Estimated Value: $472,545 - $497,000

3

Beds

3

Baths

2,733

Sq Ft

$178/Sq Ft

Est. Value

About This Home

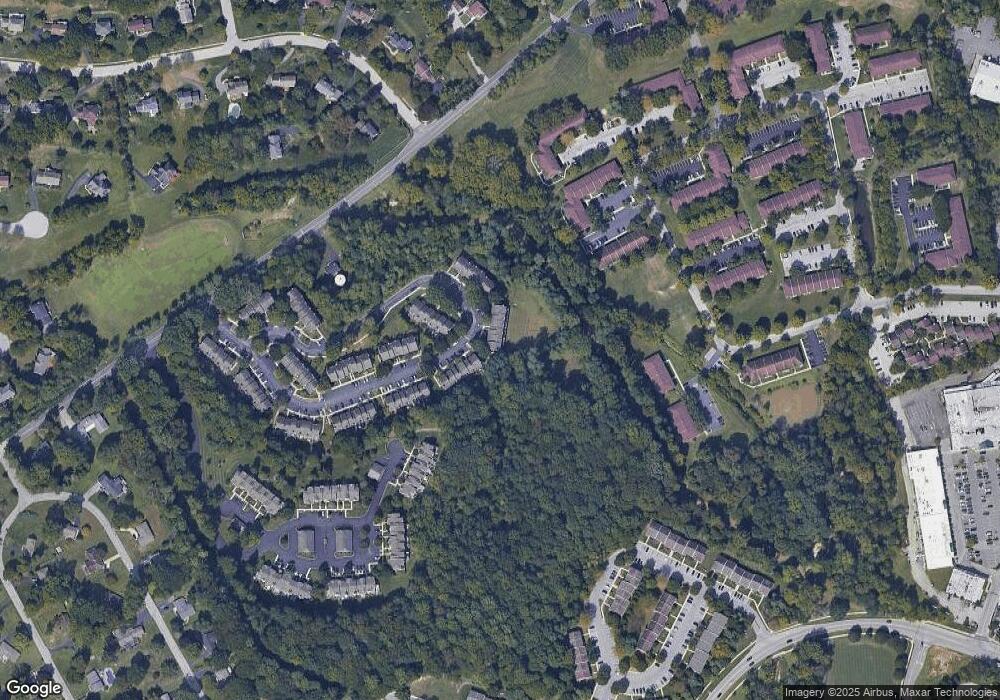

This home is located at 248 Fox Run, Exton, PA 19341 and is currently estimated at $485,886, approximately $177 per square foot. 248 Fox Run is a home located in Chester County with nearby schools including Mary C Howse Elementary School, E.N. Peirce Middle School, and Henderson High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 17, 2008

Sold by

Boinske Paul Theodore and Young Fiona C

Bought by

Mayewski Richard J and Mayewski Jessica G

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$281,277

Outstanding Balance

$180,679

Interest Rate

6.07%

Mortgage Type

FHA

Estimated Equity

$305,207

Purchase Details

Closed on

Mar 20, 2003

Sold by

Boinske Paul Theodore

Bought by

Boinske Paul Theodore and Young Fiona C

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$122,000

Interest Rate

5.88%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Feb 1, 1999

Sold by

Versak Christopher J

Bought by

Boinske Paul Theodore and Young Fiona

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$124,800

Interest Rate

6.74%

Purchase Details

Closed on

Feb 28, 1994

Sold by

Bodo Louis and Bodo Gizella

Bought by

Versak Christopher J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$137,600

Interest Rate

7.01%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Mayewski Richard J | $283,500 | None Available | |

| Boinske Paul Theodore | -- | -- | |

| Boinske Paul Theodore | $156,000 | -- | |

| Versak Christopher J | $152,900 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Mayewski Richard J | $281,277 | |

| Previous Owner | Boinske Paul Theodore | $122,000 | |

| Previous Owner | Boinske Paul Theodore | $124,800 | |

| Previous Owner | Versak Christopher J | $137,600 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,998 | $137,910 | $23,440 | $114,470 |

| 2024 | $3,998 | $137,910 | $23,440 | $114,470 |

| 2023 | $3,820 | $137,910 | $23,440 | $114,470 |

| 2022 | $3,768 | $137,910 | $23,440 | $114,470 |

| 2021 | $3,714 | $137,910 | $23,440 | $114,470 |

| 2020 | $3,688 | $137,910 | $23,440 | $114,470 |

| 2019 | $3,635 | $137,910 | $23,440 | $114,470 |

| 2018 | $3,554 | $137,910 | $23,440 | $114,470 |

| 2017 | $3,473 | $137,910 | $23,440 | $114,470 |

| 2016 | $2,940 | $137,910 | $23,440 | $114,470 |

| 2015 | $2,940 | $137,910 | $23,440 | $114,470 |

| 2014 | $2,940 | $137,910 | $23,440 | $114,470 |

Source: Public Records

Map

Nearby Homes

- 261 Watch Hill Rd

- 315 Oak Ln W

- 447 Lee Place

- 208 Morris Rd

- 218 Hendricks Ave

- 510 Woodview Dr

- 524 E Saxony Dr Unit 524

- 167 Brazier Ln

- 432 Carmarthen Ct

- 577 Pewter Dr

- 420 Oakland Dr

- 208 Lucy Cir

- 108 Mountain View Dr

- 913 Grandview Dr

- 207 Lucy Cir

- Santorini Plan at Worthington Farm - Luxury Single-Family Homes

- Monaco Plan at Worthington Farm - Luxury Single-Family Homes

- Lisbon Plan at Worthington Farm - Luxury Single-Family Homes

- 316 Longs Peak Way

- 603 Coach Hill Ct Unit B