2600 S 288th St Unit 1-3 Federal Way, WA 98003

Estimated Value: $362,000 - $426,000

3

Beds

3

Baths

1,401

Sq Ft

$285/Sq Ft

Est. Value

About This Home

This home is located at 2600 S 288th St Unit 1-3, Federal Way, WA 98003 and is currently estimated at $399,421, approximately $285 per square foot. 2600 S 288th St Unit 1-3 is a home located in King County with nearby schools including Valhalla Elementary School, Kilo Middle School, and Thomas Jefferson High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 23, 2018

Sold by

Kamau Jason N and Kinge Mercy

Bought by

Kamau Jason N

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$187,600

Outstanding Balance

$161,530

Interest Rate

4.4%

Estimated Equity

$237,891

Purchase Details

Closed on

Mar 15, 2006

Sold by

Kamau Lori

Bought by

Kamau Jason N

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$182,400

Interest Rate

6.5%

Purchase Details

Closed on

Mar 1, 2004

Sold by

Hyatt Shelly Lynn and Esparza Shelly Lynn

Bought by

Osman Halimo A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$157,700

Interest Rate

5.62%

Purchase Details

Closed on

Feb 22, 2002

Sold by

Funk Mark S and Funk Sherry K

Bought by

Esparza Shelly

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$142,300

Interest Rate

6.8%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Kamau Jason N | -- | None Available | |

| Kamau Jason N | -- | Chicago Title | |

| Kamau Jason N | $228,000 | Chicago Title | |

| Osman Halimo A | $166,000 | Chicago Title | |

| Esparza Shelly | $151,900 | Chicago Title Insurance Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Kamau Jason N | $187,600 | |

| Previous Owner | Kamau Jason N | $182,400 | |

| Previous Owner | Kamau Jason N | $45,600 | |

| Previous Owner | Osman Halimo A | $157,700 | |

| Previous Owner | Esparza Shelly | $142,300 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $4,088 | $364,000 | $65,000 | $299,000 |

| 2023 | $3,440 | $416,000 | $46,800 | $369,200 |

| 2022 | $3,094 | $349,000 | $41,600 | $307,400 |

| 2021 | $3,213 | $272,000 | $36,400 | $235,600 |

| 2020 | $2,991 | $266,000 | $36,400 | $229,600 |

| 2018 | $2,944 | $232,000 | $33,800 | $198,200 |

| 2017 | $2,426 | $207,000 | $33,800 | $173,200 |

| 2016 | $2,356 | $170,000 | $33,800 | $136,200 |

| 2015 | $2,299 | $158,000 | $33,800 | $124,200 |

| 2014 | -- | $158,000 | $33,800 | $124,200 |

| 2013 | -- | $111,000 | $33,800 | $77,200 |

Source: Public Records

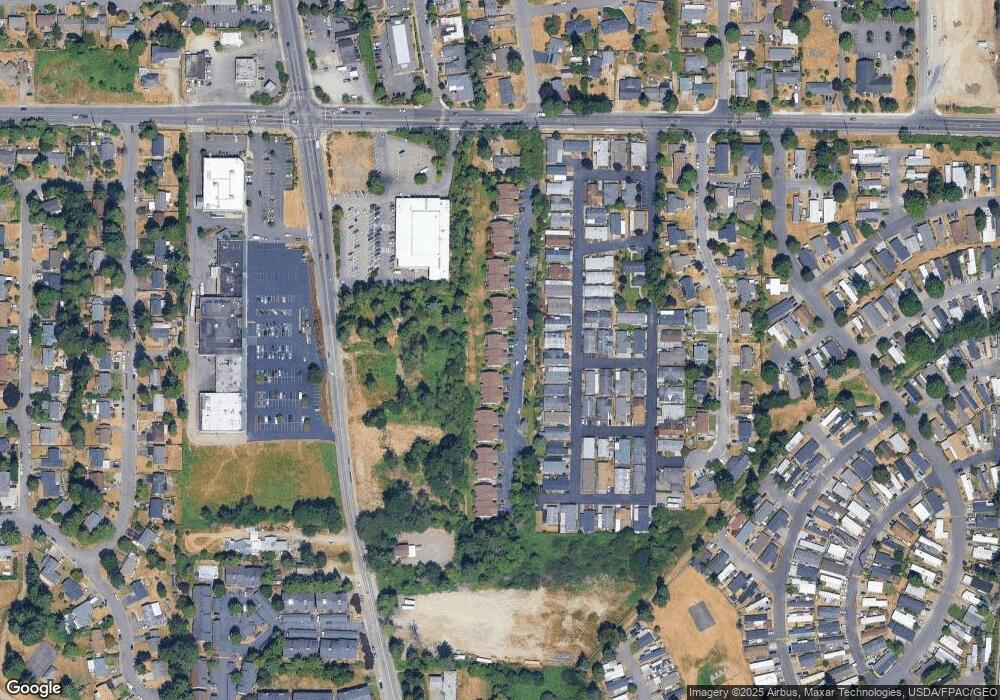

Map

Nearby Homes

- 2535 S 288th St Unit 2

- 28422 Military Rd S

- 3001 S 288th St Unit 343

- 3001 S 288th St Unit 74

- 3001 S 288th St Unit 278

- 3001 S 288th St Unit 85

- 3001 S 288th St Unit 374

- 3001 S 288th St Unit 362

- 3001 S 288th St Unit 89

- 29211 33rd Ave S

- 2930 S 284th St

- 29628 22nd Ave S

- 28846 34th Ave S

- 2807 S 282nd St

- 29540 32nd Place S

- 28710 34th Ave S Unit B5

- 28716 18th Ave S Unit Y203

- 1835 S 286th Ln Unit R-201

- 3400 S 288th St Unit C-5

- 28316 20th Ave S

- 2521 S 288th St Unit 2

- 2521 S 288th St Unit 1

- 2600 S 288th St Unit 9-3

- 2600 S 288th St Unit 6-1

- 2600 S 288th St Unit 6-4

- 2600 S 288th St Unit 2-3

- 2600 S 288th St Unit 6-3

- 2600 S 288th St Unit 5-2

- 2600 S 288th St Unit 7-3

- 2600 S 288th St Unit 4

- 2600 S 288th St Unit 9-1

- 2600 S 288th St Unit 5-4

- 2600 S 288th St Unit 9-4

- 2600 S 288th St Unit 9-2

- 2600 S 288th St Unit 8-4

- 2600 S 288th St Unit 8-3

- 2600 S 288th St Unit 8-2

- 2600 S 288th St Unit 8-1

- 2600 S 288th St Unit 7-4

- 2600 S 288th St Unit 7-2