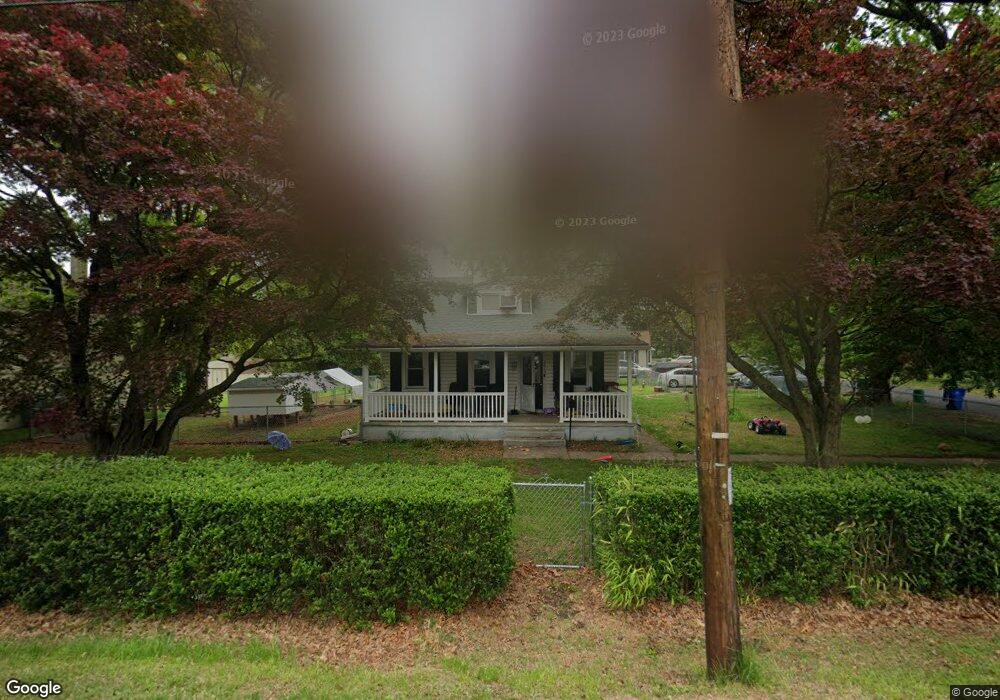

2413 State Rd Croydon, PA 19021

Estimated Value: $352,000 - $452,000

5

Beds

1

Bath

1,806

Sq Ft

$218/Sq Ft

Est. Value

About This Home

This home is located at 2413 State Rd, Croydon, PA 19021 and is currently estimated at $393,757, approximately $218 per square foot. 2413 State Rd is a home located in Bucks County with nearby schools including Truman Senior High School, Doane Academy, and St. Mark Elementary School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 8, 2016

Bought by

Piuma Debra L

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$152,921

Outstanding Balance

$121,816

Interest Rate

3.43%

Estimated Equity

$271,941

Purchase Details

Closed on

Feb 5, 2016

Sold by

Heldak Lischen and Heldak Edward Paul

Bought by

Hsbc Bank Usa Na

Purchase Details

Closed on

May 19, 1994

Sold by

Beears Robert L and Beears Mae Marshall

Bought by

Raap William and Raap Deborah L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$94,950

Interest Rate

8.44%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Piuma Debra L | -- | -- | |

| Hsbc Bank Usa Na | $1,297 | None Available | |

| Raap William | $105,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Piuma Debra L | $152,921 | |

| Closed | Piuma Debra L | -- | |

| Previous Owner | Raap William | $94,950 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,911 | $14,400 | $3,600 | $10,800 |

| 2024 | $3,911 | $14,400 | $3,600 | $10,800 |

| 2023 | $3,882 | $14,400 | $3,600 | $10,800 |

| 2022 | $3,882 | $14,400 | $3,600 | $10,800 |

| 2021 | $3,882 | $14,400 | $3,600 | $10,800 |

| 2020 | $3,882 | $14,400 | $3,600 | $10,800 |

| 2019 | $3,867 | $14,400 | $3,600 | $10,800 |

| 2018 | $3,805 | $14,400 | $3,600 | $10,800 |

| 2017 | $3,747 | $14,400 | $3,600 | $10,800 |

| 2016 | $3,747 | $14,400 | $3,600 | $10,800 |

| 2015 | $2,632 | $14,400 | $3,600 | $10,800 |

| 2014 | $2,632 | $14,400 | $3,600 | $10,800 |

Source: Public Records

Map

Nearby Homes

- 2307 State Rd

- 2506 State Rd

- 1901 Summit Ave

- 2057 Garfield Ave

- 2057 High St

- 200 Janet Ave

- 2320 Dixon Ave

- 500 Wyoming Ave

- 2349 Dixon Ave

- 2133 Maple Ave

- 1719 Dixon Ave

- 1041 Rosa Ave

- 1012 Franklin Ave

- 1 McLevins Ct

- 1005 Maryland Ave

- 1020 Hilary Ave

- 1000 Main Ave

- 2915 Lawnton Ave

- 910 Magnolia Ave

- 3208 Dixon Ave