2512 Charing Cross Rd NW Unit 45 Canton, OH 44708

Estimated Value: $295,444 - $405,000

2

Beds

3

Baths

2,428

Sq Ft

$140/Sq Ft

Est. Value

About This Home

This home is located at 2512 Charing Cross Rd NW Unit 45, Canton, OH 44708 and is currently estimated at $340,111, approximately $140 per square foot. 2512 Charing Cross Rd NW Unit 45 is a home located in Stark County with nearby schools including Avondale Elementary School, Oakwood Middle School, and GlenOak High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 22, 2015

Sold by

Addessi Paul F and Addessi Betty A

Bought by

Addessi Michael F and The Addessi Irrevocable Trust

Current Estimated Value

Purchase Details

Closed on

Aug 31, 2010

Sold by

Wolfe Teresa

Bought by

Addessi Paul F and Addessi Betty A

Purchase Details

Closed on

Jun 30, 2010

Sold by

Wolfe Teresa

Bought by

Addessi Paul F and Addessi Betty A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$139,000

Interest Rate

5%

Mortgage Type

Seller Take Back

Purchase Details

Closed on

Aug 5, 1999

Sold by

Wolfe Donald L and Wolfe Teresa

Bought by

The Terry Wolfe Living Trust and Wolfe Teresa

Purchase Details

Closed on

Sep 12, 1995

Sold by

Mckinley Dev Co

Bought by

Wolfe Donald L and Wolfe Teresa

Purchase Details

Closed on

May 6, 1994

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Addessi Michael F | -- | Attorney | |

| Addessi Paul F | $169,000 | Cornerstone Real Estate Titl | |

| Addessi Paul F | $169,000 | Attorney | |

| The Terry Wolfe Living Trust | -- | -- | |

| Wolfe Donald L | $155,900 | -- | |

| -- | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Addessi Paul F | $139,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | -- | $94,050 | $17,850 | $76,200 |

| 2024 | -- | $94,050 | $17,850 | $76,200 |

| 2023 | $3,081 | $74,940 | $14,460 | $60,480 |

| 2022 | $3,091 | $74,940 | $14,460 | $60,480 |

| 2021 | $3,104 | $74,940 | $14,460 | $60,480 |

| 2020 | $3,189 | $68,680 | $12,360 | $56,320 |

| 2019 | $3,053 | $68,680 | $12,360 | $56,320 |

| 2018 | $3,014 | $68,680 | $12,360 | $56,320 |

| 2017 | $2,814 | $61,260 | $11,060 | $50,200 |

| 2016 | $2,822 | $61,260 | $11,060 | $50,200 |

| 2015 | $2,833 | $61,260 | $11,060 | $50,200 |

| 2014 | $490 | $53,310 | $12,110 | $41,200 |

| 2013 | $1,222 | $53,310 | $12,110 | $41,200 |

Source: Public Records

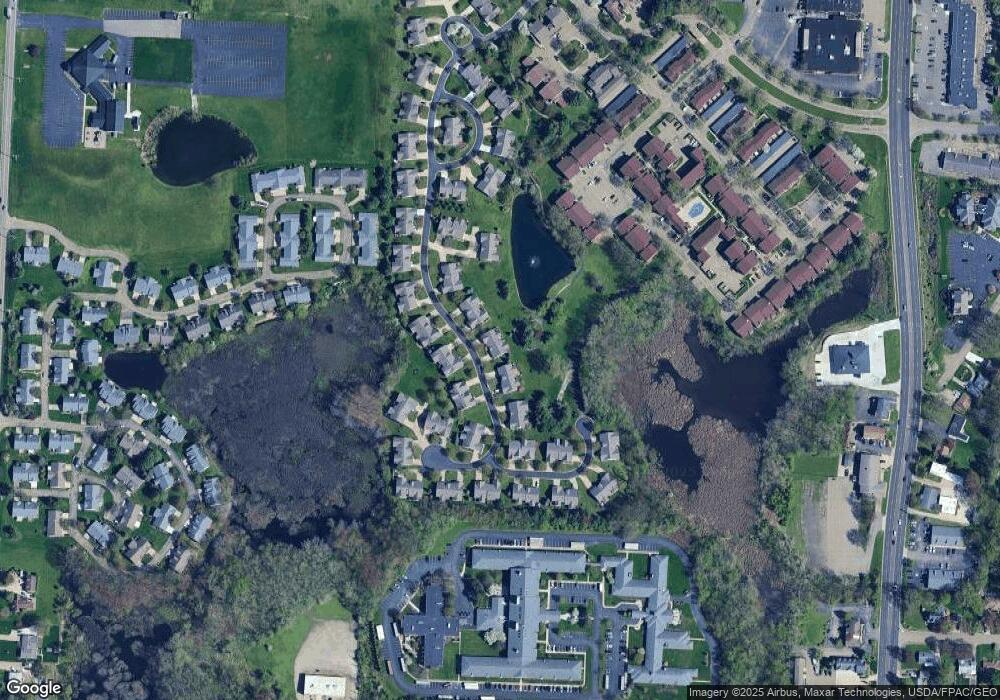

Map

Nearby Homes

- 2844 Marsh Ave NW Unit 49A

- 2520 Woodlawn Cir NW Unit 42B

- 4579 Morgate Cir NW

- 2887 Charing Cross Rd NW

- 4352 22nd St NW

- 2818 Marlin Ave NW

- 4703 Hills And Dales Rd NW Unit 304

- 1822 Woodlawn Ave NW

- 2622 Glenmont Rd NW

- 2450 Larchmoor Pkwy NW

- 4558 17th St NW

- 0 Dunkeith Dr NW Unit 5083845

- 3945 Arbor Creek Ave NW

- 4719 15th St NW

- 3431 Enfield Ave NW

- 4072 Lindbergh Ave NW

- 3878 36th St NW

- VL Woodlawn Ave NW

- 3222 25th St NW

- 3650 Overhill Dr NW

- 2514 Charing Cross Rd NW

- 2504 Charing Cross Rd NW Unit 44

- 2522 Charing Cross Rd NW

- 2511 Charing Cross Rd NW

- 2524 Charing Cross Rd NW

- 2513 Charing Cross Rd NW

- 2501 Charing Cross Rd NW Unit 42

- 2446 Charing Cross Rd NW Unit 55

- 2521 Charing Cross Rd NW Unit 38

- 2523 Charing Cross Rd NW Unit 37

- 2530 Charing Cross Rd NW

- 2530 Charing Cross Rd NW Unit 49

- 2439 Charing Cross Rd NW

- 2532 Charing Cross Rd NW Unit 50

- 2602 Charing Cross Rd NW Unit 27

- 2423 Charing Cross Rd NW Unit 79

- 2437 Charing Cross Rd NW Unit 81

- 2425 Charing Cross Rd NW Unit 80

- 2529 Charing Cross Rd NW

- 2531 Charing Cross Rd NW