2430 Rocky Point Rd NW Bremerton, WA 98312

Estimated Value: $740,000 - $874,870

3

Beds

3

Baths

2,742

Sq Ft

$297/Sq Ft

Est. Value

About This Home

This home is located at 2430 Rocky Point Rd NW, Bremerton, WA 98312 and is currently estimated at $813,468, approximately $296 per square foot. 2430 Rocky Point Rd NW is a home located in Kitsap County with nearby schools including Crownhill Elementary School, Mountain View Middle School, and Bremerton High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 25, 2020

Sold by

Powers Reina and Davidson Chal

Bought by

Davidson Chal

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$510,400

Outstanding Balance

$451,170

Interest Rate

3.4%

Mortgage Type

New Conventional

Estimated Equity

$362,298

Purchase Details

Closed on

Sep 14, 2011

Sold by

Powers Reina L and Davidson Chal S

Bought by

Davidson Chal S

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$387,030

Interest Rate

4.09%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Davidson Chal | -- | Land Ttl Co Silverdale Submi | |

| Davidson Chal S | -- | Pacific Nw Title | |

| Davidson Chal S | $399,280 | Pacific Nw Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Davidson Chal | $510,400 | |

| Previous Owner | Davidson Chal S | $387,030 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2026 | $7,309 | $759,390 | $327,280 | $432,110 |

| 2025 | $7,309 | $759,390 | $327,280 | $432,110 |

| 2024 | $7,169 | $759,390 | $327,280 | $432,110 |

| 2023 | $7,059 | $759,390 | $327,280 | $432,110 |

| 2022 | $6,738 | $652,560 | $277,350 | $375,210 |

| 2021 | $6,204 | $562,570 | $241,180 | $321,390 |

| 2020 | $5,975 | $539,410 | $230,000 | $309,410 |

| 2019 | $5,418 | $496,390 | $209,230 | $287,160 |

| 2018 | $5,829 | $395,140 | $172,490 | $222,650 |

| 2017 | $5,216 | $395,140 | $172,490 | $222,650 |

| 2016 | $5,150 | $370,420 | $159,720 | $210,700 |

| 2015 | $4,657 | $334,520 | $171,480 | $163,040 |

| 2014 | -- | $343,270 | $176,450 | $166,820 |

| 2013 | -- | $343,270 | $176,450 | $166,820 |

Source: Public Records

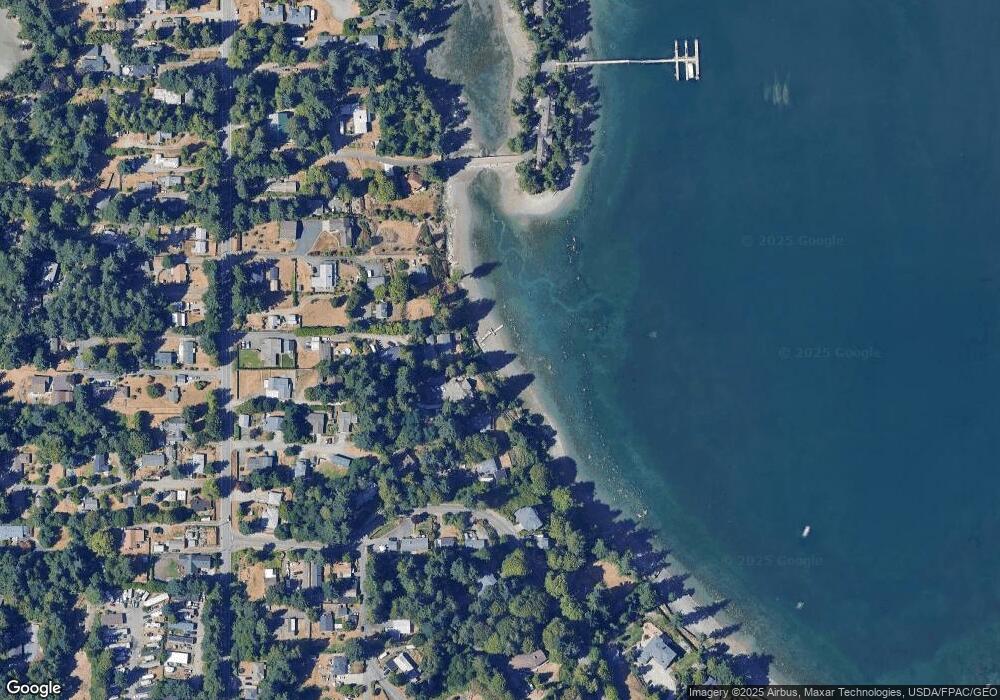

Map

Nearby Homes

- 0 NW Shaw Island Way Unit NWM2369280

- 2507 Rocky Point Rd NW

- 2415 Rocky Point Rd NW

- 2115 Rocky Point Rd NW Unit 26

- 2115 Rocky Point Rd NW Unit 22B

- 2115 Rocky Point Rd NW Unit 6

- 0 Vincent Way Unit NWM2305336

- 0 xxxx Vincent Way

- 1818 Jackson Dr

- 2010 Shamrock Dr NW

- 4209 Kelly Rd

- 2117 E Phinney Bay Dr

- 2540 E Phinney Bay Place

- 2519 Veldee Ave

- 3201 17th St

- 2008 Madrona Point Dr

- 2150 N Callow Ave

- 1720 N Wycoff Ave

- 1135 Morgan Rd NW Unit A & B

- 1551 N Callow Ave

- 1228 NW Drift Ln

- 1228 NW Drift Ln

- 1228 Drift Ln

- 1154 NW Erickson Cove Way

- 2452 Rocky Point Rd NW

- 2460 Rocky Point Rd NW

- 2424 Rocky Point Rd NW

- 2422 Rocky Point Rd NW

- 2446 Rocky Point Rd NW

- 3900 NW Phinney Bay Dr Unit LOT A

- 3900 NW Phinney Bay Dr

- 3912 NW Phinney Bay Dr

- 2432 Rocky Point Rd NW

- 2420 Rocky Point Rd NW

- 1211 NW Shaw Island Way

- 2458 Rocky Point Rd NW

- 3921 NW Phinney Bay Dr

- 3929 NW Phinney Bay Dr

- 3918 NW Phinney Bay Dr

- 2468 Rocky Point Rd NW