Estimated Value: $739,000 - $1,092,000

5

Beds

5

Baths

4,074

Sq Ft

$231/Sq Ft

Est. Value

About This Home

This home is located at 2486 Stewart Rd, Xenia, OH 45385 and is currently estimated at $939,814, approximately $230 per square foot. 2486 Stewart Rd is a home located in Greene County with nearby schools including Bell Creek Intermediate School, Stephen Bell Elementary School, and Bellbrook Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 18, 2018

Sold by

Schieman William B

Bought by

Bertke Julie G and Bertke John

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$308,275

Outstanding Balance

$189,828

Interest Rate

4.5%

Mortgage Type

New Conventional

Estimated Equity

$749,986

Purchase Details

Closed on

Jun 2, 1999

Sold by

Fifth Third Investment Company

Bought by

Schieman William D and Schieman Deborah L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$368,000

Interest Rate

6.99%

Purchase Details

Closed on

Dec 3, 1998

Sold by

Abernathy Robert D and Abernathy Jane E

Bought by

Fifth Third Investment Company

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Bertke Julie G | $628,300 | Landmark Title Agency Inc | |

| Schieman William D | $460,000 | Midwest Abstract Company | |

| Fifth Third Investment Company | $370,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Bertke Julie G | $308,275 | |

| Previous Owner | Schieman William D | $368,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $14,720 | $266,330 | $46,540 | $219,790 |

| 2023 | $14,720 | $266,330 | $46,540 | $219,790 |

| 2022 | $14,676 | $220,910 | $42,310 | $178,600 |

| 2021 | $14,841 | $220,910 | $42,310 | $178,600 |

| 2020 | $13,864 | $220,910 | $42,310 | $178,600 |

| 2019 | $13,643 | $199,390 | $42,310 | $157,080 |

| 2018 | $13,068 | $199,390 | $42,310 | $157,080 |

| 2017 | $12,913 | $199,390 | $42,310 | $157,080 |

| 2016 | $12,914 | $191,430 | $42,310 | $149,120 |

| 2015 | $12,708 | $191,430 | $42,310 | $149,120 |

| 2014 | $11,728 | $191,430 | $42,310 | $149,120 |

Source: Public Records

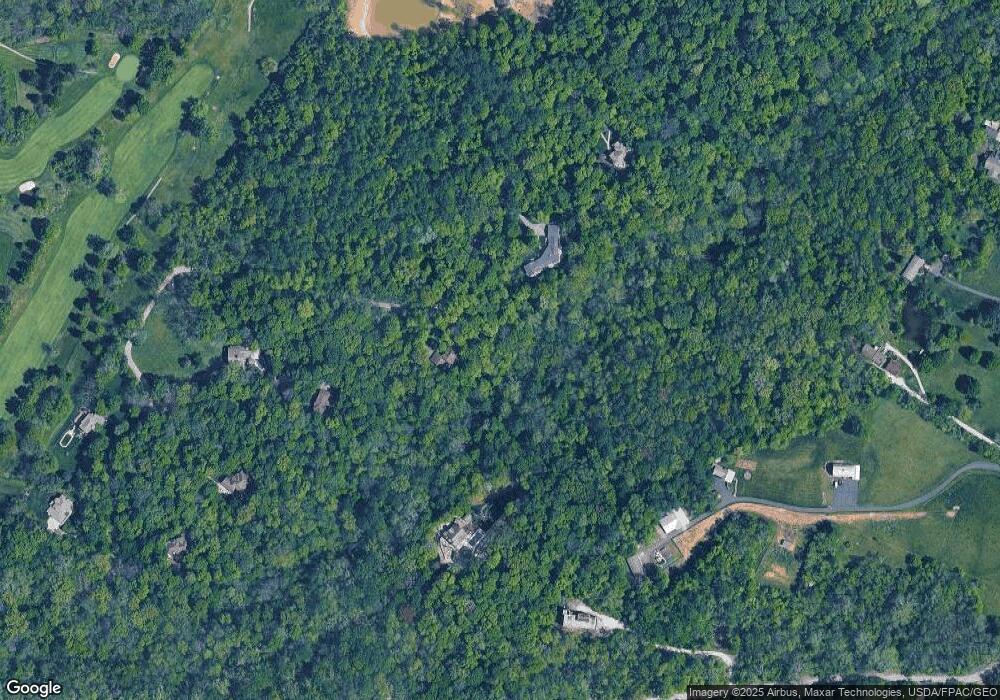

Map

Nearby Homes

- 2336 Washington Mill Rd

- 1681 Valley Heights Rd

- 1711 Mcclellan Rd

- 1753 Cedar Ridge Dr

- 295 Stratford Ln

- 1839 Simison Rd

- 185 Barrington Village Dr

- 463 Valhalla Ct

- 2018 Amberwood Ct

- 1474 Hawkshead St

- 90 Pawleys Plantation Ct

- 1292 Baybury Ave

- 1272 Baybury Ave

- 1293 Baybury Ave

- 1256 Baybury Ave

- Chatham Plan at Edenbridge

- Bellamy Plan at Edenbridge

- Holcombe Plan at Edenbridge

- Henley Plan at Edenbridge

- Newcastle Plan at Edenbridge

- 2482 Stewart Rd

- 2488 Stewart Rd

- 2490 Stewart Rd

- 2484 Stewart Rd

- 2492 Stewart Rd

- 2226 Stewart Rd

- 2202 Stewart Rd

- 2300 Stewart Rd

- 2230 Stewart Rd

- 2494 Stewart Rd

- 2385 Indian Wells Trail

- 2178 Stewart Rd

- 2496 Stewart Rd

- 2498 Stewart Rd

- 2433 Indian Wells Trail

- 2162 Stewart Rd

- 2400 Indian Wells Trail

- 2451 Indian Wells Trail

- 2500 Stewart Rd

- 2241 Stewart Rd