2555 S Tecumseh Rd Springfield, OH 45502

Estimated Value: $582,000 - $739,317

4

Beds

3

Baths

4,071

Sq Ft

$169/Sq Ft

Est. Value

About This Home

This home is located at 2555 S Tecumseh Rd, Springfield, OH 45502 and is currently estimated at $687,579, approximately $168 per square foot. 2555 S Tecumseh Rd is a home located in Clark County with nearby schools including Greenon Elementary School, Greenon Jr. High School, and Greenon High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 21, 2013

Sold by

Wieser Paula L and Dehart Paula Lynn

Bought by

Wieser Paula L and Foster Wayne L

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$157,000

Outstanding Balance

$107,366

Interest Rate

2.87%

Mortgage Type

Adjustable Rate Mortgage/ARM

Estimated Equity

$580,213

Purchase Details

Closed on

May 22, 2000

Sold by

Dehart Ronald Alan and Dehart Ronald A

Bought by

Dehart Paula Lynn and Dehart Paula L

Purchase Details

Closed on

Jan 3, 1997

Sold by

Harrison Creed S

Bought by

Dehart Ronald A and Dehart Paula L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$33,000

Interest Rate

7.6%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Wieser Paula L | -- | None Available | |

| Dehart Paula Lynn | -- | -- | |

| Dehart Ronald A | $44,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Wieser Paula L | $157,000 | |

| Closed | Dehart Ronald A | $33,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $9,368 | $232,810 | $48,270 | $184,540 |

| 2024 | -- | $199,690 | $36,510 | $163,180 |

| 2023 | $9,179 | $199,690 | $36,510 | $163,180 |

| 2022 | $5,673 | $222,010 | $58,830 | $163,180 |

| 2021 | $10,111 | $179,600 | $42,630 | $136,970 |

| 2020 | $10,136 | $179,600 | $42,630 | $136,970 |

| 2019 | $10,275 | $179,600 | $42,630 | $136,970 |

| 2018 | $9,208 | $158,390 | $39,080 | $119,310 |

| 2017 | $9,230 | $158,386 | $39,078 | $119,308 |

| 2016 | $8,049 | $158,386 | $39,078 | $119,308 |

| 2015 | $7,460 | $142,422 | $35,525 | $106,897 |

| 2014 | $7,475 | $142,422 | $35,525 | $106,897 |

| 2013 | $7,008 | $142,422 | $35,525 | $106,897 |

Source: Public Records

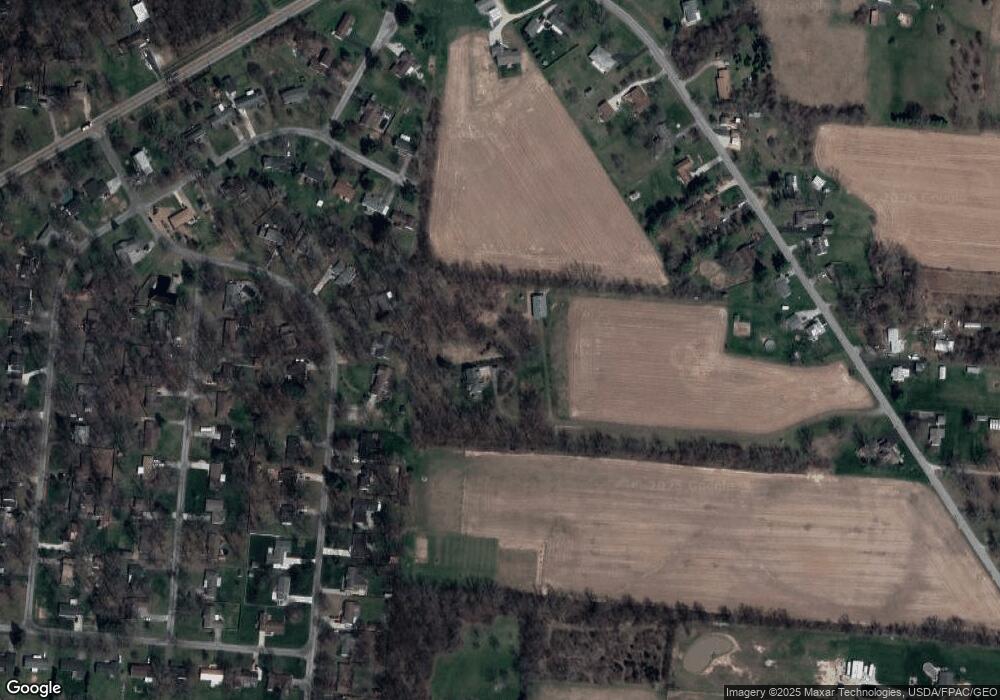

Map

Nearby Homes

- 2925 S Tecumseh Rd

- 4311 Lone Wolf Ave

- 5520 Old Lower Valley Park

- 62 Fay Dr

- 3183 Lower Valley Pike

- 3190 Rebert Pike

- 141 N Xenia Dr

- 3628-3642 Charlotte Dr

- 500 Doric Cir

- 3644-3650 Charlotte Dr

- 3611-3625 Charlotte Dr

- 4441 S Xenia Dr

- 0 S Tecumseh Rd Unit 1042892

- 0 S Tecumseh Rd Unit 1042894

- 4538 Cynthia Dr

- 96 Eastwood Dr

- 1290 Red Oaks Cir

- 128 Ravenwood Dr

- 4638 W National Rd

- 6937 Tall Timber Trail

- 2560 Lindair Dr

- 2542 Lindair Dr

- 2600 Lindair Dr

- 2528 Lindair Dr

- 2618 Lindair Dr

- 2512 Lindair Dr

- 2305 Brookdale Dr

- 2640 Lindair Dr

- 2559 Lindair Dr

- 2519 Lindair Dr

- 2605 Lindair Dr

- 2658 Lindair Dr

- 2321 Brookdale Dr

- 2496 Lindair Dr

- 2621 Lindair Dr

- 2680 Lindair Dr

- 2643 Lindair Dr

- 2548 Ehrhart Dr

- 2574 Ehrhart Dr

- 2484 Lindair Dr