Estimated Value: $203,000 - $280,204

4

Beds

2

Baths

2,512

Sq Ft

$96/Sq Ft

Est. Value

About This Home

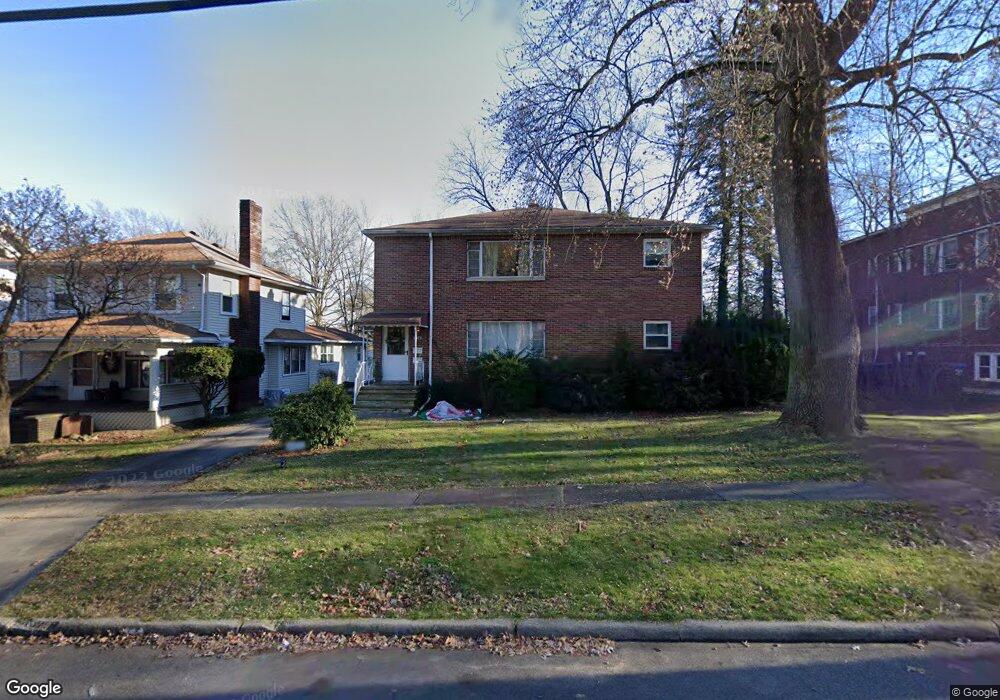

This home is located at 2471 4th St, Cuyahoga Falls, OH 44221 and is currently estimated at $240,051, approximately $95 per square foot. 2471 4th St is a home located in Summit County with nearby schools including Silver Lake Elementary School, Roberts Middle School, and Cuyahoga Falls High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 15, 2024

Sold by

Boumadi Tony S

Bought by

Boumadi Properties Iv Llc

Current Estimated Value

Purchase Details

Closed on

Dec 6, 2019

Sold by

Acu-4Th I Llc

Bought by

Boumadi Tony S

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$167,200

Interest Rate

3.75%

Mortgage Type

New Conventional

Purchase Details

Closed on

Dec 5, 2019

Sold by

Acu-4Th I Llc

Bought by

Boumadi Tony S

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$167,200

Interest Rate

3.75%

Mortgage Type

New Conventional

Purchase Details

Closed on

Aug 20, 2014

Sold by

Gjurkovitsch Ronald A and Gjurkovitsch Richard F

Bought by

Acu-4Th I Llc

Purchase Details

Closed on

Feb 22, 2011

Sold by

Gjurkovitsch Ronald A and Gjurkovitsch Vicki

Bought by

Gjurkovitsch Ronald A and Gjurkovitsch Richard F

Purchase Details

Closed on

Nov 4, 2010

Sold by

Gjurkovitsch Eva

Bought by

Gjurkovitsch Frank

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Boumadi Properties Iv Llc | -- | None Listed On Document | |

| Boumadi Tony S | $178,500 | Clear Title Solutions | |

| Boumadi Tony S | $178,500 | Clear Title Solutions | |

| Acu-4Th I Llc | $142,000 | None Available | |

| Gjurkovitsch Ronald A | -- | Attorney | |

| Gjurkovitsch Ronald A | -- | Attorney | |

| Gjurkovitsch Frank | -- | Attorney |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Boumadi Tony S | $167,200 | |

| Previous Owner | Boumadi Tony S | $167,200 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,575 | $81,047 | $12,268 | $68,779 |

| 2024 | $4,575 | $81,047 | $12,268 | $68,779 |

| 2023 | $4,575 | $81,047 | $12,268 | $68,779 |

| 2022 | $4,203 | $60,400 | $9,090 | $51,310 |

| 2021 | $4,114 | $60,400 | $9,090 | $51,310 |

| 2020 | $4,138 | $60,400 | $9,090 | $51,310 |

| 2019 | $4,197 | $57,200 | $9,390 | $47,810 |

| 2018 | $3,578 | $57,200 | $9,390 | $47,810 |

| 2017 | $3,248 | $57,200 | $9,390 | $47,810 |

| 2016 | $3,251 | $52,510 | $9,390 | $43,120 |

| 2015 | $3,248 | $52,510 | $9,390 | $43,120 |

| 2014 | $3,250 | $52,510 | $9,390 | $43,120 |

| 2013 | $3,225 | $52,560 | $9,390 | $43,170 |

Source: Public Records

Map

Nearby Homes

- 2470 Whitelaw St

- 2534 Berk St

- 2563 4th St

- 2685 Northland St

- 2711 Ironwood St

- 2331 5th Ct

- 116 Munroe Falls Ave

- 2736 Maplewood St

- 279 Birchwood Ave

- 608 Washington Ave

- 2430 Talbot St

- 2380 Schubert Ave

- 823 Washington Ave

- 2104 7th St

- 2365 Schubert Ave

- 2873 Oakwood Dr

- 2855 6th St

- 419 Keenan Ave

- 2812 Hudson Dr

- 2886 Norwood St