253 Stephens Rd Cedartown, GA 30125

Estimated Value: $884,000 - $1,864,859

3

Beds

2

Baths

2,678

Sq Ft

$513/Sq Ft

Est. Value

About This Home

This home is located at 253 Stephens Rd, Cedartown, GA 30125 and is currently estimated at $1,374,430, approximately $513 per square foot. 253 Stephens Rd is a home located in Polk County with nearby schools including Vineyard Harvester Christian Academy.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 3, 2025

Sold by

Perkins Timothy P

Bought by

Perkins Debra and Perkins Timothy P

Current Estimated Value

Purchase Details

Closed on

Nov 2, 2020

Sold by

Fortenberry Properties Llc

Bought by

Perkins Timothy P

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$98,000

Interest Rate

2.8%

Mortgage Type

Commercial

Purchase Details

Closed on

May 27, 2016

Sold by

Stephens Argris Evangeline

Bought by

Stephens Mary Jeanette and Stephens Phillip J

Purchase Details

Closed on

Aug 10, 2011

Sold by

Fortenberry Gary

Bought by

Fortenberry Properties Inc

Purchase Details

Closed on

Dec 11, 2008

Sold by

Stephens Argris V*

Bought by

Richard Darrell Stephens Sr **

Purchase Details

Closed on

Apr 26, 1999

Sold by

Stephens Ralph

Bought by

Stephens Ralph and Argris Valinge

Purchase Details

Closed on

Jan 1, 1901

Bought by

Stephens Ralph

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Perkins Debra | -- | -- | |

| Perkins Timothy P | $141,500 | -- | |

| Stephens Mary Jeanette | $52,275 | -- | |

| Sweezey Patricia D | $141,650 | -- | |

| Fortenberry Gary | $60,500 | -- | |

| Fortenberry Properties Inc | -- | -- | |

| Richard Darrell Stephens Sr ** | -- | -- | |

| Stephens Ralph | -- | -- | |

| Stephens Ralph | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Perkins Timothy P | $98,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $13,810 | $666,543 | $42,547 | $623,996 |

| 2024 | $13,810 | $662,675 | $38,679 | $623,996 |

| 2023 | $10,207 | $430,115 | $38,679 | $391,436 |

| 2022 | $826 | $34,797 | $33,659 | $1,138 |

| 2021 | $813 | $33,797 | $33,659 | $138 |

| 2020 | $814 | $33,797 | $33,659 | $138 |

| 2019 | $877 | $32,674 | $31,592 | $1,082 |

| 2018 | $900 | $32,674 | $31,592 | $1,082 |

| 2017 | $889 | $32,674 | $31,592 | $1,082 |

| 2016 | $3,696 | $135,826 | $113,998 | $21,828 |

| 2015 | $3,710 | $135,924 | $113,998 | $21,926 |

| 2014 | $3,754 | $136,547 | $113,998 | $22,550 |

Source: Public Records

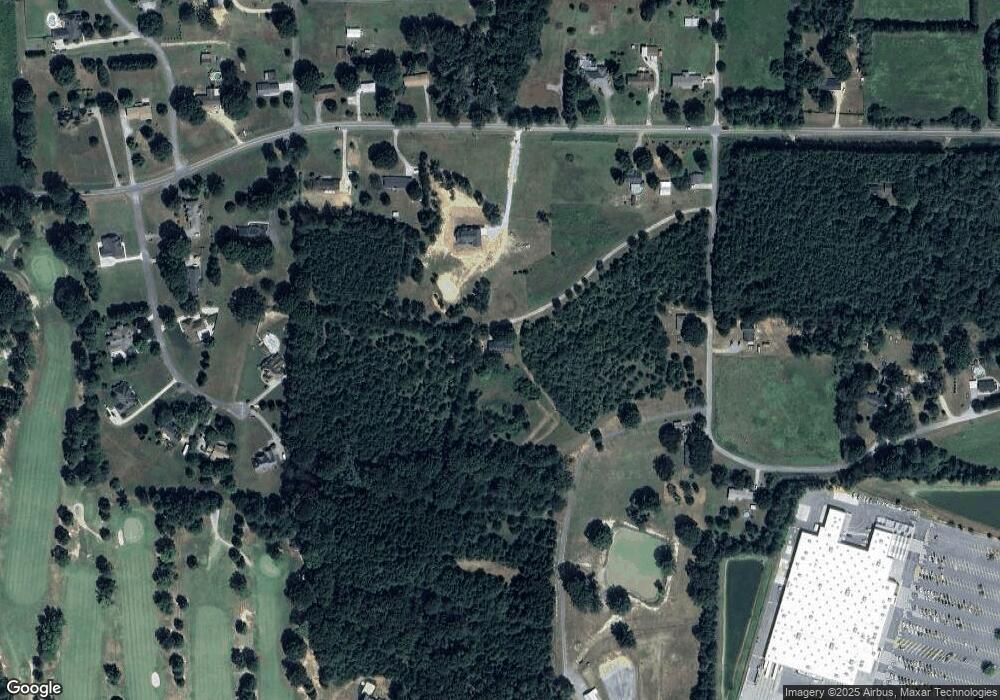

Map

Nearby Homes

- 232 Stephens Rd

- 64 Virginia Cir

- 727 Cherokee Rd

- 217 Cherokee Cir

- LOT 21 Cherokee Cir

- 621 N College Dr

- 413 N College Dr

- 220 John Phillips Rd

- 0 Joy Dr Unit 7702866

- 0 Joy Dr Unit 10669012

- 0 Joy Dr Unit 56

- 00 Joy Dr

- 112 College Cir

- 165 Lake Creek Rd

- 8 Stonegate Dr

- 812 Blanche Rd

- 2236 Rome Hwy

- 362 Oakwood Dr

- 804 Blanche Rd

- 88 Sequoyah Ct

- 84 Cherokee Fairways

- 175 Stephens Rd

- 163 Stephens Rd

- 81 Cherokee Fwy

- 7 Cherokee Fairways

- 68 Cherokee Fairways

- 218 Stephens Rd

- 0 Stephens Rd

- 0 Stephens Rd Unit LOT 2 10484213

- 0 Stephens Rd Unit 8440351

- 0 Stephens Rd Unit 8731168

- 0 Stephens Rd Unit 6676395

- 0 Stephens Rd Unit 8576060

- 219 Stephens Rd

- 219 Stephens Rd

- 2 Stephens Rd

- 2 Stephens Rd Unit LOT 2

- 47 Cherokee Fairways

- 299 Cherokee Rd

- 31 Cherokee Fairways