2449 NW 31st Ct Oakland Park, FL 33309

Estimated Value: $277,000 - $406,000

2

Beds

3

Baths

1,253

Sq Ft

$278/Sq Ft

Est. Value

About This Home

This home is located at 2449 NW 31st Ct, Oakland Park, FL 33309 and is currently estimated at $348,823, approximately $278 per square foot. 2449 NW 31st Ct is a home located in Broward County with nearby schools including Oriole Elementary School, Lauderdale Lakes Middle School, and Boyd H. Anderson High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 30, 2024

Sold by

Rodriguez Erick Paul

Bought by

Crawford Cecia and Nieves Christopher

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$363,298

Outstanding Balance

$358,194

Interest Rate

6.87%

Mortgage Type

FHA

Estimated Equity

-$9,371

Purchase Details

Closed on

Mar 31, 2020

Sold by

Broward One Llc

Bought by

Rodriguez Erick Paul

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$196,200

Interest Rate

3.4%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jun 16, 2009

Sold by

The Oaks At Oakland Park Llc

Bought by

Oackland Park United Corp

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Crawford Cecia | $370,000 | Home Partners Title Services | |

| Rodriguez Erick Paul | $218,000 | Harbor Title Inc | |

| Oackland Park United Corp | $1,557,000 | Attorney |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Crawford Cecia | $363,298 | |

| Previous Owner | Rodriguez Erick Paul | $196,200 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,096 | $303,720 | $19,230 | $284,490 |

| 2024 | $3,898 | $303,720 | $19,230 | $284,490 |

| 2023 | $3,898 | $195,120 | $0 | $0 |

| 2022 | $3,682 | $189,440 | $0 | $0 |

| 2021 | $3,507 | $183,930 | $19,230 | $164,700 |

| 2020 | $4,284 | $183,540 | $19,230 | $164,310 |

| 2019 | $4,319 | $187,390 | $19,230 | $168,160 |

| 2018 | $3,588 | $154,650 | $19,230 | $135,420 |

| 2017 | $3,306 | $135,060 | $0 | $0 |

| 2016 | $3,062 | $122,790 | $0 | $0 |

| 2015 | $2,939 | $111,630 | $0 | $0 |

| 2014 | $2,699 | $101,490 | $0 | $0 |

| 2013 | -- | $94,560 | $19,230 | $75,330 |

Source: Public Records

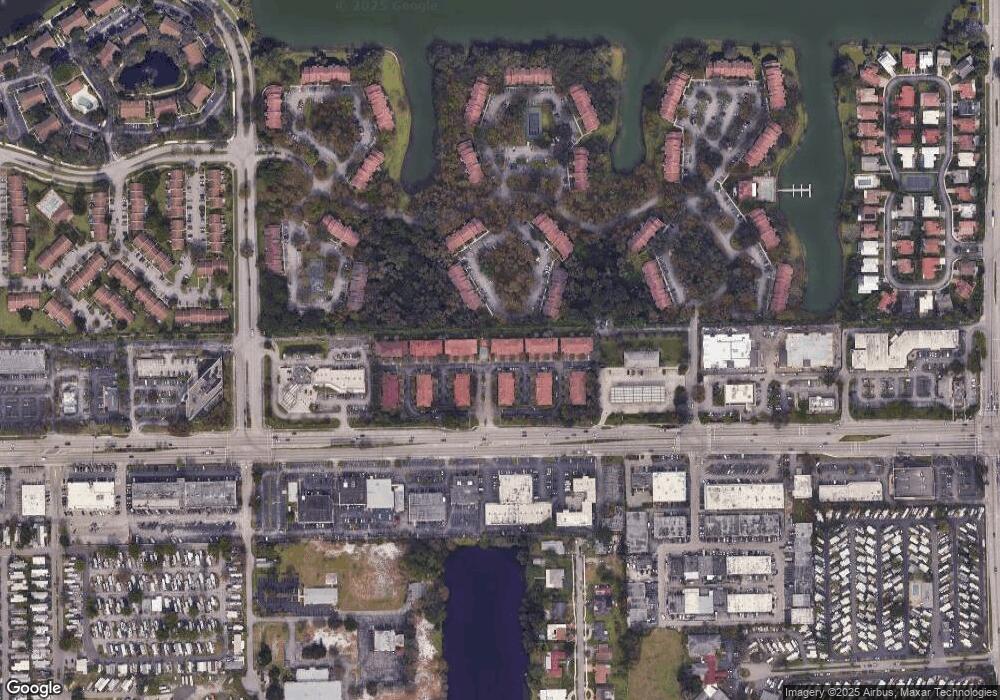

Map

Nearby Homes

- 3105 NW 25th Terrace Unit 3105

- 2445 NW 33rd St Unit 1413

- 2465 NW 33rd St Unit 1509

- 2440 NW 33rd St Unit 1808

- 2420 NW 33rd St Unit 1011

- 2445 NW 33rd St Unit 1410

- 2371 NW 33rd St Unit 702

- 2321 NW 33rd St Unit 215

- 2667 NW 33rd St Unit 2412

- 2622 NW 33rd St Unit 2011

- 2627 NW 33rd St Unit 2209

- 2667 NW 33rd St Unit 2416

- 2400 NW 33rd St Unit 1108

- 2647 NW 33rd St Unit 2306

- 2465 NW 33rd St Unit 1506

- 3264 NW 22nd Ave

- 2930 NW 24th Ave

- 3274 NW 22nd Ave

- 2031 NW 32nd St

- 2314 NW 29th St

- 2451 NW 31st Ct

- 2447 NW 31st Ct

- 2445 NW 31st Ct Unit 34

- 2501 NW 31st Ct

- 2443 NW 31st Ct

- 2503 NW 31st Ct

- 2441 NW 31st Ct

- 2505 NW 31st Ct

- 3111 NW 24th Way Unit 30

- 3111 NW 24th Way

- 2431 NW 31st Ct Unit 19

- 2431 NW 31st Ct

- 2507 NW 31st Ct

- 3109 NW 24th Way Unit 29

- 3109 NW 24th Way

- 2509 NW 31st Ct

- 3107 NW 24th Way

- 3112 NW 25th Terrace

- 2427 NW 31st Ct

- 2511 NW 31st Ct