26 Ober Rd Newton Center, MA 02459

Oak Hill NeighborhoodEstimated Value: $477,294 - $635,000

1

Bed

2

Baths

938

Sq Ft

$598/Sq Ft

Est. Value

About This Home

This home is located at 26 Ober Rd, Newton Center, MA 02459 and is currently estimated at $561,074, approximately $598 per square foot. 26 Ober Rd is a home located in Middlesex County with nearby schools including Memorial Spaulding Elementary School, Oak Hill Middle School, and Newton South High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 31, 2022

Sold by

Kats Mark

Bought by

Mark Kate Ret

Current Estimated Value

Purchase Details

Closed on

Jun 27, 2003

Sold by

Omeara Patricia J

Bought by

Fain Barbara J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$227,500

Interest Rate

5.53%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Jul 26, 2002

Sold by

Brooks Jason L and Brooks Dorothy S

Bought by

Omeara Patricia J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$248,000

Interest Rate

6.73%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Jun 17, 1996

Sold by

Yarow Judith

Bought by

Brooks Jason L and Brooks Dorothy S

Purchase Details

Closed on

Sep 1, 1994

Sold by

Freedman M David and Freedman Beverly

Bought by

Yarow Judith

Purchase Details

Closed on

Feb 12, 1987

Sold by

Freedman M David

Bought by

Green Annette

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Mark Kate Ret | -- | None Available | |

| Fain Barbara J | $287,500 | -- | |

| Omeara Patricia J | $310,000 | -- | |

| Brooks Jason L | $188,500 | -- | |

| Yarow Judith | $167,500 | -- | |

| Green Annette | $150,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Green Annette | $217,000 | |

| Previous Owner | Fain Barbara J | $227,500 | |

| Previous Owner | Omeara Patricia J | $248,000 | |

| Previous Owner | Green Annette | $74,000 | |

| Previous Owner | Green Annette | $60,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,340 | $442,900 | $0 | $442,900 |

| 2024 | $4,197 | $430,000 | $0 | $430,000 |

| 2023 | $4,082 | $401,000 | $0 | $401,000 |

| 2022 | $4,018 | $381,900 | $0 | $381,900 |

| 2021 | $3,877 | $360,300 | $0 | $360,300 |

| 2020 | $3,762 | $360,300 | $0 | $360,300 |

| 2019 | $3,655 | $349,800 | $0 | $349,800 |

| 2018 | $3,517 | $325,000 | $0 | $325,000 |

| 2017 | $3,409 | $306,600 | $0 | $306,600 |

| 2016 | $3,489 | $306,600 | $0 | $306,600 |

| 2015 | $3,390 | $292,000 | $0 | $292,000 |

Source: Public Records

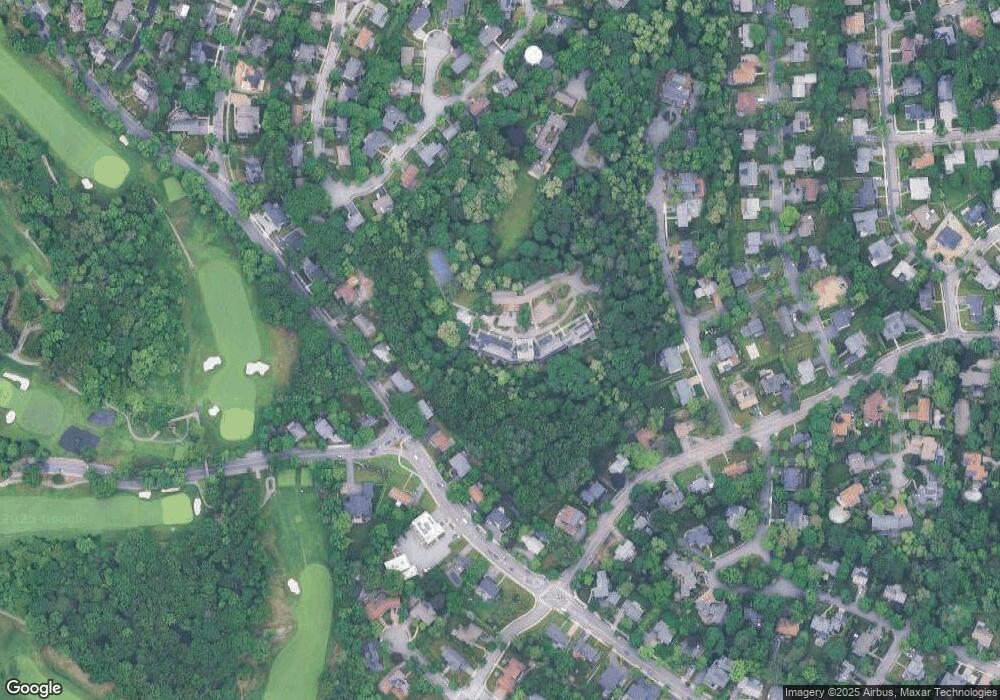

Map

Nearby Homes

- 36 Ober Rd

- 44 Lovett Rd

- 21 Lovett Rd

- 853 Dedham St

- 135 Hartman Rd

- 41 Juniper Ln

- 133 Oak Hill St

- 63 Drumlin Rd

- 22 Nightingale Path

- 59 Deborah Rd

- 99 Baldpate Hill Rd

- 65 Levbert Rd

- 58 Country Club Rd

- 544 Saw Mill Brook Pkwy

- 56 Cynthia Rd

- 30 Esty Farm Rd

- 210 Nahanton St Unit 404

- 207 Nahanton St Unit 207

- 5 Kappius Path

- 1307 Lagrange St Unit 1307