254 Queens Crossing Unit 115 Dayton, OH 45458

Estimated Value: $209,000 - $216,000

2

Beds

3

Baths

1,288

Sq Ft

$165/Sq Ft

Est. Value

About This Home

This home is located at 254 Queens Crossing Unit 115, Dayton, OH 45458 and is currently estimated at $213,012, approximately $165 per square foot. 254 Queens Crossing Unit 115 is a home located in Montgomery County with nearby schools including Primary Village South, Weller Elementary School, and Magsig Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 14, 2010

Sold by

Leesman Michael

Bought by

Petrack Jane E

Current Estimated Value

Purchase Details

Closed on

Dec 30, 2004

Sold by

Grodner Theresa J and Keaton Theresa J

Bought by

Leesman Michael

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$100,000

Interest Rate

5%

Mortgage Type

Fannie Mae Freddie Mac

Purchase Details

Closed on

Feb 1, 2002

Sold by

Shoup James W

Bought by

Keaton Theresa J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$106,700

Interest Rate

7.23%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Petrack Jane E | $116,000 | Attorney | |

| Leesman Michael | $125,000 | Meymax Title Agency Llc | |

| Keaton Theresa J | $110,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Leesman Michael | $100,000 | |

| Previous Owner | Keaton Theresa J | $106,700 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,964 | $64,180 | $11,050 | $53,130 |

| 2023 | $3,964 | $64,180 | $11,050 | $53,130 |

| 2022 | $3,690 | $47,260 | $8,130 | $39,130 |

| 2021 | $3,700 | $47,260 | $8,130 | $39,130 |

| 2020 | $3,695 | $47,260 | $8,130 | $39,130 |

| 2019 | $3,610 | $41,250 | $8,130 | $33,120 |

| 2018 | $3,225 | $41,250 | $8,130 | $33,120 |

| 2017 | $3,191 | $41,250 | $8,130 | $33,120 |

| 2016 | $3,163 | $38,550 | $8,130 | $30,420 |

| 2015 | $3,113 | $38,550 | $8,130 | $30,420 |

| 2014 | $3,113 | $38,550 | $8,130 | $30,420 |

| 2012 | -- | $38,830 | $8,130 | $30,700 |

Source: Public Records

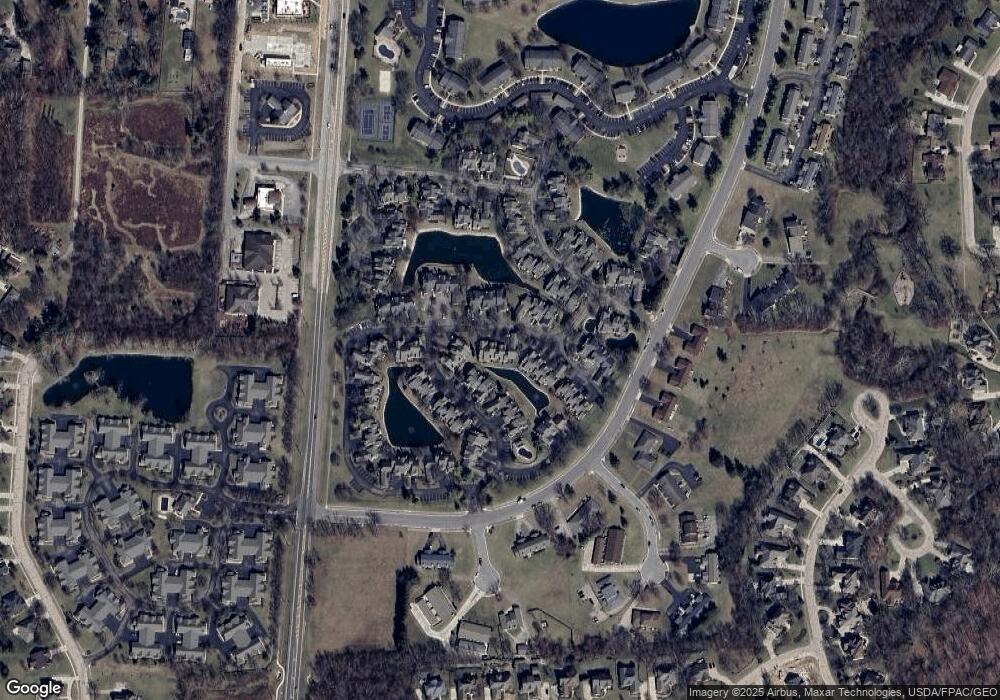

Map

Nearby Homes

- 240 Queens Crossing Unit 23121

- 154 Queens Crossing Unit 31152

- 9648 Whalers Wharf Unit 1251

- 9618 Whalers Wharf Unit 833

- 9652 Belfry Ct Unit 29652

- 30 Edinburgh Village Dr Unit 530

- 300 Grassy Creek Way

- 9971 Stonemeade Way

- 184 Edinburgh Village Dr Unit 13184

- 118 Marco Ln Unit E17

- 95 Marco Ln Unit B6

- 9452 Sugar Bend Trail

- 207 Hibberd Dr

- 10055 Mallet Dr

- 0 Yankee St Unit 934084

- 9230 Bottega South Dr Unit 38

- 9215 Bottega South Dr Unit 66

- 9197 Remy Ct

- 9161 Remy

- 9476 Sheehan Rd

- 254 Queens Crossing Unit 22115

- 244 Queens Crossing Unit 23119

- 244 Queens Crossing Unit 119

- 250 Queens Crossing Unit 22117

- 236 Queens Crossing Unit 23122

- 252 Queens Crossing Unit 22116

- 242 Queens Crossing Unit 23120

- 169 Queens Crossing Unit 35168

- 177 Queens Crossing Unit 34165

- 177 Queens Crossing Unit 165

- 179 Queens Crossing Unit 34164

- 256 Queens Crossing Unit 22114

- 167 Queens Crossing Unit 35169

- 175 Queens Crossing Unit 34166

- 163 Queens Crossing Unit 35171

- 173 Queens Crossing Unit 34167

- 267 Queens Crossing Unit 1777

- 193 Queens Crossing Unit 24126

- 165 Queens Crossing Unit 35170

- 165 Queens Crossing Unit 170