253 Adams St Centerburg, OH 43011

Estimated Value: $296,000 - $322,000

3

Beds

2

Baths

1,428

Sq Ft

$218/Sq Ft

Est. Value

About This Home

This home is located at 253 Adams St, Centerburg, OH 43011 and is currently estimated at $311,587, approximately $218 per square foot. 253 Adams St is a home located in Knox County with nearby schools including Centerburg Elementary School and Centerburg High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 19, 2005

Sold by

Gaston Albert E and Gaston Paulette E

Bought by

Realty Mortgage Corp

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$122,550

Interest Rate

5.98%

Mortgage Type

New Conventional

Purchase Details

Closed on

Oct 1, 1996

Sold by

Temple Scott A and Temple Debra K

Bought by

Orourke Michael D

Purchase Details

Closed on

Oct 3, 1995

Bought by

Temple Scott A and Temple Debra K

Purchase Details

Closed on

Apr 17, 1992

Sold by

Loudenback Kurt N and Loudenback Valer

Bought by

Mcpeek Ronald Stuart & Co

Purchase Details

Closed on

Aug 19, 1988

Sold by

Holbrook Irma

Bought by

Loudenback Kurt N and Loudenback Valer

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Realty Mortgage Corp | $96,750 | Chicago Title | |

| Orourke Michael D | $85,000 | -- | |

| Temple Scott A | $82,500 | -- | |

| Mcpeek Ronald Stuart & Co | $64,500 | -- | |

| Loudenback Kurt N | $59,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Realty Mortgage Corp | $122,550 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,734 | $78,020 | $14,630 | $63,390 |

| 2023 | $2,734 | $78,020 | $14,630 | $63,390 |

| 2022 | $2,170 | $53,810 | $10,090 | $43,720 |

| 2021 | $2,151 | $53,810 | $10,090 | $43,720 |

| 2020 | $1,966 | $53,810 | $10,090 | $43,720 |

| 2019 | $1,692 | $44,210 | $10,900 | $33,310 |

| 2018 | $1,703 | $44,210 | $10,900 | $33,310 |

| 2017 | $1,560 | $44,210 | $10,900 | $33,310 |

| 2016 | $1,413 | $40,930 | $10,090 | $30,840 |

| 2015 | $1,352 | $40,930 | $10,090 | $30,840 |

| 2014 | $1,351 | $40,930 | $10,090 | $30,840 |

| 2013 | $1,404 | $40,870 | $9,490 | $31,380 |

Source: Public Records

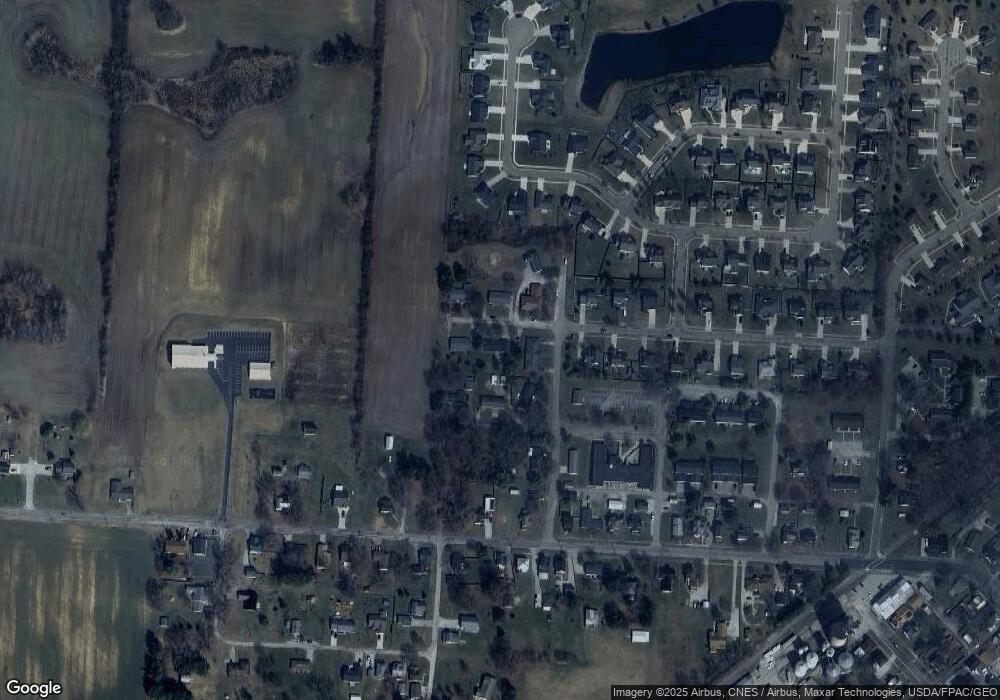

Map

Nearby Homes

- 24 Messmore Ave

- 80 N Preston St

- 76 E Main St

- 106 Union St

- 00 Ohio 314

- 436 Ohio 314

- 357 S Hartford Ave

- 0 Anderson Ln Unit Lot 13 225029362

- 0 Krause Rd Unit 225038328

- 2191 Barnes Rd

- 1001 Eckard Rd

- 2042 Croton Rd

- 5679 White Rd

- 15228 Croton Rd

- 0 Ball Rd

- 1136 Porter Ln

- 244 Ohio 314

- 4682 Webster Rd

- 334 State Route 314

- 0 Simmons Church Rd Unit 225037857