2416 Tarpon Bay Dr Unit 82416 Miamisburg, OH 45342

Estimated Value: $147,100 - $165,000

2

Beds

2

Baths

1,056

Sq Ft

$144/Sq Ft

Est. Value

About This Home

This home is located at 2416 Tarpon Bay Dr Unit 82416, Miamisburg, OH 45342 and is currently estimated at $152,275, approximately $144 per square foot. 2416 Tarpon Bay Dr Unit 82416 is a home located in Montgomery County with nearby schools including Miamisburg High School, Bishop Leibold School, and Dayton Christian School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 21, 2004

Sold by

Hud

Bought by

Jefferson Mychael D

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$84,621

Outstanding Balance

$42,636

Interest Rate

6.46%

Mortgage Type

FHA

Estimated Equity

$109,639

Purchase Details

Closed on

Oct 9, 2003

Sold by

Mindling Conny I

Bought by

Hud

Purchase Details

Closed on

Jun 25, 1999

Sold by

Charles V Simms Development Corp

Bought by

Mindling Conny I

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$95,565

Interest Rate

7.68%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Jefferson Mychael D | $83,500 | Lakeside Title & Escrow Agen | |

| Hud | $80,000 | -- | |

| Mindling Conny I | $97,800 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Jefferson Mychael D | $84,621 | |

| Previous Owner | Mindling Conny I | $95,565 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,919 | $26,760 | $7,090 | $19,670 |

| 2023 | $1,919 | $26,760 | $7,090 | $19,670 |

| 2022 | $1,678 | $19,820 | $5,250 | $14,570 |

| 2021 | $1,587 | $19,820 | $5,250 | $14,570 |

| 2020 | $1,563 | $19,820 | $5,250 | $14,570 |

| 2019 | $1,651 | $18,980 | $7,140 | $11,840 |

| 2018 | $1,639 | $18,980 | $7,140 | $11,840 |

| 2017 | $1,631 | $18,980 | $7,140 | $11,840 |

| 2016 | $1,644 | $18,340 | $7,140 | $11,200 |

| 2015 | $1,617 | $18,340 | $7,140 | $11,200 |

| 2014 | $1,617 | $18,340 | $7,140 | $11,200 |

| 2012 | -- | $25,950 | $7,110 | $18,840 |

Source: Public Records

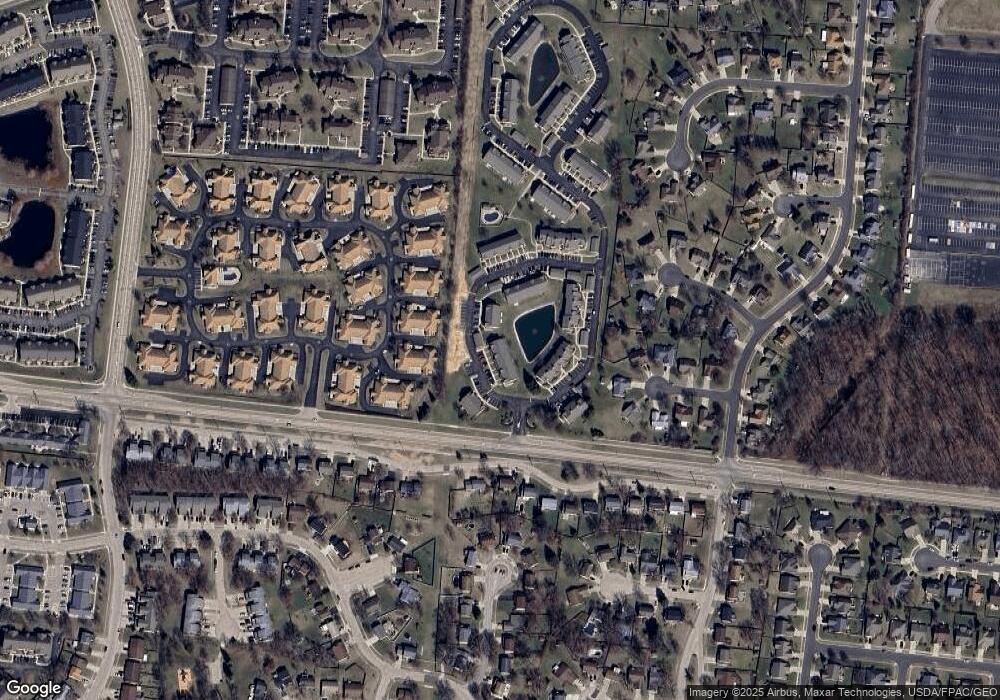

Map

Nearby Homes

- 9528 Summer Wind Trail

- 2115 Autumn Haze Trail

- 2378 Ferndown Dr

- 9616 Wild Ginger Way

- 2968 Asbury Ct

- 9406 Tahoe Dr Unit 19406

- 9604 Tahoe Dr

- 9588 Tahoe Dr

- 1794 Placid Dr

- 9607 Olde Georgetown

- 9553 Tahoe Dr

- 9540 Tahoe Dr

- 10001 Forestedge Ln

- 9515 Tahoe Dr

- 9519 Tahoe Dr

- 1963 Waterstone Blvd Unit 104

- 2540 Colinda Ct

- 9747 Cobblewood Ct

- 1875 Waterstone Blvd Unit 312

- 9251 Great Lakes Cir Unit 59251

- 2418 Tarpon Bay Dr Unit 2418

- 2418 Tarpon Bay Dr Unit 82418

- 2414 Tarpon Bay Dr Unit 82414

- 2405 Tarpon Bay Dr

- 2405 Tarpon Bay Dr Unit 2405

- 2405 Tarpon Bay Dr Unit 92405

- 2412 Tarpon Bay Dr Unit 82412

- 2410 Tarpon Bay Dr Unit 2410

- 2410 Tarpon Bay Dr Unit 82410

- 2410 Tarpon Bay Dr

- 2408 Tarpon Bay Dr Unit 82408

- 2422 Tarpon Bay Dr Unit 72422

- 2406 Tarpon Bay Dr Unit 82406

- 2424 Tarpon Bay Dr Unit 72424

- 2404 Tarpon Bay Dr Unit 82404

- 2426 Tarpon Bay Dr Unit 72426

- 2426 Tarpon Bay Dr Unit 2426

- 2426 Tarpon Bay Dr

- 2428 Tarpon Bay Dr Unit 72428

- 2428 Tarpon Bay Dr Unit 2428