2460 Field Way NE Unit 2460 Atlanta, GA 30319

Drew Valley NeighborhoodEstimated Value: $486,908 - $622,000

2

Beds

3

Baths

1,264

Sq Ft

$429/Sq Ft

Est. Value

About This Home

This home is located at 2460 Field Way NE Unit 2460, Atlanta, GA 30319 and is currently estimated at $542,227, approximately $428 per square foot. 2460 Field Way NE Unit 2460 is a home located in DeKalb County with nearby schools including John Robert Lewis Elementary School, Sequoyah Middle School, and Cross Keys High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 3, 2017

Sold by

Cusick Stephen M

Bought by

Justice Matthew Ryan

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$332,405

Outstanding Balance

$275,110

Interest Rate

4.1%

Mortgage Type

New Conventional

Estimated Equity

$267,117

Purchase Details

Closed on

Mar 2, 2009

Sold by

Bank Of Ny 2004-17Cb

Bought by

Coon Allison E and Cusick Stephen

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$193,900

Interest Rate

5.14%

Mortgage Type

New Conventional

Purchase Details

Closed on

Sep 2, 2008

Sold by

Derby Doris

Bought by

Bank Of Ny 2004-17Cb

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Justice Matthew Ryan | $349,900 | -- | |

| Coon Allison E | $215,500 | -- | |

| Bank Of Ny 2004-17Cb | $262,182 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Justice Matthew Ryan | $332,405 | |

| Previous Owner | Coon Allison E | $193,900 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,063 | $189,520 | $40,000 | $149,520 |

| 2024 | $5,069 | $187,800 | $40,000 | $147,800 |

| 2023 | $5,069 | $159,800 | $40,000 | $119,800 |

| 2022 | $4,430 | $159,640 | $38,360 | $121,280 |

| 2021 | $4,129 | $146,920 | $38,360 | $108,560 |

| 2020 | $4,070 | $141,360 | $38,360 | $103,000 |

| 2019 | $4,069 | $142,960 | $38,360 | $104,600 |

| 2018 | $3,760 | $139,960 | $32,480 | $107,480 |

| 2017 | $3,731 | $116,000 | $32,480 | $83,520 |

| 2016 | $3,282 | $135,840 | $38,360 | $97,480 |

| 2014 | $2,446 | $75,240 | $38,360 | $36,880 |

Source: Public Records

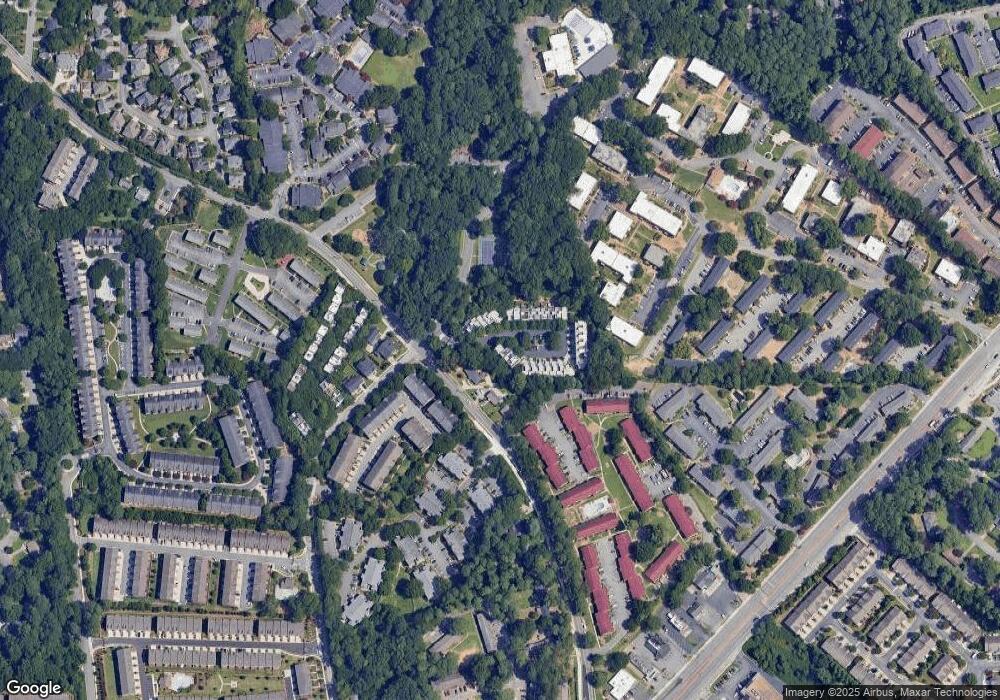

Map

Nearby Homes

- 2188 Millennium Way NE

- 2180 Millennium Way NE

- 2176 Millennium Way NE

- 1364 Keys Crossing Dr NE

- 1356 Keys Crossing Dr NE

- 1468 Briarwood Rd NE Unit 2003

- 1468 Briarwood Rd NE Unit 806

- 1468 Briarwood Rd NE Unit 805

- 1468 Briarwood Rd NE Unit 1304

- 1468 Briarwood Rd NE Unit 602

- 1468 Briarwood Rd NE Unit 108

- 1468 Briarwood Rd NE Unit 805

- 1468 Briarwood Rd NE Unit 505

- 1468 Briarwood Rd NE Unit 406

- 1468 Briarwood Rd NE Unit 303

- 2093 Pine Cone Ln NE

- 2029 Cobblestone Cir NE

- 2160 Prestwick Ct NE

- 2448 Field Way NE

- 2456 Field Way NE

- 2458 Field Way NE

- 2458 Field Way NE Unit 2458

- 2460 Field Way NE

- 2456 Ne Field

- 2442 Field Way NE

- 2440 Field Way NE

- 2438 Field Way NE

- 2446 Field Way NE

- 0 Field Way Unit 3149005

- 0 Field Way Unit 7157501

- 0 Field Way

- 2430 Field Way NE

- 1528 Briarwood Rd NE

- 2457 Field Way NE Unit n/a

- 2457 Field Way NE

- 2457 Field Way NE Unit 2457

- 2455 Field Way NE

- 2455 Field Way NE Unit 2455