243 Amanda Way Decatur, TX 76234

Estimated Value: $555,000 - $922,000

3

Beds

2

Baths

1,960

Sq Ft

$350/Sq Ft

Est. Value

About This Home

This home is located at 243 Amanda Way, Decatur, TX 76234 and is currently estimated at $685,865, approximately $349 per square foot. 243 Amanda Way is a home located in Wise County with nearby schools including Decatur High School and Victory Christian Academy.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 21, 2011

Sold by

Pigg Jackie D and Pigg Jonna

Bought by

Cox Robert R and Cox Lari J

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$219,000

Outstanding Balance

$149,955

Interest Rate

4.03%

Mortgage Type

New Conventional

Estimated Equity

$535,910

Purchase Details

Closed on

Aug 27, 2010

Sold by

Whiting John Hadley and Whiting Monica L

Bought by

Pigg Jackie D and Pigg Jonna

Purchase Details

Closed on

Jan 12, 2009

Sold by

Edomon Serena Virginia

Bought by

Whiting John Hadley and Whiting Minica L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$206,878

Interest Rate

5.48%

Mortgage Type

FHA

Purchase Details

Closed on

Feb 25, 2008

Sold by

Edgmon Randy B

Bought by

Edgmon Serena Virginia

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$157,000

Interest Rate

5.88%

Purchase Details

Closed on

Mar 26, 2003

Sold by

Boyd Derrick S and Boyd Cheri

Bought by

Cox Robert and Cox Lari

Purchase Details

Closed on

Jul 16, 1998

Bought by

Cox Robert and Cox Lari

Purchase Details

Closed on

Aug 18, 1987

Bought by

Cox Robert and Cox Lari

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Cox Robert R | -- | -- | |

| Pigg Jackie D | -- | -- | |

| Whiting John Hadley | -- | -- | |

| Edgmon Serena Virginia | -- | -- | |

| Cox Robert | -- | -- | |

| Cox Robert | -- | -- | |

| Cox Robert | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Cox Robert R | $219,000 | |

| Previous Owner | Whiting John Hadley | $206,878 | |

| Previous Owner | Edgmon Serena Virginia | $157,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,483 | $606,512 | -- | -- |

| 2024 | $5,483 | $549,259 | $0 | $0 |

| 2023 | $6,032 | $499,326 | $0 | $0 |

| 2022 | $6,966 | $453,933 | $0 | $0 |

| 2021 | $6,615 | $412,670 | $97,490 | $315,180 |

| 2020 | $6,400 | $396,700 | $89,990 | $306,710 |

| 2019 | $6,466 | $376,310 | $89,990 | $286,320 |

| 2018 | $6,164 | $372,660 | $89,990 | $282,670 |

| 2017 | $5,535 | $311,850 | $54,000 | $257,850 |

| 2016 | $4,824 | $271,740 | $54,000 | $217,740 |

| 2015 | -- | $270,110 | $54,000 | $216,110 |

| 2014 | -- | $227,650 | $47,990 | $179,660 |

Source: Public Records

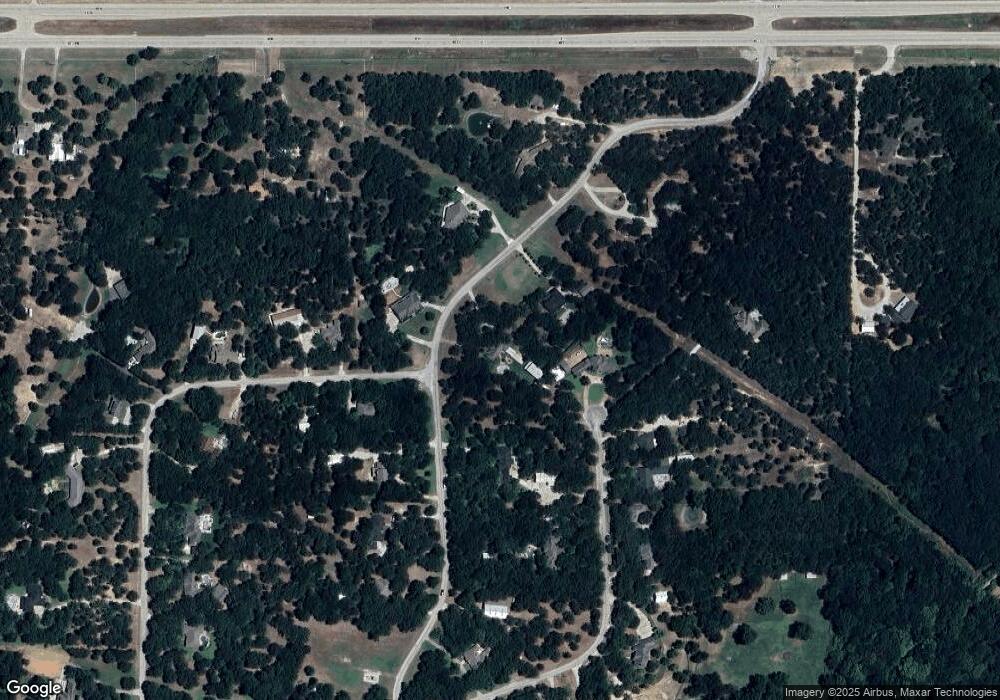

Map

Nearby Homes

- 263 Eastridge Rd

- 258 W Ridge St

- 286 W Ridge St

- 209 Rio Rancho Dr

- 189 Rio Rancho Dr

- 206 Rio Rancho Dr

- 131 San Miguel Dr

- 159 Rio Rancho Dr

- 112 La Paloma Way

- 516 Wild Wood Dr

- 141 Mission Oak Trail

- 380 Private Road 4219

- 1117 Acorn Dr

- 1121 Acorn Dr

- 0 Hlavek Rd

- 1802 Hlavek Rd

- 0000 Hlavek Rd

- 293 County Road 1111

- 910 County Road 1111

- 996 Hlavek Rd