2443 Tarpon Bay Dr Unit 62443 Miamisburg, OH 45342

Estimated Value: $154,000 - $171,000

2

Beds

2

Baths

1,088

Sq Ft

$151/Sq Ft

Est. Value

About This Home

This home is located at 2443 Tarpon Bay Dr Unit 62443, Miamisburg, OH 45342 and is currently estimated at $163,746, approximately $150 per square foot. 2443 Tarpon Bay Dr Unit 62443 is a home located in Montgomery County with nearby schools including Miamisburg High School, Bishop Leibold School, and Dayton Christian School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 30, 2019

Sold by

Brunie Leah N and Brunie Jason

Bought by

Fryman Jacob D

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$88,350

Outstanding Balance

$77,546

Interest Rate

3.7%

Mortgage Type

New Conventional

Estimated Equity

$86,200

Purchase Details

Closed on

Dec 29, 2011

Sold by

Federal Home Loan Mortgage Corporation

Bought by

Sampson Brunie Leah N and Lerner Sampson & Rothfuss

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$38,250

Interest Rate

3.87%

Mortgage Type

New Conventional

Purchase Details

Closed on

Sep 28, 2011

Sold by

Lambert Cheryl P

Bought by

Federal Home Loan Mortgage Corp

Purchase Details

Closed on

Nov 3, 2006

Sold by

Lambert Cheryl and Lambert Cheryl P

Bought by

Lambert Cheryl P and The Cheryl P Lambert Revocable Trust

Purchase Details

Closed on

Jul 28, 2005

Sold by

Bailey Joseph M and Bailey Andrea L

Bought by

Lambert Cheryl

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$94,050

Interest Rate

5.66%

Mortgage Type

Fannie Mae Freddie Mac

Purchase Details

Closed on

Jun 26, 2001

Sold by

Charles V Simms Development Corp

Bought by

Bailey Joseph M and Bonecutter Andrea L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$99,279

Interest Rate

7.22%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Fryman Jacob D | $93,000 | Fidelity Lawyers Ttl Agcy Ll | |

| Sampson Brunie Leah N | $51,000 | Accutitle Agency | |

| Federal Home Loan Mortgage Corp | $38,000 | None Available | |

| Lambert Cheryl P | -- | Attorney | |

| Lambert Cheryl | $99,000 | -- | |

| Bailey Joseph M | $101,600 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Fryman Jacob D | $88,350 | |

| Previous Owner | Sampson Brunie Leah N | $38,250 | |

| Previous Owner | Lambert Cheryl | $94,050 | |

| Previous Owner | Bailey Joseph M | $99,279 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,766 | $38,720 | $7,090 | $31,630 |

| 2023 | $2,766 | $38,720 | $7,090 | $31,630 |

| 2022 | $2,418 | $28,680 | $5,250 | $23,430 |

| 2021 | $2,287 | $28,680 | $5,250 | $23,430 |

| 2020 | $2,252 | $28,680 | $5,250 | $23,430 |

| 2019 | $2,104 | $24,260 | $5,250 | $19,010 |

| 2018 | $2,089 | $24,260 | $5,250 | $19,010 |

| 2017 | $2,078 | $24,260 | $5,250 | $19,010 |

| 2016 | $2,086 | $23,340 | $5,250 | $18,090 |

| 2015 | $2,051 | $23,340 | $5,250 | $18,090 |

| 2014 | $2,051 | $23,340 | $5,250 | $18,090 |

| 2012 | -- | $26,410 | $7,110 | $19,300 |

Source: Public Records

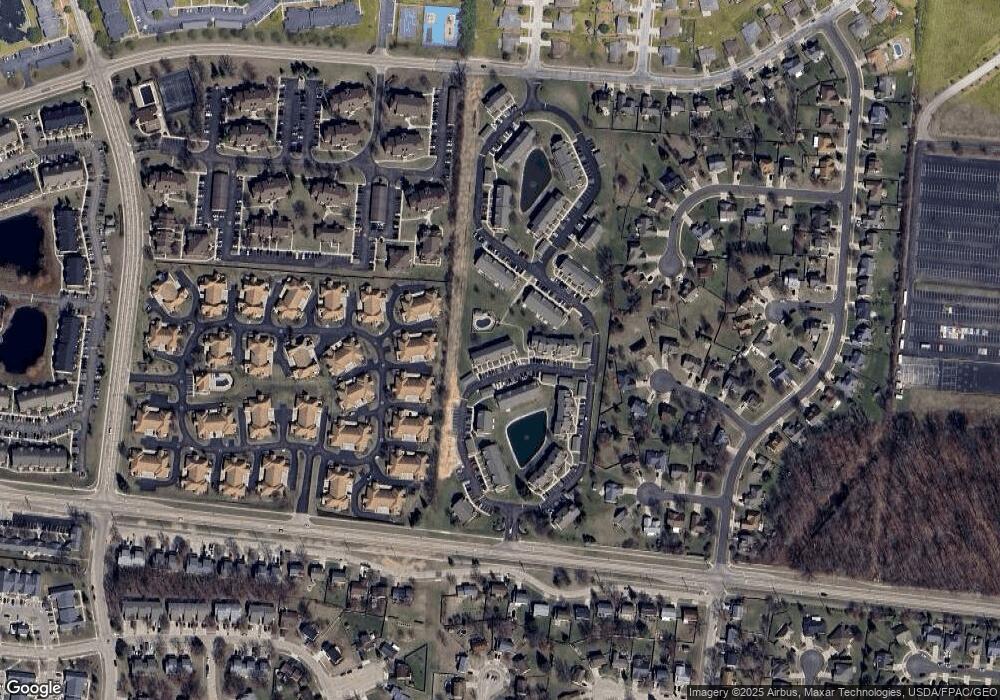

Map

Nearby Homes

- 2378 Ferndown Dr

- 2115 Autumn Haze Trail

- 9528 Summer Wind Trail

- 3412 Old Lantern Ct

- 9406 Tahoe Dr Unit 19406

- 2968 Asbury Ct

- 9604 Tahoe Dr

- 9588 Tahoe Dr

- 1794 Placid Dr

- 9616 Wild Ginger Way

- 1963 Waterstone Blvd Unit 104

- 9540 Tahoe Dr

- 9553 Tahoe Dr

- 1875 Waterstone Blvd Unit 312

- 9515 Tahoe Dr

- 9519 Tahoe Dr

- 9607 Olde Georgetown

- 9251 Great Lakes Cir Unit 59251

- 1739 Waterstone Blvd Unit 208

- 1591 Watermark Ct Unit 241591

- 2445 Tarpon Bay Dr Unit 62445

- 2447 Tarpon Bay Dr Unit 62447

- 2447 Tarpon Bay Dr Unit 2447

- 2437 Tarpon Bay Dr Unit 62437

- 2441 Tarpon Bay Dr Unit 62441

- 2435 Tarpon Bay Dr Unit 62435

- 2433 Tarpon Bay Dr Unit 2433

- 2451 Tarpon Bay Dr Unit F3

- 2451 Tarpon Bay Dr Unit 42451

- 2451 Tarpon Bay Dr

- 2453 Tarpon Bay Dr Unit 42453

- 2453 Tarpon Bay Dr Unit 2453

- 2453 Tarpon Bay Dr

- 2438 Tarpon Bay Dr Unit G1

- 2438 Tarpon Bay Dr Unit 2438

- 2455 Tarpon Bay Dr Unit 42455

- 2455 Tarpon Bay Dr Unit 2455

- 2455 Tarpon Bay Dr

- 2440 Tarpon Bay Dr Unit 2440

- 2440 Tarpon Bay Dr Unit 2440