Estimated Value: $310,000 - $357,000

4

Beds

3

Baths

2,050

Sq Ft

$161/Sq Ft

Est. Value

About This Home

This home is located at 25392 Oklahoma 88 Unit B, Inola, OK 74036 and is currently estimated at $330,619, approximately $161 per square foot. 25392 Oklahoma 88 Unit B is a home located in Rogers County with nearby schools including Justus-Tiawah Public School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 20, 2020

Sold by

Vang Biong and Vang Xiong

Bought by

Donaldson Justus

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$202,000

Outstanding Balance

$177,778

Interest Rate

3.4%

Mortgage Type

VA

Estimated Equity

$152,841

Purchase Details

Closed on

Nov 30, 2013

Sold by

Osborn Steve

Bought by

Vong Blang & Ge Xiong

Purchase Details

Closed on

Jun 4, 2007

Sold by

Jackson Alphonso

Bought by

Osborn Steve

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$100,000

Interest Rate

6.16%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Donaldson Justus | $202,000 | Apex Ttl & Closing Svcs Llc | |

| Vong Blang & Ge Xiong | $128,000 | -- | |

| Osborn Steve | -- | First American Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Donaldson Justus | $202,000 | |

| Previous Owner | Osborn Steve | $100,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,283 | $27,494 | $7,014 | $20,480 |

| 2024 | $2,185 | $26,184 | $6,680 | $19,504 |

| 2023 | $2,185 | $24,938 | $6,348 | $18,590 |

| 2022 | $1,976 | $23,750 | $4,798 | $18,952 |

| 2021 | $1,919 | $22,619 | $4,798 | $17,821 |

| 2020 | $1,203 | $15,881 | $4,798 | $11,083 |

| 2019 | $1,192 | $14,766 | $3,999 | $10,767 |

| 2018 | $1,221 | $15,079 | $3,229 | $11,850 |

| 2017 | $1,132 | $14,884 | $3,229 | $11,655 |

| 2016 | $1,154 | $14,532 | $3,229 | $11,303 |

| 2015 | $1,221 | $14,233 | $3,229 | $11,004 |

| 2014 | $1,244 | $14,490 | $3,229 | $11,261 |

Source: Public Records

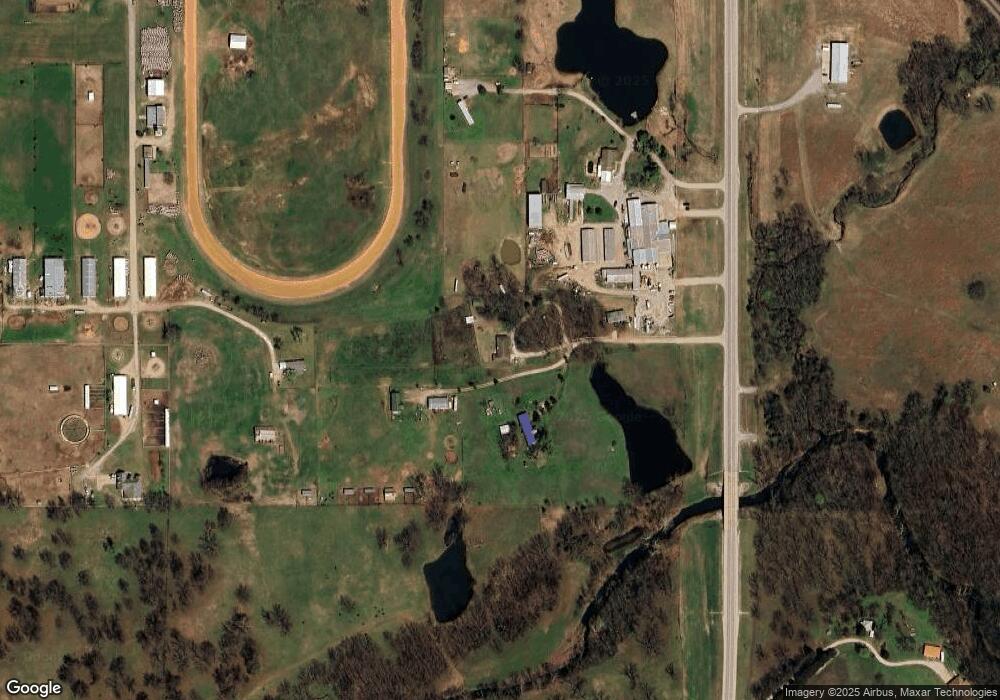

Map

Nearby Homes

- 15864 E 530 Rd

- 24550 S Meadow Circle Rd

- 25152 S Hackamore Rd E

- 14155 E 540 Rd

- 1102 W Lawton Rd

- 23425 S Hooty Creek Rd

- 23316 S Hwy 88

- 23025 S 4190 Rd

- 0 S 4210 Rd Unit 2546264

- 13549 S Hwy 88

- 22677 S Pony Lake Dr Unit A

- 14350 E 510 Rd

- 13126 E 510 Rd

- 28255 S 4170 Rd

- 22450 S Rocky Ridge Ln

- 13820 E 500 Rd

- 11777 E Oak St

- 0 S 4190 Rd Unit 2529871

- 0 S 4190 Rd Unit 2539076

- 0 E 540 Unit 2531424

- 25392 S Highway 88 Unit B

- 25392 S Highway 88

- 25256 S Highway 88

- 25355 S 4178 Rd

- 25255 S 4178 Rd

- 15050 E 530 Rd

- 25400 S 4178 Rd

- 15054 E 530 Rd

- 15100 E 530 Rd

- 4491 SE Hwy 88

- 25055 S 4178 Rd

- 24995 S 4180 Rd

- null N4180 Rd

- 0 N4180 Rd

- 24975 S 4180 Rd

- 15125 E 530 Rd

- 15145 E 530 Rd

- 15105 E 530 Rd Unit D

- 15105 E 530 Rd

- 15105 E 530 Rd Unit C