2516 W 65th St Hialeah, FL 33016

Estimated Value: $437,000 - $495,000

3

Beds

2

Baths

1,170

Sq Ft

$402/Sq Ft

Est. Value

About This Home

This home is located at 2516 W 65th St, Hialeah, FL 33016 and is currently estimated at $470,499, approximately $402 per square foot. 2516 W 65th St is a home located in Miami-Dade County with nearby schools including Ernest R. Graham K-8 Academy, Miami Lakes Middle School, and Hialeah Gardens Senior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 27, 2004

Sold by

Losada Mary

Bought by

Pastor Maritza Libertad

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$136,500

Outstanding Balance

$66,234

Interest Rate

5.89%

Mortgage Type

Unknown

Estimated Equity

$404,265

Purchase Details

Closed on

Feb 26, 2002

Sold by

Lorena Rodriguez I

Bought by

Losada Mary

Purchase Details

Closed on

Jun 26, 1993

Sold by

Housing & Urban Dev Wa Dc

Bought by

Torres Medardo and Rodriguez Lorena

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$79,516

Interest Rate

7.52%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Pastor Maritza Libertad | $145,000 | Statewide Title Corp | |

| Losada Mary | $110,000 | -- | |

| Torres Medardo | $76,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Pastor Maritza Libertad | $136,500 | |

| Previous Owner | Torres Medardo | $79,516 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,726 | $137,511 | -- | -- |

| 2024 | $1,664 | $133,636 | -- | -- |

| 2023 | $1,664 | $129,744 | $0 | $0 |

| 2022 | $1,590 | $125,966 | $0 | $0 |

| 2021 | $1,569 | $122,298 | $0 | $0 |

| 2020 | $1,543 | $120,610 | $0 | $0 |

| 2019 | $1,494 | $117,899 | $0 | $0 |

| 2018 | $1,412 | $115,701 | $0 | $0 |

| 2017 | $1,389 | $113,322 | $0 | $0 |

| 2016 | $1,376 | $110,992 | $0 | $0 |

| 2015 | $1,390 | $110,221 | $0 | $0 |

| 2014 | $1,405 | $109,347 | $0 | $0 |

Source: Public Records

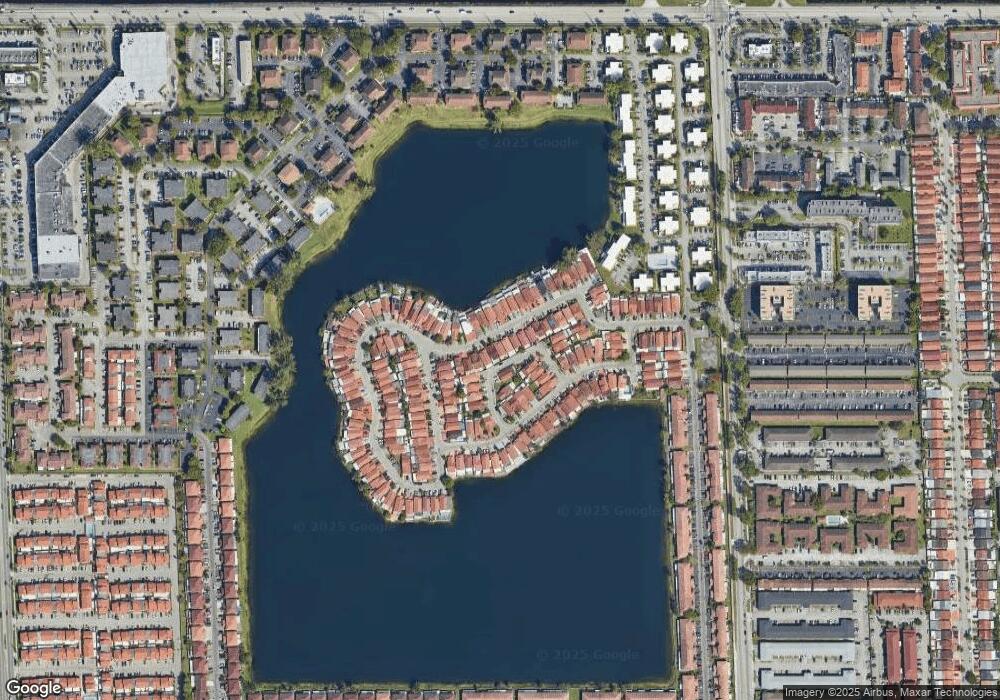

Map

Nearby Homes

- 2551 W 64th Place

- 2614 W 65th St

- 2540 W 67th Place Unit 20428

- 2540 W 67th Place Unit 20228

- 2530 W 67th Place Unit 1229

- 2570 W 67th Place Unit 212

- 6455 W 27th Ave Unit 44-13

- 2450 W 67th Place Unit 13-12

- 2480 W 67th Place Unit 2312

- 2635 W 67th Place Unit 1412

- 2531 W 60th Place Unit 10518

- 2377 W 66th Place Unit 204

- 6545 W 27th Ct Unit 2447

- 6411 W 27th Way Unit 201

- 6580 W 27th Ct Unit 58-21

- 6215 W 24th Ave Unit 2067

- 6080 W 26th Ct Unit 1019

- 6410 W 27th Ln Unit 10119

- 2760 W 62nd Place Unit 203

- 6041 W 24th Ave Unit B202

Your Personal Tour Guide

Ask me questions while you tour the home.