24610 W Manor Dr Shorewood, IL 60404

Estimated Value: $557,787 - $809,000

4

Beds

4

Baths

3,200

Sq Ft

$201/Sq Ft

Est. Value

About This Home

This home is located at 24610 W Manor Dr, Shorewood, IL 60404 and is currently estimated at $642,197, approximately $200 per square foot. 24610 W Manor Dr is a home located in Will County with nearby schools including Shorewood Elementary School, Troy Middle School, and Orenic Intermediate School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 26, 2025

Sold by

Carol R Odell Declaration Of Trust and Odell Carol R

Bought by

David K Odell Declaration Of Trust and Carol R Odell Declaration Of Trust

Current Estimated Value

Purchase Details

Closed on

Sep 1, 2009

Sold by

Priovolos Virginia M

Bought by

Odell Carol R and The Carol R Odell Declaration

Purchase Details

Closed on

Jul 24, 1999

Sold by

Schalk Farley R and Schalk Jayne E

Bought by

Privolos Ted D and Privolos Virginia M

Purchase Details

Closed on

Jul 14, 1995

Sold by

Nbd Bank

Bought by

Schalk Farley R and Schalk Jayne E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$240,000

Interest Rate

7.79%

Purchase Details

Closed on

Jan 18, 1995

Sold by

Nbd Bank

Bought by

Nbd Bank and Amerifed Bank Fsb

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| David K Odell Declaration Of Trust | -- | None Listed On Document | |

| Odell Carol R | $425,000 | None Available | |

| Privolos Ted D | $300,000 | Chicago Title Insurance Co | |

| Schalk Farley R | $324,000 | -- | |

| Nbd Bank | $45,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Schalk Farley R | $240,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $13,329 | $171,210 | $26,199 | $145,011 |

| 2023 | $13,329 | $153,827 | $23,539 | $130,288 |

| 2022 | $12,385 | $145,559 | $22,274 | $123,285 |

| 2021 | $11,202 | $136,932 | $20,954 | $115,978 |

| 2020 | $11,288 | $136,932 | $20,954 | $115,978 |

| 2019 | $10,979 | $131,350 | $20,100 | $111,250 |

| 2018 | $10,734 | $125,150 | $20,550 | $104,600 |

| 2017 | $10,667 | $122,100 | $20,550 | $101,550 |

| 2016 | $10,660 | $118,850 | $20,550 | $98,300 |

| 2015 | $10,344 | $112,750 | $19,950 | $92,800 |

| 2014 | $10,344 | $115,093 | $19,950 | $95,143 |

| 2013 | $10,344 | $115,093 | $19,950 | $95,143 |

Source: Public Records

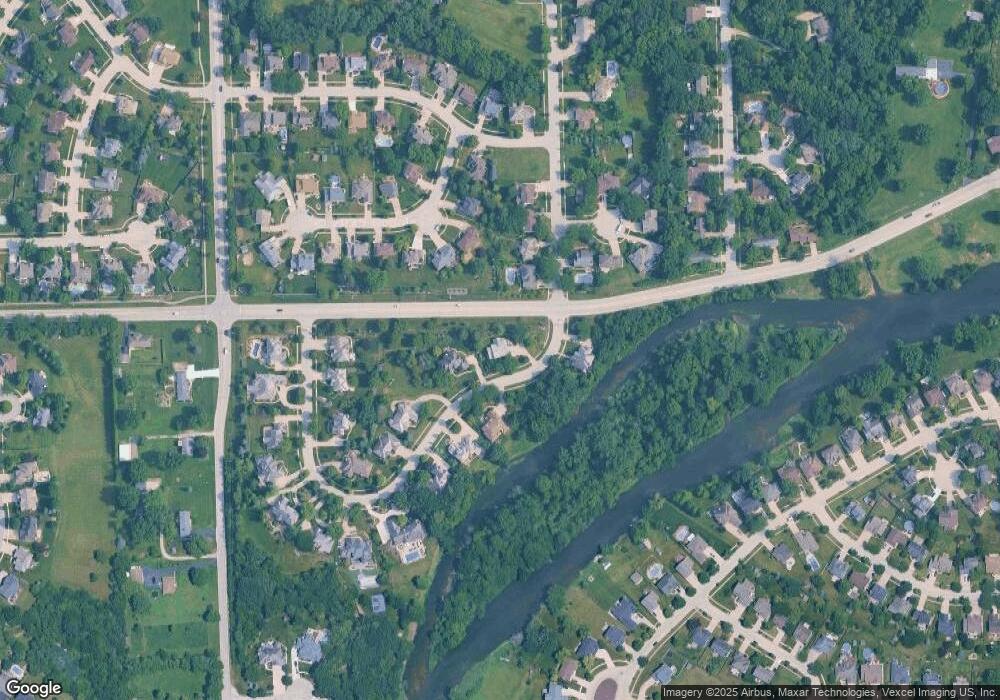

Map

Nearby Homes

- 1007 Windsor Dr

- 22020 S River Rd

- 24614 Kaylee St

- 20941 Lee St

- 2057 Isabella Ln

- 2031 Isabell Ln Unit 1

- 2037 Isabell Ln

- 2048 Isabella Ln

- 00002 Jefferson St

- 1 AC Jefferson St

- 00001 Jefferson St

- 0000 W Seil Rd

- 20948 Lakewoods Ln

- 20718 S Sarver Dr Unit 1

- 741 River Bluff Dr

- 21053 Benjamin Dr

- 21042 Lakewoods Ln

- 24539 Bantry Dr

- 1018 Butterfield Cir E Unit 5

- 24620 River Crossing Dr

- 24620 W Manor Dr

- 815 Ravinia Dr

- 24625 W Manor Dr

- 24605 W Manor Dr Unit 1

- 406 Stanford Dr

- 813 Ravinia Dr

- 24640 W Manor Dr

- 404 Stanford Dr

- 24635 W Manor Dr Unit 1

- 801 Cornell Ct

- 408 Stanford Dr

- 811 Ravinia Dr

- 803 Cornell Ct

- 24750 W Manor Dr

- 402 Stanford Dr

- 410 Stanford Dr

- 24650 W Manor Dr

- 24740 W Manor Dr

- 809 Ravinia Dr

- 412 Stanford Dr Unit 6