2450 SW 131st Terrace Davie, FL 33325

Flamingo Groves NeighborhoodEstimated Value: $1,282,103 - $1,526,000

5

Beds

3

Baths

3,270

Sq Ft

$439/Sq Ft

Est. Value

About This Home

This home is located at 2450 SW 131st Terrace, Davie, FL 33325 and is currently estimated at $1,437,026, approximately $439 per square foot. 2450 SW 131st Terrace is a home located in Broward County with nearby schools including Country Isles Elementary School, Indian Ridge Middle School, and Western High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 1, 2011

Sold by

Gegunde Eduardo and Gegunde Arialguys

Bought by

Sevigny Patrick

Current Estimated Value

Purchase Details

Closed on

Dec 19, 2008

Sold by

Gegunde Eduardo and Gegunde Arialquys

Bought by

Gegunde Eduardo and Gegunde Arialquys

Purchase Details

Closed on

Jan 23, 2007

Sold by

Bruser Robert W and Bruser Gayle I

Bought by

Gegunde Eduardo

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$74,250

Interest Rate

6.07%

Mortgage Type

Credit Line Revolving

Purchase Details

Closed on

Dec 28, 1995

Sold by

Emerald Springs Homes Of Davie

Bought by

Bruser Robert W and Bruser Gayle I

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Sevigny Patrick | $450,000 | Attorney | |

| Gegunde Eduardo | -- | Attorney | |

| Gegunde Eduardo | $743,000 | Priority Title Inc | |

| Bruser Robert W | $80,500 | -- | |

| Emerald Springs Realty Inc | $55,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Gegunde Eduardo | $74,250 | |

| Previous Owner | Gegunde Eduardo | $594,400 | |

| Previous Owner | Emerald Springs Realty Inc | $100,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $10,526 | $546,380 | -- | -- |

| 2024 | $10,328 | $530,990 | -- | -- |

| 2023 | $10,328 | $515,530 | $0 | $0 |

| 2022 | $9,732 | $500,520 | $0 | $0 |

| 2021 | $9,448 | $485,950 | $0 | $0 |

| 2020 | $9,351 | $479,250 | $0 | $0 |

| 2019 | $9,108 | $468,480 | $0 | $0 |

| 2018 | $8,836 | $459,750 | $0 | $0 |

| 2017 | $8,686 | $450,300 | $0 | $0 |

| 2016 | $8,629 | $441,040 | $0 | $0 |

| 2015 | $8,831 | $437,980 | $0 | $0 |

| 2014 | $8,930 | $434,510 | $0 | $0 |

| 2013 | -- | $435,540 | $122,750 | $312,790 |

Source: Public Records

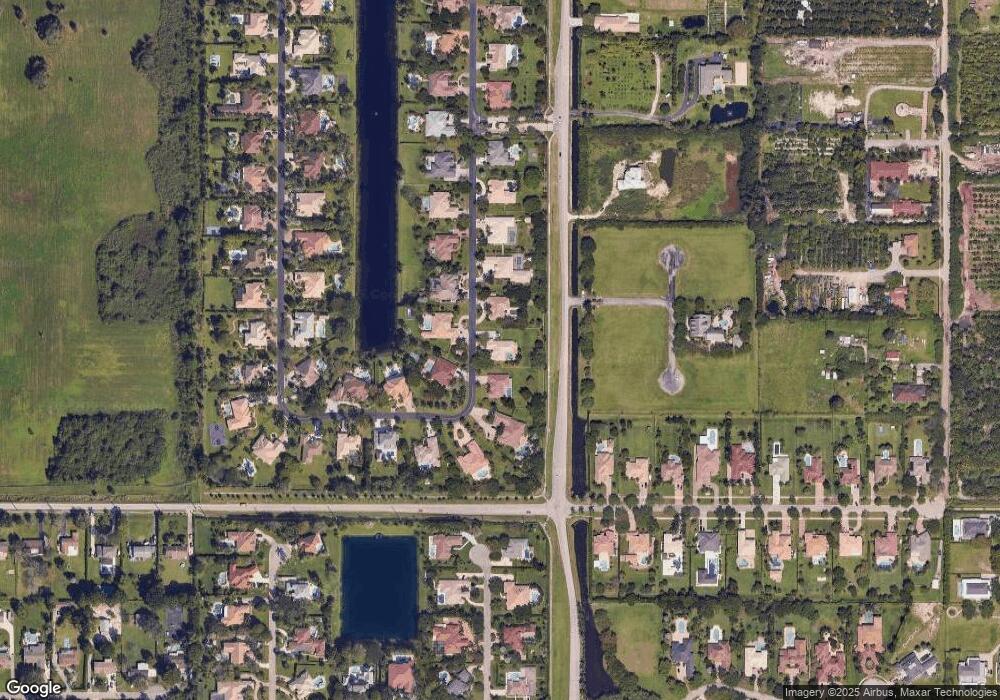

Map

Nearby Homes

- 2341 SW 131st Terrace

- 14270 SW 20th St

- 12854 Stonebrook Dr

- 2753 W Stonebrook Cir

- 12641 N Stonebrook Cir

- 2045 SW 127th Ave

- 2269 SW 127th Ave

- 12450 Oak Park Dr

- 13040 SW 30th Ct

- 13751 Pine Meadow Ct

- 3290 SW 131st Terrace

- 12462 Brookwood Ct

- 12911 SW 17th Place

- 4385 SW 123rd Ln

- 3250 W Stonebrook Cir

- 3200 SW 135th Terrace

- 3303 W Stonebrook Cir

- 13150 SW 16th Ct

- 13851 SW 26th St

- 12265 SW 22nd Ct

- 2420 SW 131st Terrace

- 2470 SW 131st Terrace

- 2432 SW 130th Ave

- 2431 SW 131st Terrace

- 2400 SW 131st Terrace

- 2461 SW 131st Terrace

- 2500 SW 131st Terrace

- 2401 SW 131st Terrace

- 13103 SW 25th Place

- 2370 SW 131st Terrace

- 13004 SW 25th Place

- 2371 SW 131st Terrace

- 12971 SW 26th St

- 13054 SW 25th Place

- 2350 SW 131st Terrace

- 12941 SW 26th St

- 13104 SW 25th Place

- 13153 SW 25th Place

- 13660 SW 26th St

- 0 SW 26th St