250 Fieldstone Ct Unit 34 Alpharetta, GA 30009

Estimated Value: $810,000 - $921,000

5

Beds

4

Baths

2,834

Sq Ft

$304/Sq Ft

Est. Value

About This Home

This home is located at 250 Fieldstone Ct Unit 34, Alpharetta, GA 30009 and is currently estimated at $860,917, approximately $303 per square foot. 250 Fieldstone Ct Unit 34 is a home located in Fulton County with nearby schools including Alpharetta Elementary School, Hopewell Middle School, and Cambridge High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 20, 2022

Sold by

Mccarthy Eugene

Bought by

Setterlind Erik and Setterlind Allison

Current Estimated Value

Purchase Details

Closed on

Nov 30, 2020

Sold by

Spaid Thomas E

Bought by

Mccarthy Eugene and Setterlind Allison

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$427,250

Interest Rate

2.8%

Mortgage Type

New Conventional

Purchase Details

Closed on

Aug 30, 1996

Sold by

Mccar Dev Corp

Bought by

Spaid Thomas E

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Setterlind Erik | $410,005 | -- | |

| Mccarthy Eugene | $507,250 | -- | |

| Spaid Thomas E | $201,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Mccarthy Eugene | $427,250 | |

| Closed | Spaid Thomas E | $0 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,531 | $266,400 | $60,200 | $206,200 |

| 2023 | $7,514 | $266,200 | $60,160 | $206,040 |

| 2022 | $4,408 | $217,720 | $42,720 | $175,000 |

| 2021 | $5,528 | $196,800 | $39,360 | $157,440 |

| 2020 | $5,819 | $173,480 | $38,400 | $135,080 |

| 2019 | $929 | $161,560 | $28,240 | $133,320 |

| 2018 | $4,454 | $157,800 | $27,600 | $130,200 |

| 2017 | $3,911 | $134,040 | $22,440 | $111,600 |

| 2016 | $3,912 | $134,040 | $22,440 | $111,600 |

| 2015 | $4,698 | $134,040 | $22,440 | $111,600 |

| 2014 | $3,730 | $121,680 | $20,360 | $101,320 |

Source: Public Records

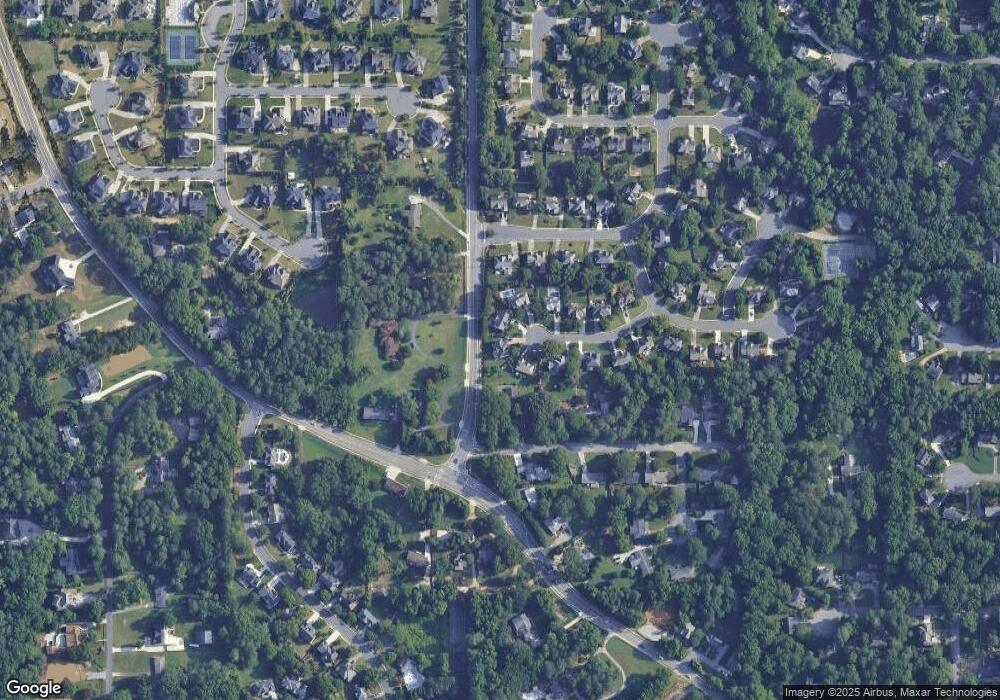

Map

Nearby Homes

- 1845 Evergreen Ln

- 1830 Mayfield Rd

- 150 Cobblestone Way

- 925 Pebblestone Ct

- 1880 Mayfield Rd

- 295 Pebble Trail

- 1045 Mayfield Manor Dr

- 322 Pebble Trail

- 320 Shady Grove Ln

- 5610 Surrey Ct

- 1835 Henley Way

- 265 Dania Dr

- 3051 Maple Ln

- 265 Mayfield Rd

- 260 Mayfield Rd

- 250 Mayfield Rd

- 215 Mayfield Cir

- 4016 Dover Ave

- 250 Fieldstone Ct

- 250 Fieldstone Ct

- 240 Fieldstone Ct

- 255 Fieldstone Ct

- 12595 Providence Rd Unit 1

- 245 Fieldstone Ct

- 230 Fieldstone Ct

- 235 Fieldstone Ct Unit 1

- 1820 Evergreen Ln Unit 1

- 1830 Evergreen Ln

- 12600 Providence Rd

- 6805 Weatherstone Way

- 225 Fieldstone Ct

- 220 Fieldstone Ct

- 12610 Providence Rd

- 6815 Weatherstone Way

- 0 Fieldstone Ct Unit 7258551

- 0 Fieldstone Ct Unit 3188139

- 0 Fieldstone Ct Unit 8597508

- 0 Fieldstone Ct Unit 8482547