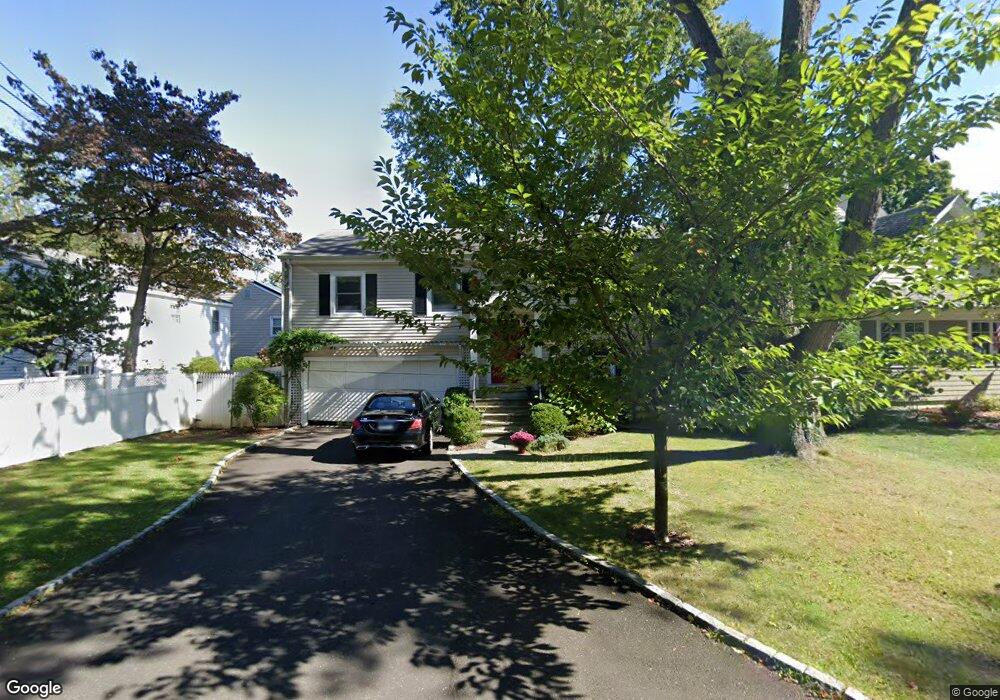

25 Brownhouse Rd Old Greenwich, CT 06870

Old Greenwich NeighborhoodEstimated Value: $1,654,000 - $1,908,000

4

Beds

2

Baths

1,932

Sq Ft

$913/Sq Ft

Est. Value

About This Home

This home is located at 25 Brownhouse Rd, Old Greenwich, CT 06870 and is currently estimated at $1,763,216, approximately $912 per square foot. 25 Brownhouse Rd is a home located in Fairfield County with nearby schools including International School At Dundee, Eastern Middle School, and Greenwich High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 25, 2023

Sold by

Chibans Taizo and Yano Ayako

Bought by

Shao Qun and Ding Yan

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$980,000

Outstanding Balance

$951,077

Interest Rate

6.27%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$812,139

Purchase Details

Closed on

Jun 24, 2005

Sold by

Kido Hideaki and Kido Kumiko

Bought by

Chibana Taizo and Yano Ayako

Purchase Details

Closed on

Mar 20, 1995

Sold by

Neil Michael J and Neil Julie M

Bought by

Kido Hideaki and Kido Kumiko

Purchase Details

Closed on

Sep 22, 1994

Sold by

Pino Victor and Pino Maria Olga

Bought by

Neil Michael J and Neil Julie M

Purchase Details

Closed on

Dec 28, 1990

Sold by

Townsend Curtis

Bought by

Pino Victor

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Shao Qun | $1,422,900 | None Available | |

| Chibana Taizo | $1,010,000 | -- | |

| Kido Hideaki | $410,000 | -- | |

| Neil Michael J | $385,000 | -- | |

| Pino Victor | $345,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Shao Qun | $980,000 | |

| Previous Owner | Pino Victor | $236,000 | |

| Previous Owner | Pino Victor | $150,000 | |

| Previous Owner | Pino Victor | $324,587 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $9,709 | $785,610 | $611,450 | $174,160 |

| 2024 | $9,377 | $785,610 | $611,450 | $174,160 |

| 2023 | $8,606 | $739,620 | $611,450 | $128,170 |

| 2022 | $8,528 | $739,620 | $611,450 | $128,170 |

| 2021 | $8,147 | $676,620 | $532,140 | $144,480 |

| 2020 | $8,133 | $676,620 | $532,140 | $144,480 |

| 2019 | $8,214 | $676,620 | $532,140 | $144,480 |

| 2018 | $8,031 | $676,620 | $532,140 | $144,480 |

| 2017 | $8,132 | $676,620 | $532,140 | $144,480 |

| 2016 | $8,004 | $676,620 | $532,140 | $144,480 |

| 2015 | $6,312 | $529,270 | $450,240 | $79,030 |

| 2014 | $6,153 | $529,270 | $450,240 | $79,030 |

Source: Public Records

Map

Nearby Homes

- 51 Forest Ave Unit 98

- 51 Forest Ave Unit 82

- 7 Highview Ave

- 8 Park Ave

- 20 Center Dr

- 143 Lockwood Rd

- 27 Sound Beach Ave

- 18 Sound Beach Ave

- 602 Fairfield Ave

- 61 Aberdeen St

- 22 Summit Rd

- 119 Hendrie Ave

- 1465 E Putnam Ave Unit 525

- 11 Shorelands Place

- 175 West Ave Unit 6

- 25 Dialstone Ln

- 348 Sound Beach Ave

- 40 Orchard St

- 6 Dorchester Ln

- 25 Hoover Rd

- 25 Brown House Rd

- 23 Brownhouse Rd

- 55 Harding Rd

- 57 Harding Rd

- 21 Brownhouse Rd

- 24 Brownhouse Rd

- 63 Harding Rd Unit A

- 63 Harding Rd Unit B

- 63 Harding Rd

- 19 Brown House Rd

- 22 Brownhouse Rd

- 24 Brown House Rd

- 59 Harding Rd

- 51 Harding Rd

- 63 Harding Road B Unit B

- 63 Harding Road B

- 22 Brown House Rd

- 65 Harding Rd

- 67 Harding Rd

- 2 Kensington Ct