2430 Elk Ln Grants Pass, OR 97527

Estimated Value: $438,000 - $546,886

3

Beds

3

Baths

2,145

Sq Ft

$230/Sq Ft

Est. Value

About This Home

This home is located at 2430 Elk Ln, Grants Pass, OR 97527 and is currently estimated at $492,443, approximately $229 per square foot. 2430 Elk Ln is a home located in Josephine County with nearby schools including Allen Dale Elementary School, South Middle School, and Grants Pass High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 18, 2021

Sold by

Dicarolis Brittany E

Bought by

Dicarolis Brittany and The Brittany Dicarolis Living

Current Estimated Value

Purchase Details

Closed on

Oct 26, 2016

Sold by

Dicarolis Brittany E and Dicarolis Stephen A

Bought by

Dicarolis Brittany E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$169,400

Outstanding Balance

$135,999

Interest Rate

3.42%

Mortgage Type

FHA

Estimated Equity

$356,444

Purchase Details

Closed on

Jun 29, 2010

Sold by

Carton Robert G and Carton Misty Breeze

Bought by

Dicarolis Brittany E and Dicarolis Stephen A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$194,275

Interest Rate

4.75%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Dicarolis Brittany | -- | None Available | |

| Dicarolis Brittany E | -- | None Available | |

| Dicarolis Brittany E | $200,000 | First American |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Dicarolis Brittany E | $169,400 | |

| Closed | Dicarolis Brittany E | $194,275 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,309 | $278,470 | -- | -- |

| 2023 | $1,917 | $270,360 | $0 | $0 |

| 2022 | $1,876 | $262,490 | $0 | $0 |

| 2021 | $1,814 | $254,850 | $0 | $0 |

| 2020 | $1,764 | $247,430 | $0 | $0 |

| 2019 | $1,715 | $240,230 | $0 | $0 |

| 2018 | $1,718 | $233,240 | $0 | $0 |

| 2017 | $1,703 | $226,450 | $0 | $0 |

| 2016 | $1,451 | $219,860 | $0 | $0 |

| 2015 | $1,400 | $213,460 | $0 | $0 |

| 2014 | $1,364 | $207,250 | $0 | $0 |

Source: Public Records

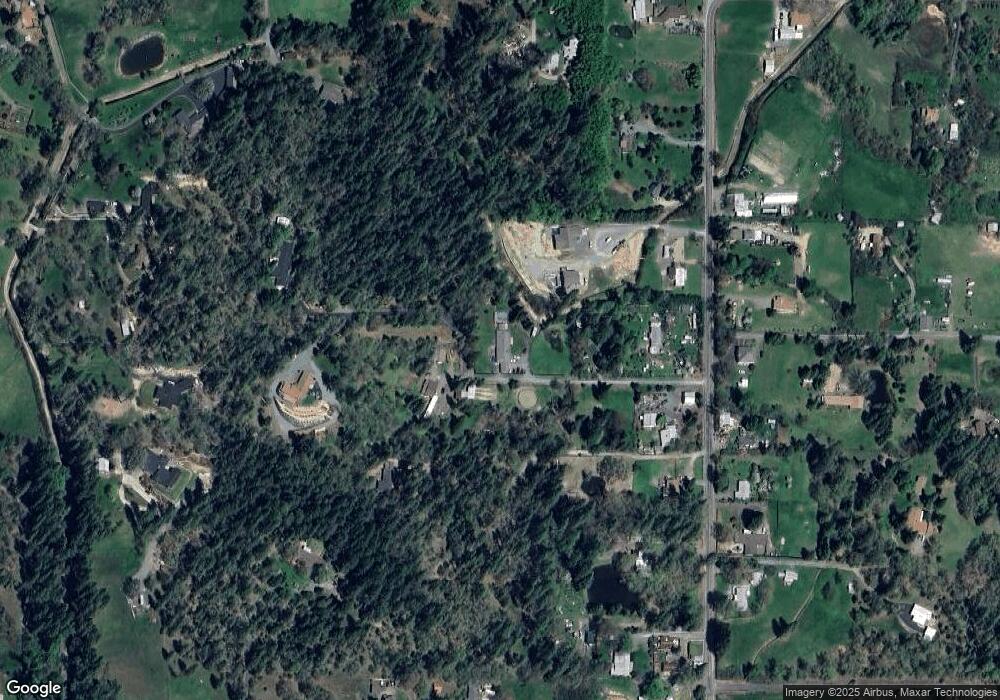

Map

Nearby Homes

- 2444 Elk Ln

- 2970 Elk Ln

- 1950 Demaray Dr Unit 10

- 3044 Elk Ln

- 0 Bushnell Way Unit 412

- 1880 Medart Ln

- 2521 SW Elmer Nelson Ln

- 2882 Esther Ln

- Lot 4 Sylvan Dr

- 1700 Medart Ln

- 1694 Nunnwood Ln

- 1746 SW Waterstone Dr

- 1885 Hubbard Ln

- 2140 Nick Way

- 1484 SW Schutzwohl Ln

- 2858 SW Shimmer Ln

- 2376 Lonnon Rd

- 2709 Jerome Prairie Rd

- 1634 Medart Ln

- 1630 Medart Ln