245 Redsox Path Hernando, FL 34442

Estimated Value: $401,007 - $571,000

2

Beds

2

Baths

1,692

Sq Ft

$288/Sq Ft

Est. Value

About This Home

This home is located at 245 Redsox Path, Hernando, FL 34442 and is currently estimated at $486,502, approximately $287 per square foot. 245 Redsox Path is a home located in Citrus County with nearby schools including Forest Ridge Elementary School, Lecanto Middle School, and Lecanto High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 22, 2022

Sold by

Hampton Hills Llc

Bought by

Robinson Mark Thomas and Robinson Anafe

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$395,430

Outstanding Balance

$382,558

Interest Rate

6.61%

Mortgage Type

Construction

Estimated Equity

$103,944

Purchase Details

Closed on

Apr 26, 2022

Sold by

Good Deeds Abounding Qrp Llc

Bought by

Hampton Hills Llc

Purchase Details

Closed on

Jun 12, 2020

Sold by

Horton Catherine R and Horton Catherine R

Bought by

Good Deeds Abounding Qrp Llc

Purchase Details

Closed on

Nov 9, 2015

Sold by

Taylor J Atwood and Land Trust #6867

Bought by

Horton Catherine R and Land Trust #6867

Purchase Details

Closed on

Jan 11, 2005

Sold by

Pouw Tiong Oen and Pouw Sian Tie

Bought by

Taylor J Atwood and Land Trust #6867

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$73,800

Interest Rate

5.71%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

May 1, 1998

Bought by

Horton Catherine R and Land Trust No 6867 Dated

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Robinson Mark Thomas | -- | Manatee Title | |

| Robinson Mark Thomas | -- | Manatee Title | |

| Hampton Hills Llc | $26,000 | Manatee Title | |

| Hampton Hills Llc | $26,000 | Manatee Title | |

| Good Deeds Abounding Qrp Llc | $9,500 | Express Ttl Svcs Of Citrus I | |

| Good Deeds Abounding Qrp Llc | $9,500 | Express Ttl Svcs Of Citrus I | |

| Horton Catherine R | -- | Attorney | |

| Horton Catherine R | -- | Attorney | |

| Taylor J Atwood | $82,000 | Manatee Title Co Inc | |

| Taylor J Atwood | $82,000 | Manatee Title Co Inc | |

| Horton Catherine R | $68,300 | -- | |

| Horton Catherine R | $68,300 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Robinson Mark Thomas | $395,430 | |

| Previous Owner | Taylor J Atwood | $73,800 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,899 | $347,966 | $31,350 | $316,616 |

| 2024 | $421 | $362,167 | $30,610 | $331,557 |

| 2023 | $421 | $27,830 | $27,830 | $0 |

| 2022 | $558 | $55,650 | $55,650 | $0 |

| 2021 | $798 | $55,650 | $55,650 | $0 |

| 2020 | $813 | $55,650 | $55,650 | $0 |

| 2019 | $824 | $55,650 | $55,650 | $0 |

| 2018 | $842 | $55,650 | $55,650 | $0 |

| 2017 | $861 | $55,650 | $55,650 | $0 |

| 2016 | $895 | $55,650 | $55,650 | $0 |

| 2015 | $925 | $56,070 | $56,070 | $0 |

| 2014 | $958 | $56,100 | $56,100 | $0 |

Source: Public Records

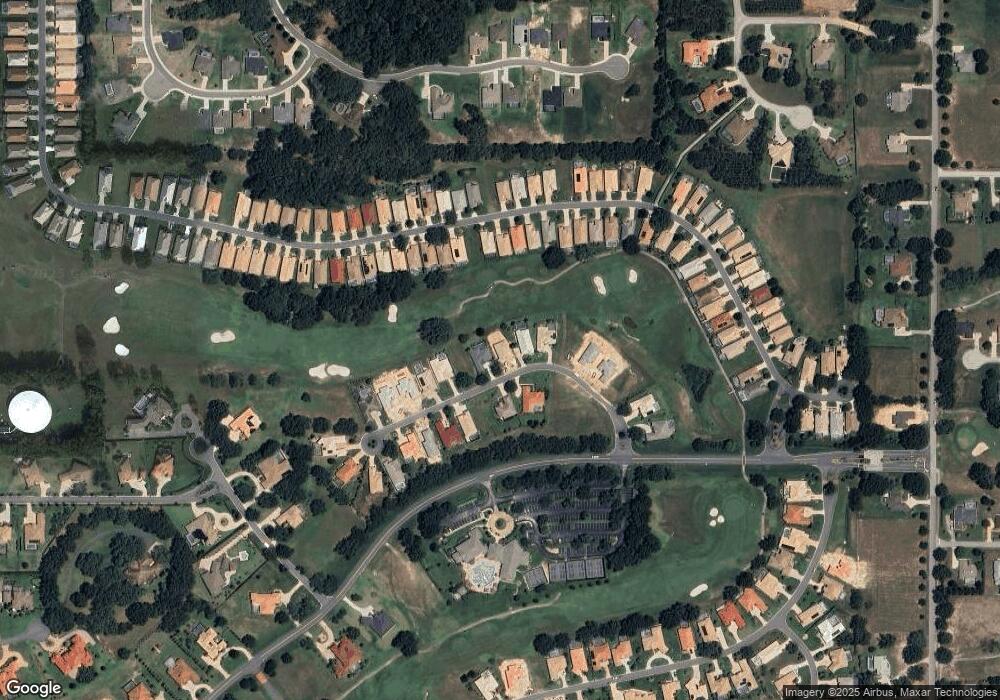

Map

Nearby Homes

- 319 W Redsox Path

- 161 W Redsox Path

- 336 W Doerr Path

- 263 W Doerr Path

- 366 W Doerr Path

- 335 W Doerr Path

- 2218 N Heritage Oaks Path

- 389 W Doerr Path

- 51 W Doerr Path

- 191 W Mickey Mantle Path

- 418 W Doerr Path

- 22 W Doerr Path

- 107 W Mickey Mantle Path

- 23 W Mickey Mantle Path

- 83 W Mickey Mantle Path

- 126 W Mickey Mantle Path

- 251 W Mickey Mantle Path

- 2293 N Heritage Oaks Path

- 1952 N Essex Ave

- 50 W Glen Arbor Ln

- 245 N Redsox Path

- 245 W Redsox Path

- 255 W Redsox Path

- 235 W Redsox Path

- 19 W Redsox Path

- 245 W Redsox Path

- 0 W Redsox Path

- 329 W Redsox Path

- 264 W Redsox Path

- 215 W Redsox Path

- 202 W Redsox Path

- 265 W Redsox Path

- 225 W Redsox Path

- 234 W Redsox Path

- 277 W Redsox Path

- 287 W Redsox Path

- 276 W Redsox Path

- 202 W Red Sox

- 286 W Redsox Path