2423 N County Road 810 Alvarado, TX 76009

Osage-North Fisk NeighborhoodEstimated Value: $260,570 - $475,000

--

Bed

--

Bath

1,200

Sq Ft

$300/Sq Ft

Est. Value

About This Home

This home is located at 2423 N County Road 810, Alvarado, TX 76009 and is currently estimated at $359,893, approximately $299 per square foot. 2423 N County Road 810 is a home located in Johnson County with nearby schools including Alvarado High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 30, 2015

Sold by

Hoerig Jason and Hoerig Kamra

Bought by

Mann William P

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$56,216

Outstanding Balance

$44,556

Interest Rate

4.5%

Mortgage Type

FHA

Estimated Equity

$315,337

Purchase Details

Closed on

Mar 11, 2014

Sold by

Mann Dan and Mann Graham Rhonda J

Bought by

Hoerig Jason and Hoerig Kamra

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$24,568

Interest Rate

4.44%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Mann William P | -- | Wfg National Title Ins Co | |

| Hoerig Jason | -- | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Mann William P | $56,216 | |

| Previous Owner | Hoerig Jason | $24,568 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $769 | $195,634 | $150,500 | $45,134 |

| 2024 | $2,108 | $118,964 | $0 | $0 |

| 2023 | $593 | $179,509 | $134,375 | $45,134 |

| 2022 | $1,847 | $135,434 | $90,300 | $45,134 |

| 2021 | $1,700 | $0 | $0 | $0 |

| 2020 | $1,627 | $0 | $0 | $0 |

| 2019 | $1,583 | $0 | $0 | $0 |

| 2018 | $1,439 | $0 | $0 | $0 |

| 2017 | $1,300 | $0 | $0 | $0 |

| 2016 | $1,300 | $0 | $0 | $0 |

| 2015 | $1,288 | $0 | $0 | $0 |

| 2014 | $1,288 | $0 | $0 | $0 |

Source: Public Records

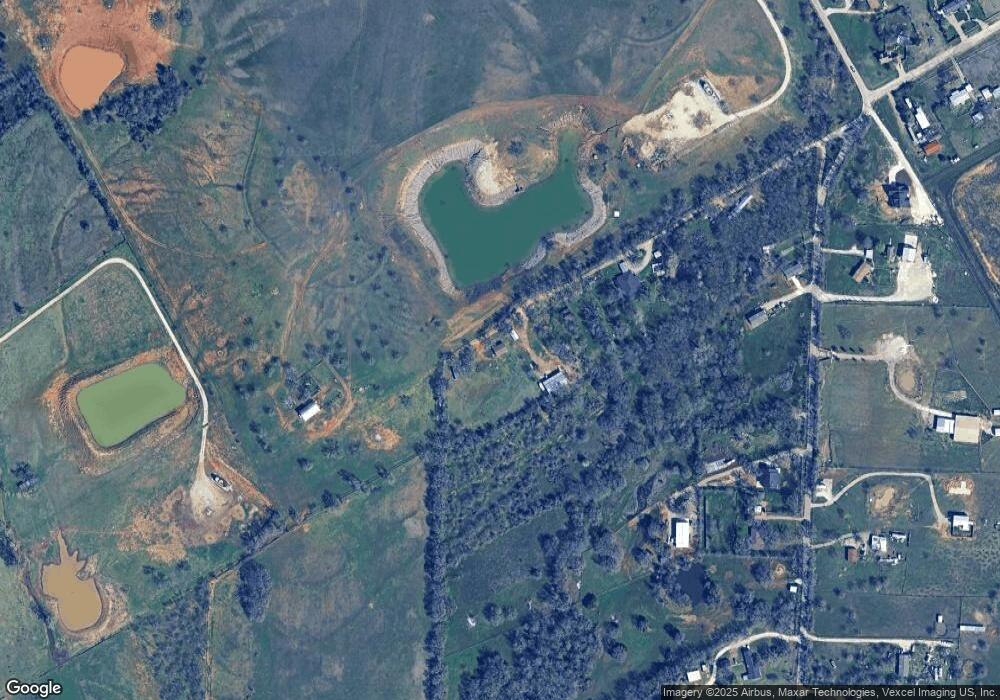

Map

Nearby Homes

- 2108 N County Road 810

- 4916 County Road 707

- 4620 County Road 707

- 3308 N County Road 810

- 6108 County Road 809

- 4105 Highland Oaks Ln

- 6625 Conveyor Dr

- 4032 Highland Oaks Ln

- 2001 Beauty Berry Ct

- 3813 Ponderosa Cir

- 5405 County Road 704d

- 4072 County Road 711d

- 6467 Asher Rd

- TBD County Road 703a

- 3205 Flora St

- 5227 County Road 703

- 5000 Highpoint Pkwy

- TBD Dan Rd

- 4519 County Road 711

- 803 Lakewood Dr

- 2417 N County Road 810

- 2321 N County Road 810

- 2341 N County Road 810

- 2361 N County Road 810

- 2217 N County Road 810

- 2432 N County Road 810

- 2201 N County Road 810

- 2436 N County Road 810

- 2340 N County Road 810

- TBD County Road 810 N

- 2113 N County Road 810

- 5301 Spring St

- 2508 County Road 810 N

- 2649 N County Road 810

- 2112 N County Road 810

- 5308 Spring St

- 2101 N County Road 810

- 707A&705 707 Main Rd

- 5316 Spring St

- 2017 N County Road 810