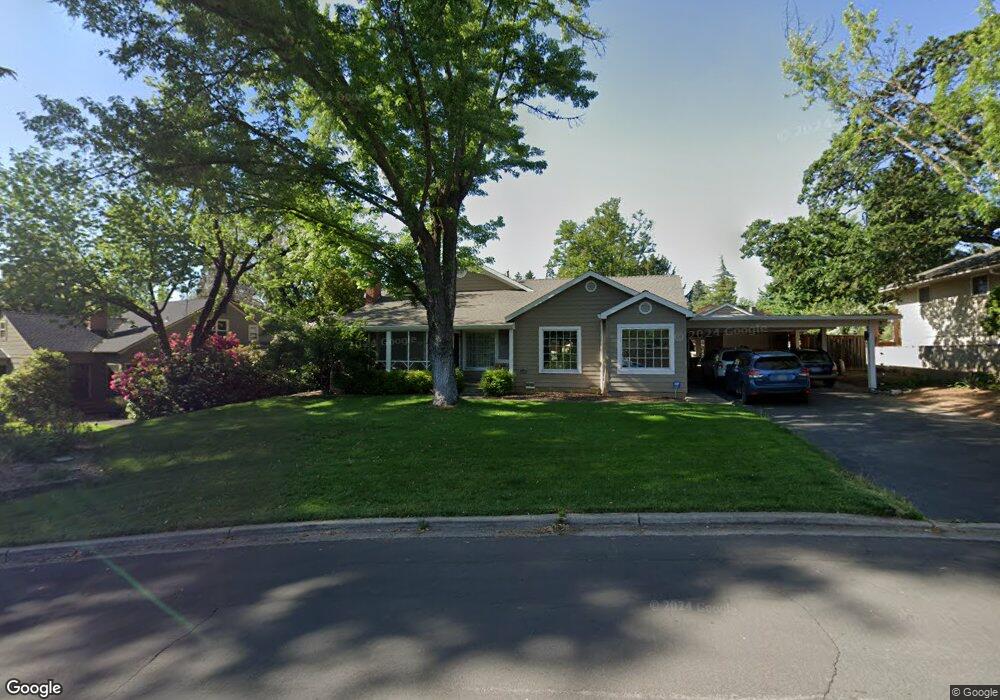

2439 Lyman Ave Medford, OR 97504

Estimated Value: $478,000 - $662,000

2

Beds

2

Baths

1,790

Sq Ft

$338/Sq Ft

Est. Value

About This Home

This home is located at 2439 Lyman Ave, Medford, OR 97504 and is currently estimated at $605,336, approximately $338 per square foot. 2439 Lyman Ave is a home located in Jackson County with nearby schools including Lone Pine Elementary School, Hedrick Middle School, and North Medford High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 6, 2012

Sold by

Greidanus Roger J and Greidanus Kathleen M

Bought by

Greidanus Roger and Greidanus Kathy

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$255,000

Outstanding Balance

$174,785

Interest Rate

3.9%

Mortgage Type

New Conventional

Estimated Equity

$430,551

Purchase Details

Closed on

Sep 5, 2008

Sold by

Greidanus Roger J and Greidanus Kathleen M

Bought by

Greidanus Roger and Greidanus Kathy

Purchase Details

Closed on

May 14, 2001

Sold by

Bennett Kenneth R and Bennett Frances A

Bought by

Greidanus Roger J and Greidanus Kathleen M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$143,100

Interest Rate

7.03%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Greidanus Roger | -- | Ticor Title | |

| Greidanus Roger J | -- | Ticor Title | |

| Greidanus Roger | -- | None Available | |

| Greidanus Roger J | $178,900 | Crater Title Insurance |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Greidanus Roger J | $255,000 | |

| Closed | Greidanus Roger J | $143,100 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,538 | $312,890 | $87,010 | $225,880 |

| 2024 | $4,538 | $303,780 | $84,470 | $219,310 |

| 2023 | $4,399 | $294,940 | $82,010 | $212,930 |

| 2022 | $4,291 | $294,940 | $82,010 | $212,930 |

| 2021 | $4,180 | $286,350 | $79,620 | $206,730 |

| 2020 | $4,092 | $278,010 | $77,300 | $200,710 |

| 2019 | $3,995 | $262,060 | $72,880 | $189,180 |

| 2018 | $3,893 | $254,430 | $70,760 | $183,670 |

| 2017 | $3,823 | $254,430 | $70,760 | $183,670 |

| 2016 | $3,848 | $239,830 | $66,700 | $173,130 |

| 2015 | $3,699 | $239,830 | $66,700 | $173,130 |

| 2014 | $3,633 | $226,070 | $62,870 | $163,200 |

Source: Public Records

Map

Nearby Homes

- 109 Kensington Square

- 91 Black Oak Dr

- 721 Brookdale Ave

- 164 Black Oak Dr

- 2020 Ridge Way

- 101 S Modoc Ave

- 740 N Modoc Ave

- 2233 Oakwood Dr

- 889 Valley View Dr

- 1925 Stratford Ave

- 312 N Barneburg Rd

- 305 S Groveland Ave

- 1711 E Main St

- 1560 Cambridge Cir

- 1137 Riverrock Way

- 325 Sutter Ave

- 1744 Carrera Cir

- 1277 Gardendale Ave

- 1258 Paulita Dr

- 2556 Dellwood Ave

- 2447 Lyman Ave

- 2435 Lyman Ave

- 2508 E Jackson Dr

- 2595 E Jackson Dr

- 2427 Lyman Ave

- 201 Girard Dr

- 2416 Lyman Ave

- 2451 Lyman Ave

- 112 Scheffel Ave

- 207 Bradford Way

- 205 Girard Dr

- 2415 Lyman Ave

- 214 Girard Dr

- 2501 Lyman Ave

- 140 Kensington Square

- 2502 Jackson Dr

- 2447 Hillcrest Rd

- 132 Kensington Square

- 204 Bradford Way

- 209 Girard Dr