2455 Parkview Dr Grove City, OH 43123

Estimated Value: $285,816 - $338,000

3

Beds

2

Baths

1,472

Sq Ft

$216/Sq Ft

Est. Value

About This Home

This home is located at 2455 Parkview Dr, Grove City, OH 43123 and is currently estimated at $318,204, approximately $216 per square foot. 2455 Parkview Dr is a home located in Franklin County with nearby schools including Monterey Elementary School, Park Street Intermediate School, and Grove City High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 25, 2011

Sold by

Ladina Karey A and Ladina Frank J

Bought by

Allen Marvin and Allen Nancy

Current Estimated Value

Purchase Details

Closed on

May 15, 2002

Sold by

Sadowski George T and Sadowski Patricia M

Bought by

Ladina Karey A and Sasina Margaret L

Purchase Details

Closed on

May 18, 1999

Sold by

Thomas Victor G and Thomas Lehna F

Bought by

Sadowski George T and Sadowski Patricia M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$74,900

Interest Rate

6.92%

Purchase Details

Closed on

Sep 26, 1986

Bought by

Thomas Victor G and Thomas Lehna F

Purchase Details

Closed on

Jul 1, 1984

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Allen Marvin | $135,000 | Real Living | |

| Ladina Karey A | $159,000 | Chicago Title | |

| Sadowski George T | $134,900 | Chicago Title | |

| Thomas Victor G | $85,000 | -- | |

| -- | $76,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Sadowski George T | $74,900 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,674 | $90,580 | $21,140 | $69,440 |

| 2023 | $3,650 | $90,580 | $21,140 | $69,440 |

| 2022 | $3,110 | $59,750 | $13,060 | $46,690 |

| 2021 | $3,170 | $59,750 | $13,060 | $46,690 |

| 2020 | $3,702 | $59,750 | $13,060 | $46,690 |

| 2019 | $3,313 | $49,600 | $10,890 | $38,710 |

| 2018 | $3,353 | $49,600 | $10,890 | $38,710 |

| 2017 | $3,347 | $49,600 | $10,890 | $38,710 |

| 2016 | $3,405 | $46,980 | $10,540 | $36,440 |

| 2015 | $3,406 | $46,980 | $10,540 | $36,440 |

| 2014 | $3,409 | $46,980 | $10,540 | $36,440 |

| 2013 | $1,655 | $46,970 | $10,535 | $36,435 |

Source: Public Records

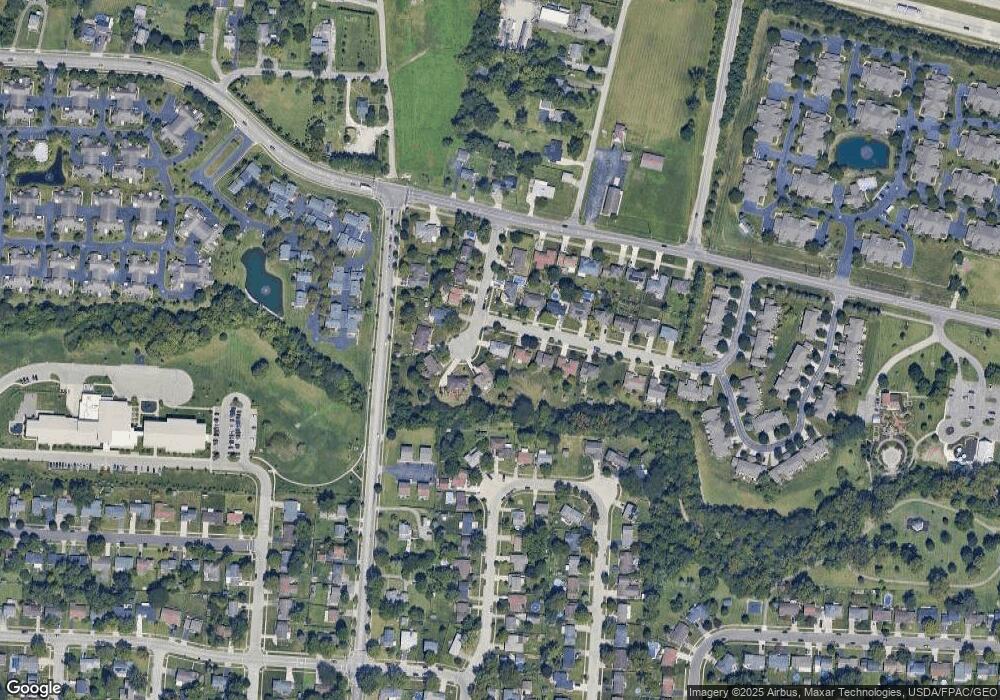

Map

Nearby Homes

- 3153 Scenic Way

- 3156 Hoover Rd

- 2539 Swan Dr Unit 2539

- 2541 Swan Dr

- 3187 Parkview Cir Unit 3187

- 3172 Pine Manor Blvd Unit 3172

- 3140 Catan Loop Unit 3140

- 3333 Tareyton Dr

- 3378 Josephine Cir

- 3267 Castleton St

- 3120-3122 Walden Place

- 2711-2713 Charles Dr

- 3343 Marshrun Dr

- 2300 Ziner Cir N

- 3400 Marshrun Dr

- 3474 Highland St

- 2545 Scott Ct

- 2571 Scott Ct

- 3542 Hoover Rd

- 3454 Independence St

- 3190 Scenic Way

- 2435 Parkview Dr

- 3193 Scenic Way

- 3158 Scenic Way

- 2444 Parkview Dr

- 3167 Scenic Way

- 2427 Parkview Dr

- 2434 Parkview Dr

- 3177 Scenic Way

- 3183 Scenic Way

- 3189 Scenic Way

- 2450 Lark Ave

- 2424 Parkview Dr

- 2417 Parkview Dr

- 3138 Scenic Way

- 3231 Tareyton Dr

- 2444 Lark Ave

- 2435 Home Rd

- 2434 Lark Ave

- 2427 Home Rd