26 Red Rim Rd Lander, FL 82520

Estimated Value: $749,000 - $861,000

2

Beds

2

Baths

1,684

Sq Ft

$473/Sq Ft

Est. Value

About This Home

This home is located at 26 Red Rim Rd, Lander, FL 82520 and is currently estimated at $796,544, approximately $473 per square foot. 26 Red Rim Rd is a home located in Fremont County with nearby schools including Lander Valley High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 10, 2025

Sold by

Kniola James and Kniola Renee

Bought by

Dwyer Michael and Dwyer Yvette

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$551,250

Outstanding Balance

$549,548

Interest Rate

5.85%

Mortgage Type

New Conventional

Estimated Equity

$246,996

Purchase Details

Closed on

Mar 18, 2022

Sold by

Jennifer Lee Wills Living Trust

Bought by

Kniola James and Kniola Renee

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$476,000

Interest Rate

4.16%

Mortgage Type

New Conventional

Purchase Details

Closed on

Nov 7, 2013

Sold by

Turner Robert T and Turner Judith H

Bought by

Wills Jennifer Lee and Jennifer Lee Willis Living Trust

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$154,000

Interest Rate

4.37%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jul 25, 2011

Sold by

Turnerwz Judith H

Bought by

Turner Robert T and Turner Judith H

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Dwyer Michael | -- | None Listed On Document | |

| Kniola James | -- | None Listed On Document | |

| Wills Jennifer Lee | -- | First American Title Ins Co | |

| Turner Robert T | -- | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Dwyer Michael | $551,250 | |

| Previous Owner | Kniola James | $476,000 | |

| Previous Owner | Wills Jennifer Lee | $154,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,459 | $38,063 | $6,014 | $32,049 |

| 2024 | $3,459 | $47,919 | $8,018 | $39,901 |

| 2023 | $3,052 | $42,640 | $8,018 | $34,622 |

| 2022 | $2,571 | $36,776 | $8,018 | $28,758 |

| 2021 | $2,228 | $30,774 | $8,018 | $22,756 |

| 2020 | $2,424 | $33,547 | $7,888 | $25,659 |

| 2019 | $2,343 | $31,872 | $7,888 | $23,984 |

| 2018 | $2,378 | $31,969 | $7,888 | $24,081 |

| 2017 | $2,142 | $28,730 | $7,888 | $20,842 |

| 2016 | $1,926 | $25,871 | $7,070 | $18,801 |

| 2015 | $1,878 | $25,523 | $8,315 | $17,208 |

| 2014 | $2,072 | $28,216 | $8,315 | $19,901 |

Source: Public Records

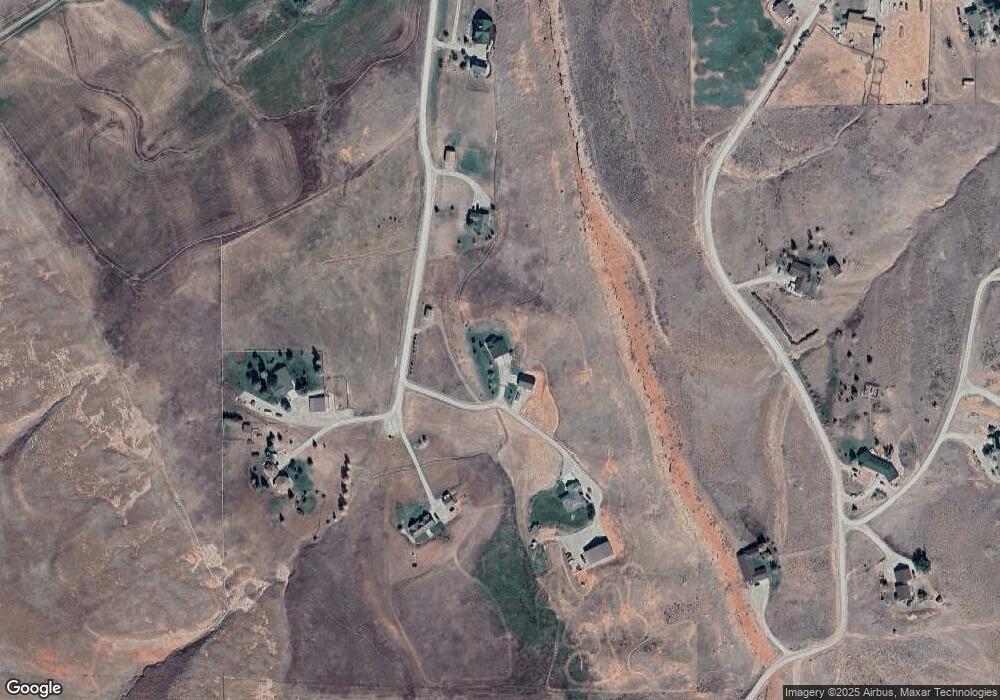

Map

Nearby Homes

- 18 Lewis Dr

- 2241 Squaw Creek Rd

- 7 Raschell Ct

- 2377 Baldwin Creek Rd

- 625 Hancock Dr

- 0000 Baldwin Creek Rd

- 2067 Baldwin Creek Rd

- 0 Baldwin Creek Rd Unit 24005149

- 0 Baldwin Creek Rd Unit 11520931

- 1400 Sinks Canyon Rd

- 225 Chapman St

- 120 Roaring Fork Ct

- 200 Irwin Ln

- 824 Vance Dr

- 791 Garner Dr

- 980 Spriggs Dr

- 2021 Hillcrest Dr

- 317 Rosewood Ave

- 908 11th St

- 654 W Main St

- 20 Red Rim Rd Unit Squaw Creek

- 30 Red Rim Rd

- 34 Red Rim Rd

- 29 Red Rim Rd

- 33 Red Rim Rd Unit Squaw Creek Road

- 16 Sacajawea Ave Unit Squaw Creek Rd

- 10 Red Rim Rd

- 43 Sacajawea Ave

- 30 Sacajawea Ave

- 55 Sacajawea Ave

- 55 Sacajawea Ave Unit Boulder Loop

- 24 Boulder Loop Unit Squaw Creek

- 4 Lewis Dr

- 00 Lewis Dr

- 28 Boulder Loop

- 44 Sacajawea Ave Unit Boulder Loop

- 10 Lewis Dr

- 16 Lewis Dr

- 20 Boulder Loop

- 20 Lewis Dr