2429 Sardis Chase Ct Unit 314A Buford, GA 30519

Estimated Value: $337,000 - $358,113

3

Beds

3

Baths

1,944

Sq Ft

$178/Sq Ft

Est. Value

About This Home

This home is located at 2429 Sardis Chase Ct Unit 314A, Buford, GA 30519 and is currently estimated at $346,778, approximately $178 per square foot. 2429 Sardis Chase Ct Unit 314A is a home located in Gwinnett County with nearby schools including Ivy Creek Elementary School and Glenn C. Jones Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 9, 2025

Sold by

Howard Dejah Krissette

Bought by

Howard Dejah Krissette and Thomas Brittney

Current Estimated Value

Purchase Details

Closed on

Jul 16, 2020

Sold by

Sph Property Two Llc

Bought by

Howard Dejah Krissette

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$215,033

Interest Rate

3.1%

Mortgage Type

FHA

Purchase Details

Closed on

Jan 31, 2020

Sold by

Ramsey Trista Renee

Bought by

Sph Property Two Llc

Purchase Details

Closed on

Dec 29, 2015

Sold by

Watts Louis E

Bought by

Ramsey Trista Renee

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$156,750

Interest Rate

3.96%

Mortgage Type

New Conventional

Purchase Details

Closed on

Aug 16, 2010

Sold by

Winmark Homes Inc

Bought by

Watts Louis E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$137,547

Interest Rate

4.37%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Howard Dejah Krissette | -- | -- | |

| Howard Dejah Krissette | $219,000 | -- | |

| Sph Property Two Llc | $216,400 | -- | |

| Ramsey Trista Renee | $165,000 | -- | |

| Watts Louis E | $139,400 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Howard Dejah Krissette | $215,033 | |

| Previous Owner | Ramsey Trista Renee | $156,750 | |

| Previous Owner | Watts Louis E | $137,547 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,339 | $145,640 | $28,000 | $117,640 |

| 2024 | $5,448 | $145,600 | $22,160 | $123,440 |

| 2023 | $5,448 | $145,600 | $22,160 | $123,440 |

| 2022 | $4,559 | $121,440 | $18,800 | $102,640 |

| 2021 | $3,407 | $87,600 | $13,880 | $73,720 |

| 2020 | $3,537 | $90,640 | $13,880 | $76,760 |

| 2019 | $3,191 | $84,560 | $13,120 | $71,440 |

| 2018 | $2,894 | $76,040 | $11,400 | $64,640 |

| 2016 | $2,495 | $64,160 | $10,800 | $53,360 |

| 2015 | $2,321 | $64,160 | $10,800 | $53,360 |

| 2014 | -- | $61,000 | $10,800 | $50,200 |

Source: Public Records

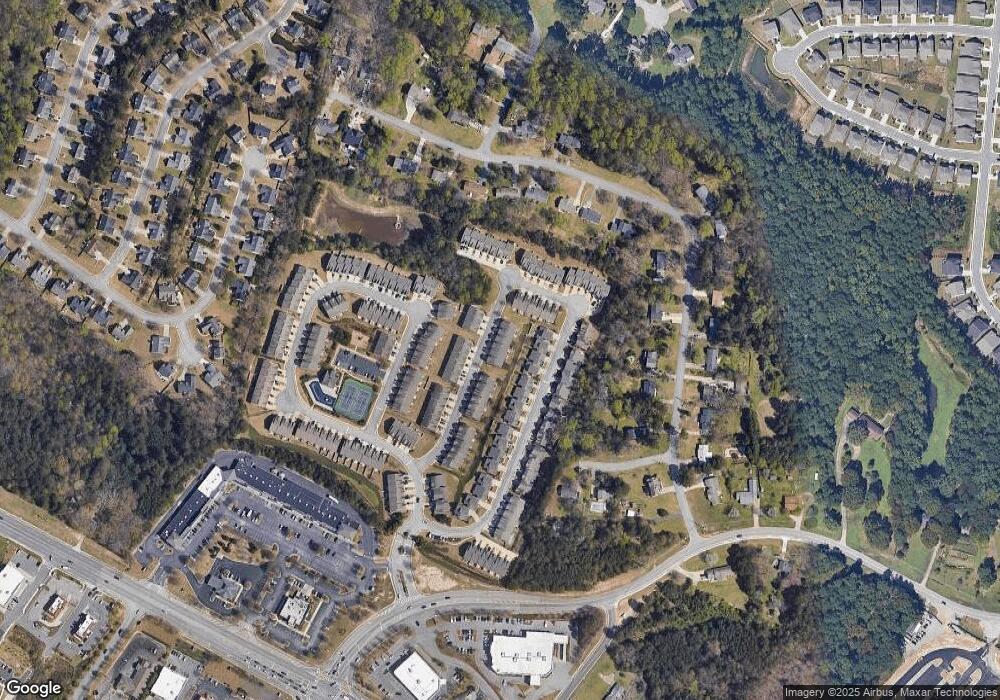

Map

Nearby Homes

- 2647 Sardis Chase Ct

- 2425 Sardis Chase Ct

- 2685 Sardis Chase Ct

- 2662 Sardis Chase Ct

- 2410 Sardis Chase Ct

- 3550 & 3570 Sardis Church Way

- 3675 Ridgehurst Ln

- 3617 Victoria Dr

- 3342 Sardis Bend Dr

- 2845 Sardis Dr

- 2649 Ogden Trail

- 3508 Cast Palm Dr

- 2716 Hamilton Mill

- 2898 Hamilton Mill Rd

- 2651 W Rock Quarry Rd NE

- 2631 W Rock Quarry Rd

- 2988 Hamilton Mill Rd

- 2626 Sardis Way

- 3190 Hampton Trace Ct

- 2840 General Lee Way

- 2431 Sardis Chase Ct Unit 2431

- 2431 Sardis Chase Ct

- 2431 Sardis Chase Ct Unit 313

- 2433 Sardis Chase Ct Unit 2433

- 2433 Sardis Chase Ct

- 2433 Sardis Chase Ct Unit 312

- 2429 Sardis Chase Ct

- 2435 Sardis Chase Ct

- 2427 Sardis Chase Ct

- 2427 Sardis Chase Ct Unit 2427

- 2427 Sardis Chase Ct Unit 315

- 2425 Sardis Chase Ct Unit 2425

- 2675 Sardis Chase Ct

- 2675 Sardis Chase Ct Unit 112A

- 2673 Sardis Chase Ct Unit 111

- 2673 Sardis Chase Ct Unit 2673

- 2673 Sardis Chase Ct

- 2673 Sardis Chase Ct

- 2677 Sardis Chase Ct Unit 113

- 2432 Sardis Chase Ct