24748 Buck Creek San Antonio, TX 78255

Estimated Value: $438,105 - $495,000

4

Beds

4

Baths

2,733

Sq Ft

$172/Sq Ft

Est. Value

About This Home

This home is located at 24748 Buck Creek, San Antonio, TX 78255 and is currently estimated at $470,276, approximately $172 per square foot. 24748 Buck Creek is a home located in Bexar County with nearby schools including Aue Elementary School, Rawlinson Middle School, and Clark High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 30, 2017

Sold by

Walther Philip James

Bought by

Walther Philip James and Walther Deborah A

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$175,000

Outstanding Balance

$96,101

Interest Rate

3.83%

Mortgage Type

New Conventional

Estimated Equity

$374,175

Purchase Details

Closed on

May 29, 2013

Sold by

Weekley Homes Llc

Bought by

Walther Philip James

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$276,400

Outstanding Balance

$196,089

Interest Rate

3.43%

Mortgage Type

New Conventional

Estimated Equity

$274,187

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Walther Philip James | -- | None Available | |

| Walther Philip James | -- | Ptc |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Walther Philip James | $175,000 | |

| Open | Walther Philip James | $276,400 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,634 | $473,564 | $77,280 | $413,540 |

| 2024 | $3,634 | $430,513 | $77,280 | $386,620 |

| 2023 | $3,634 | $391,375 | $77,280 | $383,460 |

| 2022 | $7,064 | $355,795 | $59,960 | $363,950 |

| 2021 | $6,663 | $323,450 | $57,040 | $266,410 |

| 2020 | $6,443 | $306,150 | $57,040 | $249,110 |

| 2019 | $6,622 | $304,210 | $57,040 | $247,170 |

| 2018 | $6,131 | $281,620 | $57,040 | $224,580 |

| 2017 | $6,201 | $283,940 | $57,040 | $226,900 |

| 2016 | $6,113 | $279,890 | $57,040 | $222,850 |

| 2015 | $5,846 | $284,400 | $57,040 | $227,360 |

| 2014 | $5,846 | $273,260 | $0 | $0 |

Source: Public Records

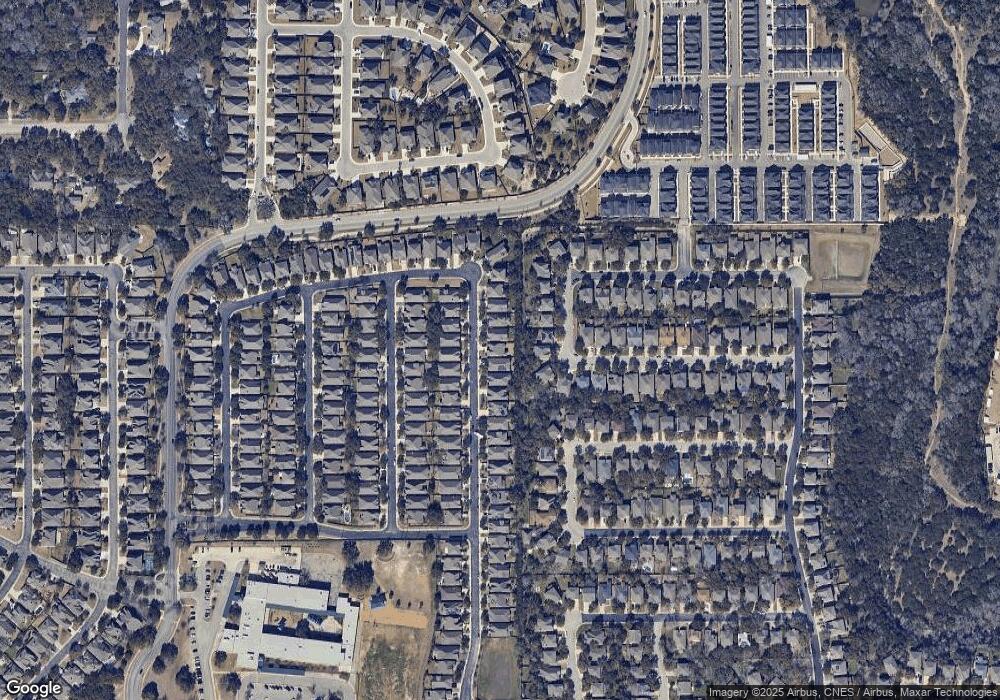

Map

Nearby Homes

- 25151 Buttermilk Ln

- 25127 Royal Land

- 8312 Merchants Lodge

- 8111 Jalane Park

- 8110 Cooper Corral Cir

- 25410 Tidal Creek

- 8226 Two Winds

- 24915 White Creek

- 8219 Wayside Creek

- 24831 Cloudy Creek

- 8503 Silent Creek

- 8318 Cactus Wren Ln

- 24442 Buck Creek

- 24710 Cloudy Creek

- 14728 Childress Falls

- 24423 Elise Falls

- 25007 Seal Cove

- 7811 Midnight Stage

- 25764 Velvet Creek

- 24406 Treaty Creek

- 24752 Buck Creek

- 24744 Buck Creek

- 24756 Buck Creek

- 24740 Buck Creek

- 24736 Buck Creek

- 24760 Buck Creek

- 24747 Buck Creek

- 24751 Buck Creek

- 25111 Royal Land

- 25103 Royal Land

- 24743 Buck Creek

- 24755 Buck Creek

- 25115 Royal Land

- 24732 Buck Creek

- 24764 Buck Creek

- 24739 Buck Creek

- 24759 Buck Creek

- 25119 Royal Land

- 24735 Buck Creek

- 24763 Buck Creek