,010 | $2,380 | $9,630 |

| 2015 | $722 | $12,010 | $2,380 | $9,630 |

| 2014 | $724 | $12,010 | $2,380 | $9,630 |

| 2013 | $407 | $13,300 | $2,625 | $10,675 |

Source: Public Records

Map

Nearby Homes

- 2395 Briers Dr

- 2424 Ravenel Dr

- 2468 Natchez Dr Unit D

- 2639 Halleck Dr

- 3050 Peters St

- 2846 Petzinger Rd Unit 70

- 2866 Kingsrowe Ct Unit 38

- 2664 Sonata Dr

- 1782 Newfield Rd

- 1677 Kenview Rd

- 2567 Scottwood Rd

- 3036 Wadsworth Ct

- 3038 Wadsworth Ct

- 1866 Queensrowe Ct

- 2866 Landon Dr

- 2894 Landon Dr

- 1855 Zettler Rd

- 2103 Rochelle Place

- 1634 S James Rd

- 2275 Wadsworth Dr

- 2412 Briers Dr Unit A

- 2414 Briers Dr

- 2410 Briers Dr Unit 51C

- 2410 Briers Dr Unit C

- 2408 Briers Dr

- 2416 Briers Dr

- 2404 Briers Dr Unit B52

- 2402 Briers Dr

- 2418 Briers Dr

- 2406 Briers Dr

- 2406 Briers Dr Unit D

- 2420 Briers Dr

- 2420 Briers Dr Unit B

- 2422 Briers Dr

- 2400 Briers Dr

- 2409 Briers Dr Unit 40D

- 2415 Briers Dr

- 2415 Briers Dr Unit C

- 2398 Briers Dr

- 2426 Briers Dr