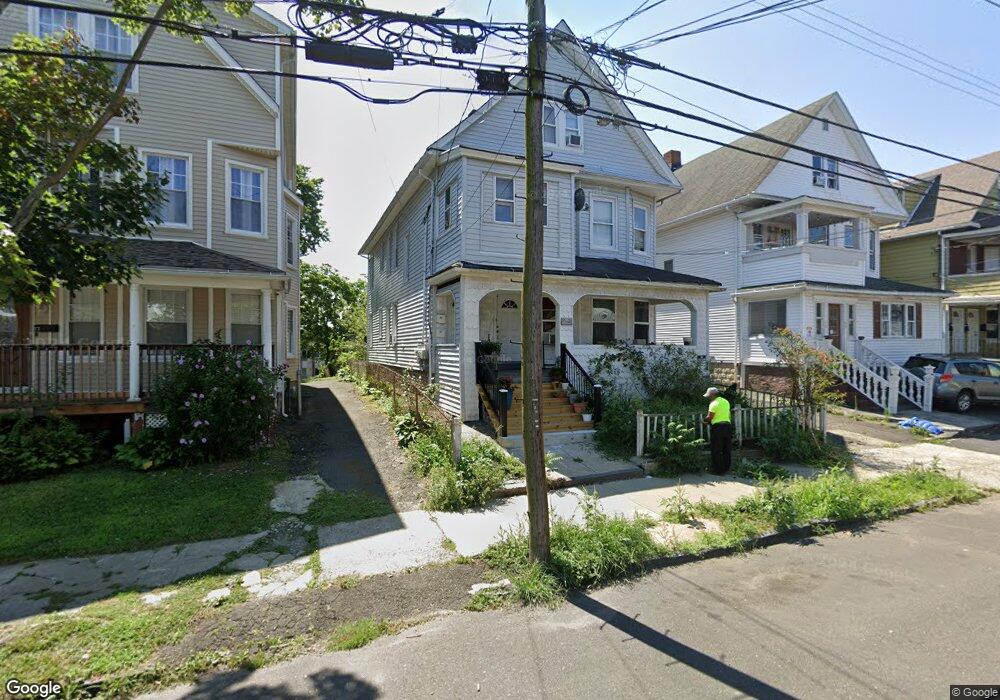

25 Worth St Unit 1 Bridgeport, CT 06604

The Hollow NeighborhoodEstimated Value: $415,343 - $619,000

3

Beds

1

Bath

3,277

Sq Ft

$169/Sq Ft

Est. Value

About This Home

This home is located at 25 Worth St Unit 1, Bridgeport, CT 06604 and is currently estimated at $552,836, approximately $168 per square foot. 25 Worth St Unit 1 is a home located in Fairfield County with nearby schools including James J. Curiale School, Bassick High School, and Catholic Academy of Bridgeport-St. Raphael Academy.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 31, 2007

Sold by

Stvictor Samuel and Stvictor Ines

Bought by

Cesar Carlo and Stvictor Cateline

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$296,000

Outstanding Balance

$177,291

Interest Rate

6.16%

Estimated Equity

$375,545

Purchase Details

Closed on

Mar 19, 2001

Sold by

Alves Jose G and Alves Ana P

Bought by

Saintvictor Samuel and Saintvictor Ines

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$134,900

Interest Rate

9.16%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Cesar Carlo | $370,000 | -- | |

| Cesar Carlo | $370,000 | -- | |

| Saintvictor Samuel | $142,000 | -- | |

| Saintvictor Samuel | $142,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Saintvictor Samuel | $296,000 | |

| Closed | Saintvictor Samuel | $296,000 | |

| Previous Owner | Saintvictor Samuel | $255,000 | |

| Previous Owner | Saintvictor Samuel | $134,900 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,601 | $174,940 | $42,060 | $132,880 |

| 2024 | $7,601 | $174,940 | $42,060 | $132,880 |

| 2023 | $7,601 | $174,940 | $42,060 | $132,880 |

| 2022 | $7,601 | $174,940 | $42,060 | $132,880 |

| 2021 | $7,601 | $174,940 | $42,060 | $132,880 |

| 2020 | $7,001 | $129,670 | $19,910 | $109,760 |

| 2019 | $7,001 | $129,670 | $19,910 | $109,760 |

| 2018 | $7,050 | $129,670 | $19,910 | $109,760 |

| 2017 | $7,050 | $129,670 | $19,910 | $109,760 |

| 2016 | $7,050 | $129,670 | $19,910 | $109,760 |

| 2015 | $8,320 | $197,160 | $41,440 | $155,720 |

| 2014 | $8,320 | $197,160 | $41,440 | $155,720 |

Source: Public Records

Map

Nearby Homes

- 391 Coleman St

- 200 Harral Ave

- 60 Olive St

- 592 Norman St Unit 594

- 1199 Iranistan Ave Unit 1201

- 75 Sanford Ave

- 191 Oak St

- 414 Wood Ave

- 1146 Iranistan Ave Unit 1148

- 30 Pacific St Unit 32

- 687 Wood Ave

- 700 Laurel Ave

- 393 Laurel Ave Unit 203

- 393 Laurel Ave Unit 415

- 357 Norman St

- 41 Hanover St

- 865 Iranistan Ave

- 533 Clinton Ave

- 162 Cottage St

- 468 Colorado Ave

- 25 Worth St

- 33 Worth St

- 17 Worth St

- 41 Worth St

- 9-11 Worth St

- 49 Worth St Unit 53

- 387 Coleman St

- 9 Worth St Unit 11

- 379 Coleman St

- 36 Worth St

- 369 Coleman St Unit 371

- 369 Coleman St

- 55 Worth St

- 50 Worth St

- 4 Worth St

- 24 Worth St

- 335 Benham Ave

- 46 Worth St Unit 1

- 46 Worth St Unit 2

- 46 Worth St Unit 3