2415 SW 102nd Ave Miramar, FL 33025

Avalon NeighborhoodEstimated Value: $557,000 - $602,000

3

Beds

2

Baths

1,713

Sq Ft

$339/Sq Ft

Est. Value

About This Home

This home is located at 2415 SW 102nd Ave, Miramar, FL 33025 and is currently estimated at $580,426, approximately $338 per square foot. 2415 SW 102nd Ave is a home located in Broward County with nearby schools including Sea Castle Elementary School, New Renaissance Middle School, and Miramar High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 18, 2005

Sold by

Rolle Wellington and Rolle Esperlean

Bought by

Galvin Randall and Galvin Sophia

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$256,000

Outstanding Balance

$92,500

Interest Rate

1%

Mortgage Type

Negative Amortization

Estimated Equity

$487,926

Purchase Details

Closed on

Jan 14, 1999

Sold by

Centex Homes

Bought by

Rolle Wellington and Rolle Esperlean

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$123,450

Interest Rate

6.72%

Mortgage Type

New Conventional

Purchase Details

Closed on

May 30, 1997

Sold by

Ansin Edmund N and Ansin Ronald M

Bought by

Centex Homes

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Galvin Randall | $320,000 | Partners Title Inc | |

| Rolle Wellington | $133,000 | -- | |

| Centex Homes | $3,319,200 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Galvin Randall | $256,000 | |

| Previous Owner | Centex Homes | $123,450 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,775 | $203,940 | -- | -- |

| 2024 | $3,677 | $198,200 | -- | -- |

| 2023 | $3,677 | $192,430 | $0 | $0 |

| 2022 | $3,407 | $186,830 | $0 | $0 |

| 2021 | $3,341 | $181,390 | $0 | $0 |

| 2020 | $3,301 | $178,890 | $0 | $0 |

| 2019 | $3,257 | $174,870 | $0 | $0 |

| 2018 | $3,127 | $171,610 | $0 | $0 |

| 2017 | $3,012 | $168,090 | $0 | $0 |

| 2016 | $2,994 | $164,640 | $0 | $0 |

| 2015 | $2,987 | $163,500 | $0 | $0 |

| 2014 | $2,940 | $162,210 | $0 | $0 |

| 2013 | -- | $161,840 | $39,900 | $121,940 |

Source: Public Records

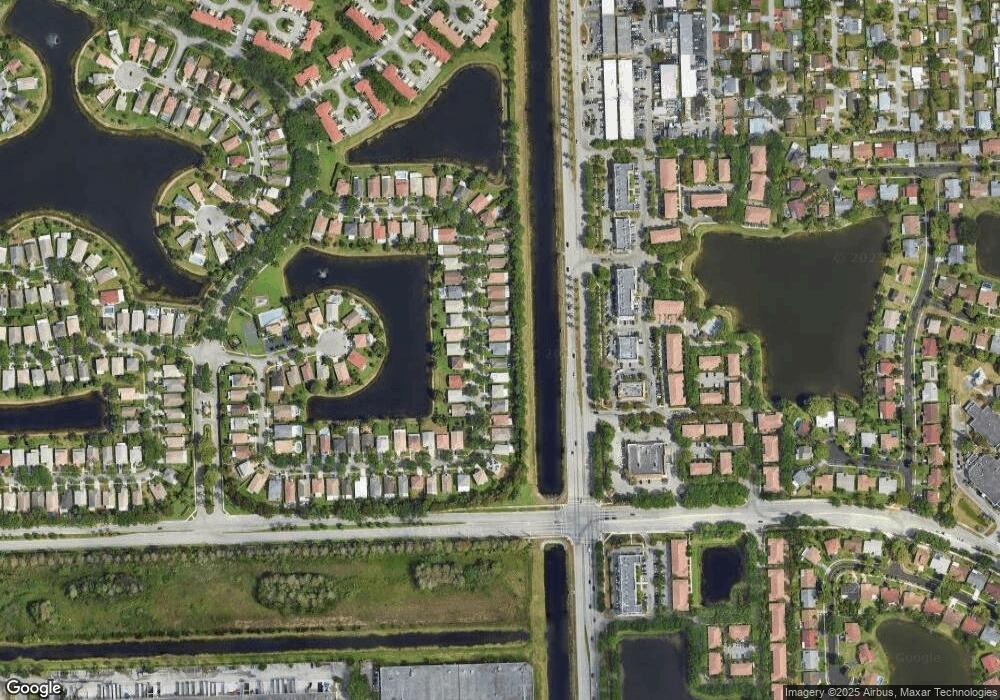

Map

Nearby Homes

- 2452 SW 99th Way

- 10161 SW 21st St

- 2771 River Run Cir W

- 10400 SW 24th Ct

- 1851 SW 101st Way

- 10219 SW 18th Ct

- 10471 SW 24th Ct

- 10320 SW 18th St

- 10311 SW 18th St

- 1845 SW 102nd Way

- 2472 SW 106th Ave

- 9701 Millpond Rd

- 1821 SW 98th Terrace

- 2011 SW 97th Terrace

- 1912 SW 97th Terrace

- 10510 SW 20th St

- 1710 SW 98th Terrace

- 3291 Kapot Terrace

- 9941 SW 16th St

- 10698 SW 21st St

- 2399 SW 102nd Ave

- 2429 SW 102nd Ave

- 2395 SW 102nd Ave

- 2381 SW 102nd Ave

- 2459 SW 102nd Ave

- 2416 SW 102nd Ave

- 2430 SW 102nd Ave

- 2400 SW 102nd Ave

- 2379 SW 102nd Ave

- 2461 SW 102nd Ave

- 2396 SW 102nd Ave

- 2446 SW 102nd Ave

- 2386 SW 102nd Ave

- 2445 SW 102nd Ave

- 2460 SW 102nd Ave

- 2371 SW 102nd Ave

- 2471 SW 102nd Ave

- 2380 SW 102nd Ave

- 2462 SW 102nd Ave

- 2481 SW 102nd Ave