2485 Silver Beach Dr Henderson, NV 89052

Green Valley Ranch NeighborhoodEstimated Value: $728,187 - $794,000

4

Beds

3

Baths

2,776

Sq Ft

$273/Sq Ft

Est. Value

About This Home

This home is located at 2485 Silver Beach Dr, Henderson, NV 89052 and is currently estimated at $758,547, approximately $273 per square foot. 2485 Silver Beach Dr is a home located in Clark County with nearby schools including Glen C. Taylor Elementary School, Bob Miller Middle School, and Coronado High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 17, 2016

Sold by

Jones Karen H

Bought by

Christensen Ray

Current Estimated Value

Purchase Details

Closed on

May 9, 2013

Sold by

Bergman Tolza Ada

Bought by

Bergman Tolza Ada and Tolza A Bergman Living Trust

Purchase Details

Closed on

Sep 27, 2007

Sold by

Bergman Leon and Bergman Tolza A

Bought by

Bergman Leon and Bergman Tolza A

Purchase Details

Closed on

May 5, 1999

Sold by

Richmond American Homes Of Nevada Inc

Bought by

Bergman Leon and Bergman Tolza A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$50,000

Interest Rate

7.97%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Christensen Ray | -- | None Available | |

| Bergman Tolza Ada | -- | None Available | |

| Bergman Leon | -- | None Available | |

| Bergman Leon | -- | None Available | |

| Bergman Leon | $242,000 | Old Republic Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Bergman Leon | $50,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,699 | $177,761 | $66,850 | $110,911 |

| 2024 | $3,592 | $177,761 | $66,850 | $110,911 |

| 2023 | $3,592 | $160,627 | $55,300 | $105,327 |

| 2022 | $3,487 | $150,386 | $54,250 | $96,136 |

| 2021 | $3,386 | $138,796 | $47,250 | $91,546 |

| 2020 | $3,284 | $137,537 | $46,900 | $90,637 |

| 2019 | $3,189 | $128,354 | $39,200 | $89,154 |

| 2018 | $3,096 | $122,092 | $36,050 | $86,042 |

| 2017 | $3,495 | $120,570 | $33,250 | $87,320 |

| 2016 | $2,931 | $115,777 | $27,300 | $88,477 |

| 2015 | $2,931 | $110,727 | $23,450 | $87,277 |

| 2014 | $2,840 | $95,125 | $17,500 | $77,625 |

Source: Public Records

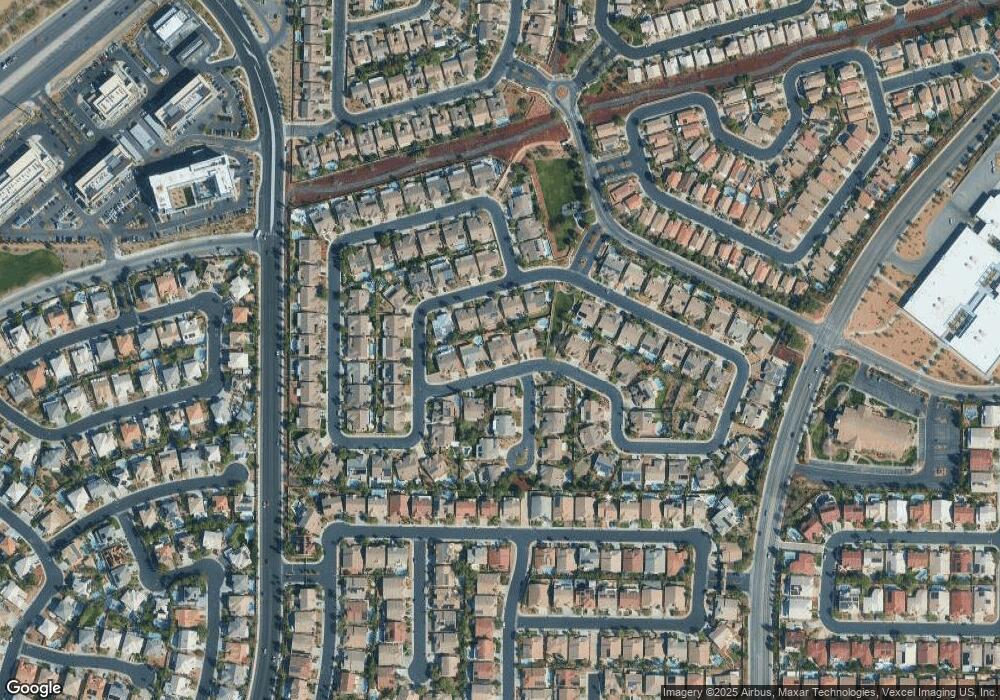

Map

Nearby Homes

- 330 Quiet Harbor Dr

- 505 Enchanted Lakes Dr

- 2506 Vintage Rose Ave

- 2543 Citrus Garden Cir

- 514 Enchanted Lakes Dr

- 691 Vineland Ave

- 442 Beardsley Cir

- 2501 Citrus Garden Cir

- 464 Beardsley Cir

- 2412 Goldfire Cir

- 2524 New Salem Ave

- 511 Broken Shale Cir

- 2388 Kenneth Ave

- 2381 Goldfire Cir

- 2667 Hourglass Dr

- 2405 Esteem Ridge Dr

- 533 Blanche Ct

- 269 Jaramillo Ct

- 489 Annet St

- 521 Kanani Ct

- 2483 Silver Beach Dr

- 2487 Silver Beach Dr

- 2545 Silver Beach Dr

- 2543 Silver Beach Dr

- 2547 Silver Beach Dr

- 2481 Silver Beach Dr

- 2541 Silver Beach Dr

- 2549 Silver Beach Dr

- 2482 Silver Beach Dr

- 359 Vincents Hollow Cir

- 2491 Silver Beach Dr

- 358 Vincents Hollow Cir

- 358 Vincents Hollow Cir Unit n/a

- 308 Quiet Harbor Dr

- 2544 Silver Beach Dr

- 2546 Silver Beach Dr

- 2548 Silver Beach Dr

- 357 Vincents Hollow Cir

- 2537 Silver Beach Dr

- 360 Quiet Harbor Dr