24615 Thicket Ln Unit G17 Olmsted Falls, OH 44138

Estimated Value: $222,657 - $256,000

2

Beds

2

Baths

1,326

Sq Ft

$182/Sq Ft

Est. Value

About This Home

This home is located at 24615 Thicket Ln Unit G17, Olmsted Falls, OH 44138 and is currently estimated at $241,414, approximately $182 per square foot. 24615 Thicket Ln Unit G17 is a home located in Cuyahoga County with nearby schools including Falls-Lenox Primary Elementary School, Olmsted Falls Intermediate Building, and Olmsted Falls Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 1, 2003

Sold by

Hoffa Janice L

Bought by

Wilson Corinne L

Current Estimated Value

Purchase Details

Closed on

Mar 24, 2000

Sold by

Whitlatch & Co

Bought by

Wilson Corinne L and Hoffa Janice L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$90,000

Interest Rate

8.39%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Wilson Corinne L | -- | -- | |

| Wilson Corinne L | $148,700 | General Title Agency Inc |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Wilson Corinne L | $90,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,761 | $66,500 | $6,650 | $59,850 |

| 2023 | $3,394 | $50,970 | $5,080 | $45,890 |

| 2022 | $3,394 | $50,960 | $5,080 | $45,890 |

| 2021 | $3,360 | $50,960 | $5,080 | $45,890 |

| 2020 | $3,069 | $42,840 | $4,270 | $38,570 |

| 2019 | $2,723 | $122,400 | $12,200 | $110,200 |

| 2018 | $2,725 | $42,840 | $4,270 | $38,570 |

| 2017 | $2,403 | $36,230 | $4,130 | $32,100 |

| 2016 | $2,389 | $36,230 | $4,130 | $32,100 |

| 2015 | $2,771 | $36,230 | $4,130 | $32,100 |

| 2014 | $2,771 | $40,260 | $4,590 | $35,670 |

Source: Public Records

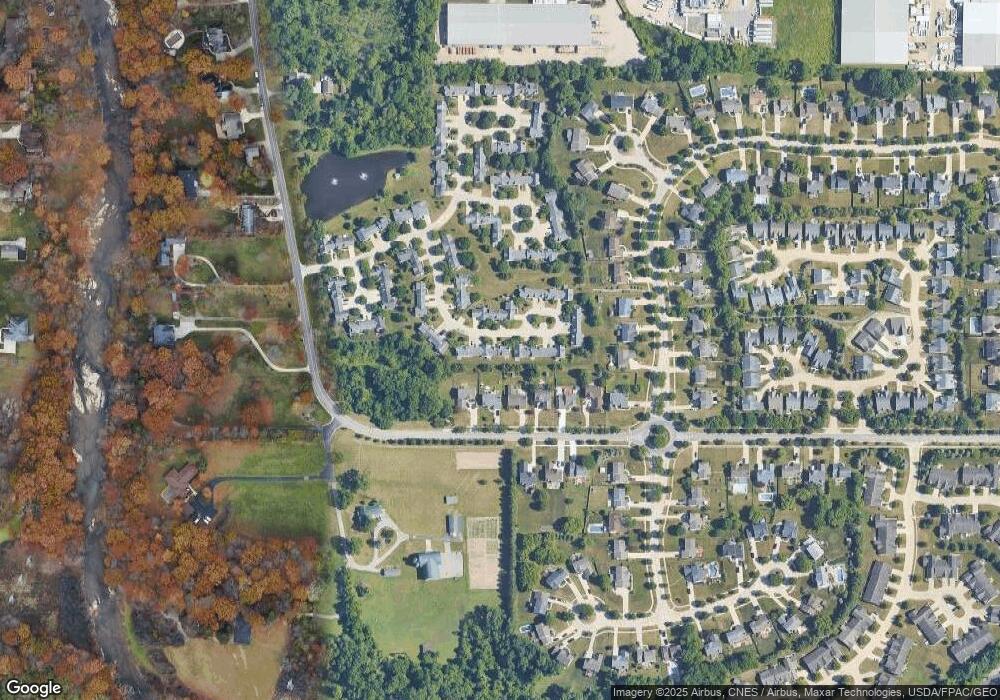

Map

Nearby Homes

- 8757 Roberts Ct Unit 25C

- 8241 Lewis Rd

- Anderson Plan at Smokestack Trails

- Bramante Ranch Plan at Smokestack Trails

- Hudson Plan at Smokestack Trails

- Columbia Plan at Smokestack Trails

- Lehigh Plan at Smokestack Trails

- 0

- 396 Crossbrook Dr

- Caroline Plan at Falls Landing - Villas

- Wexford Plan at Falls Landing - Villas

- Rosecliff Plan at Falls Landing - Villas

- 136 River Rock Way Unit D

- 100 River Rock Way

- 549 Wyleswood Dr

- 543 Wyleswood Dr

- 537 Wyleswood Dr

- 105 Clay Ct

- 23514 Grist Mill Ct Unit 4

- 260 Stone Ridge Way

- 24637 Thicket Ln Unit G16

- 24645 Thicket Ln Unit G15

- 24640 Thicket Ln Unit K28

- 24620 Thicket Ln Unit K27

- 24600 Thicket Ln Unit K26

- 24630 West Rd

- 24690 West Rd

- 24655 Thicket Ln

- 24659 Thicket Ln

- 24655 Thicket Ln Unit 14

- 24515 Thicket Ln Unit H20

- 24547 Thicket Ln Unit H19

- 24589 Thicket Ln Unit H18

- 24580 West Rd

- 24680 Thicket Ln Unit L30

- 24670 Thicket Ln Unit L29

- 24520 West Rd

- 24683 Thicket Ln Unit E11

- 24661 Thicket Ln Unit E12

- 24540 Thicket Ln Unit J24