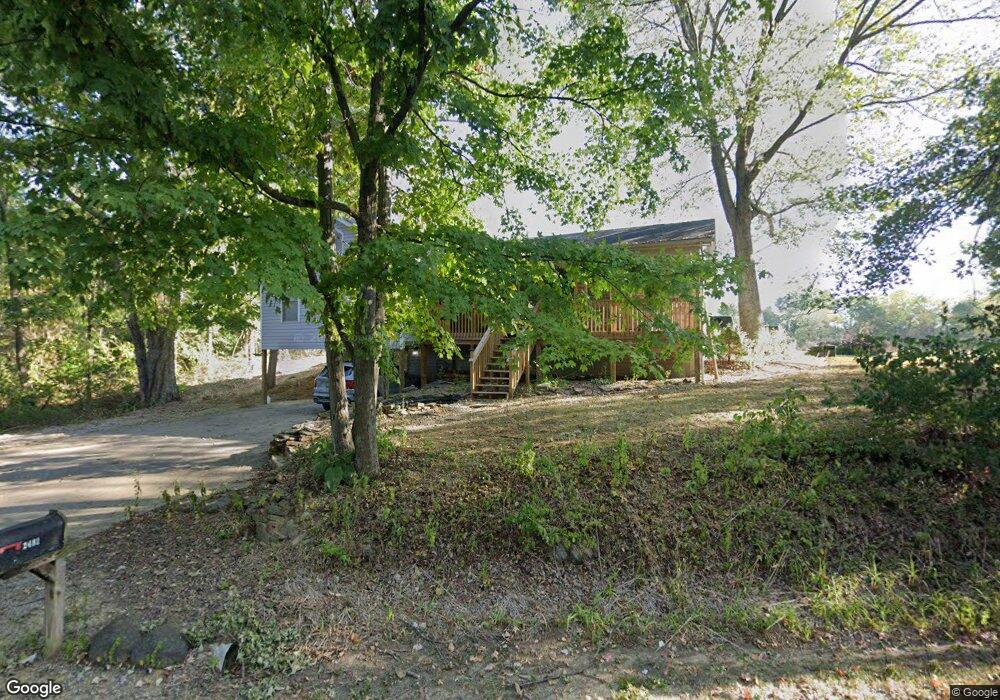

2481 Beech Grove Rd Georgetown, OH 45121

Estimated Value: $273,000 - $345,000

4

Beds

2

Baths

1,748

Sq Ft

$182/Sq Ft

Est. Value

About This Home

This home is located at 2481 Beech Grove Rd, Georgetown, OH 45121 and is currently estimated at $318,021, approximately $181 per square foot. 2481 Beech Grove Rd is a home located in Brown County with nearby schools including Western Brown High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 29, 2015

Sold by

Gumbert Sandra J and Gumbert Jacob A

Bought by

Gumbert Jacob A

Current Estimated Value

Purchase Details

Closed on

Mar 26, 2010

Sold by

Reynolds Mark L and Reynolds Lisa M

Bought by

Gumbert Jacob A and Sipos Sandra J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$103,098

Outstanding Balance

$68,223

Interest Rate

4.87%

Mortgage Type

FHA

Estimated Equity

$249,798

Purchase Details

Closed on

Dec 11, 2006

Sold by

Meyer Michael J and Meyer Amy L

Bought by

Reynolds Mark L and Reynolds Lisa M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$137,400

Interest Rate

6.24%

Mortgage Type

Unknown

Purchase Details

Closed on

Sep 20, 2006

Sold by

Vaughn David

Bought by

Meyer Michael J and Meyer Amy L

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Gumbert Jacob A | -- | None Available | |

| Gumbert Jacob A | $105,000 | Prominent Title | |

| Reynolds Mark L | $139,000 | Attorney | |

| Meyer Michael J | $75,600 | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Gumbert Jacob A | $103,098 | |

| Previous Owner | Reynolds Mark L | $137,400 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,239 | $79,510 | $9,510 | $70,000 |

| 2023 | $2,239 | $58,500 | $6,890 | $51,610 |

| 2022 | $1,768 | $58,500 | $6,890 | $51,610 |

| 2021 | $1,631 | $58,500 | $6,890 | $51,610 |

| 2020 | $1,502 | $50,870 | $5,990 | $44,880 |

| 2019 | $1,616 | $50,870 | $5,990 | $44,880 |

| 2018 | $1,601 | $50,870 | $5,990 | $44,880 |

| 2017 | $1,403 | $44,250 | $6,590 | $37,660 |

| 2016 | $1,375 | $44,250 | $6,590 | $37,660 |

| 2015 | $1,409 | $44,250 | $6,590 | $37,660 |

| 2014 | $1,409 | $43,650 | $5,990 | $37,660 |

| 2013 | $1,405 | $43,650 | $5,990 | $37,660 |

Source: Public Records

Map

Nearby Homes

- 9291 Daugherty Marks Rd

- 1420 T-301

- 0 Barnes Rd Unit 1851215

- 7809 Ohio 505

- 0 St Rt 221 & Footbridge Unit 1826509

- 3571 Shaw Rd

- 7678 J Bolender Rd

- 10300 St Rt 774

- 405 N Main St

- 508 Mount Orab Pike

- 505 S Water St

- 7029 Free Soil Rd

- 155 Free Soil Rd

- 399 Elmwood Ct

- 401 Elmwood Ct

- 406 E North St

- 470 Free Soil Rd

- 427 Kenwood Ave

- 2 N Kenwood Ave

- 1 N Kenwood Ave

- 2496 Beech Grove Rd

- 2435 Beech Grove Rd

- 2530 Beech Grove Rd

- 2470 Eden Rd

- 0 Eden Rd Unit 737276

- 64.66ac Eden Rd

- 2409 Eden Rd

- 2379 Eden Rd

- 2642 Eden Rd

- 2358 Eden Rd

- 2610 Eden Rd

- 2340 Eden Rd

- 2326 Eden Rd

- 2479 Eden Rd

- 2654 Eden Rd

- 2660 Beech Grove Rd

- 2672 Eden Rd

- 2690 Eden Rd

- 2806 Eden Rd

- 2693 Beech Grove Rd