2550 Apache Dr Sidney, OH 45365

Estimated Value: $237,000 - $291,000

3

Beds

2

Baths

1,904

Sq Ft

$136/Sq Ft

Est. Value

About This Home

This home is located at 2550 Apache Dr, Sidney, OH 45365 and is currently estimated at $258,550, approximately $135 per square foot. 2550 Apache Dr is a home located in Shelby County with nearby schools including Sidney High School, Holy Angels Catholic School, and Christian Academy Schools.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 27, 2015

Sold by

Quezada Alicia

Bought by

Salas Eriberto S and Salas Bernarda

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$118,750

Outstanding Balance

$91,579

Interest Rate

3.63%

Mortgage Type

New Conventional

Estimated Equity

$166,971

Purchase Details

Closed on

Aug 13, 1999

Sold by

Schoen Paula and Schoen Carey

Bought by

Middleton Thomas B

Purchase Details

Closed on

Nov 28, 1995

Sold by

Associates Relocation Ma

Bought by

Schoen Paula R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$90,400

Interest Rate

7.56%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Salas Eriberto S | $125,000 | American Title Resources | |

| Middleton Thomas B | $124,500 | -- | |

| Schoen Paula R | $95,250 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Salas Eriberto S | $118,750 | |

| Previous Owner | Schoen Paula R | $90,400 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,555 | $74,020 | $10,280 | $63,740 |

| 2023 | $2,591 | $74,020 | $10,280 | $63,740 |

| 2022 | $2,278 | $57,070 | $9,430 | $47,640 |

| 2021 | $2,301 | $57,070 | $9,430 | $47,640 |

| 2020 | $2,301 | $57,070 | $9,430 | $47,640 |

| 2019 | $1,892 | $47,050 | $7,850 | $39,200 |

| 2018 | $1,865 | $47,050 | $7,850 | $39,200 |

| 2017 | $1,849 | $47,050 | $7,850 | $39,200 |

| 2016 | $1,598 | $40,580 | $8,270 | $32,310 |

| 2015 | $1,648 | $40,580 | $8,270 | $32,310 |

| 2014 | $1,648 | $40,580 | $8,270 | $32,310 |

| 2013 | $2,032 | $46,230 | $8,270 | $37,960 |

Source: Public Records

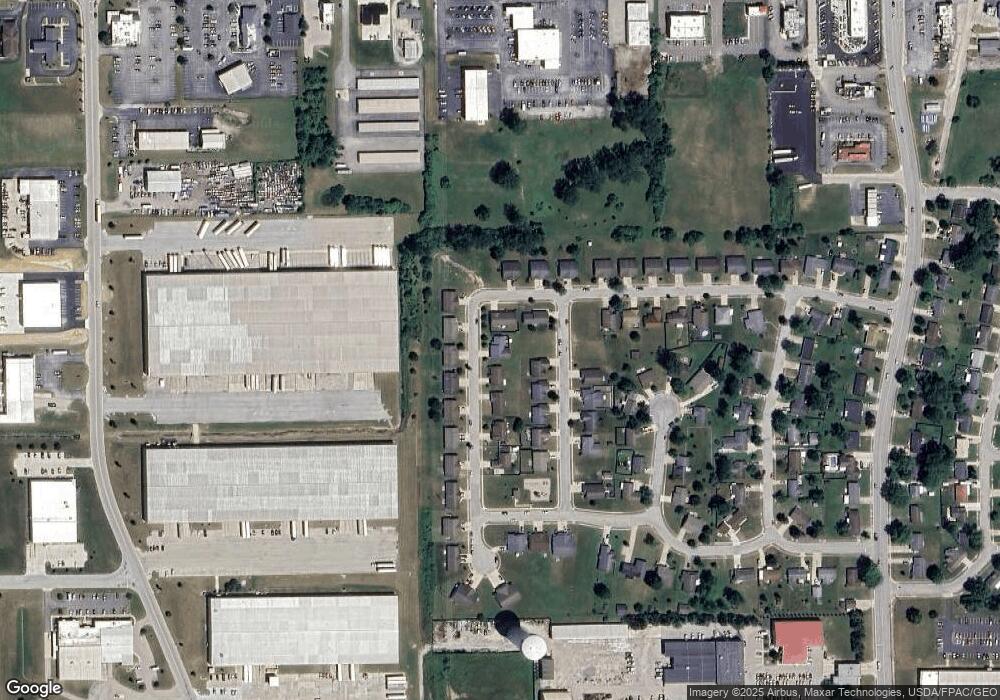

Map

Nearby Homes

- 1901 Shawnee Dr

- 1883 Shawnee Dr

- 0 Apache Dr

- 3202 W Michigan St

- 1843 Robert Place

- 00 Folkerth Ave

- 00 Norcold Dr

- 000 Norcold Dr

- 508 Urban Ave

- 0 Sharp Unit 1043619

- 0 County Road 25a Rd Unit 951259

- 0 County Road 25a Rd Unit 1043551

- 0 Russell Unit 1043361

- 1624 Holly Place

- 206 Charles Ave

- 00 Fair Rd

- 610 N Wagner Ave

- 1042 Apple Blossom Ln

- 2423 Cole Ct

- 2417 Cole Ct

- 2540 Apache Dr

- 1931 Shawnee Dr

- 225 Sherri Ann Ave

- 1915 Shawnee Dr

- 2551 Apache Dr Unit 53

- 2561 Apache Dr

- 2530 Apache Dr

- 241 Sherri Ann Ave

- 2541 Apache Dr

- 2571 Apache Dr

- 257 Sherri Ann Ave

- 2531 Apache Dr

- 1932 Shawnee Dr Unit 1934

- 2520 Apache Dr

- 1916 Shawnee Dr

- 226 Sherri Ann Ave

- 273 Sherri Ann Ave

- 1900 Shawnee Dr

- 2521 Apache Dr

- 242 Sherri Ann Ave