261 Sand Hill Rd Unit 1.85 acres / VIEW / Grandview, WA 98930

Estimated Value: $454,000 - $745,000

4

Beds

6

Baths

2,488

Sq Ft

$231/Sq Ft

Est. Value

About This Home

This home is located at 261 Sand Hill Rd Unit 1.85 acres / VIEW /, Grandview, WA 98930 and is currently estimated at $575,199, approximately $231 per square foot. 261 Sand Hill Rd Unit 1.85 acres / VIEW / is a home located in Yakima County with nearby schools including Grandview High School and Grandview Seventh-day Adventist School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 25, 2023

Sold by

Vicenty Luis R and Vicenty Wanda I

Bought by

Camacho Juan Ramon

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$532,000

Outstanding Balance

$515,358

Interest Rate

6.15%

Mortgage Type

New Conventional

Estimated Equity

$59,841

Purchase Details

Closed on

Mar 8, 2018

Sold by

Mitzefeldt James W

Bought by

Vincenty Luis R and Crespo Gonzalez Wanda I

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$324,000

Interest Rate

4.15%

Mortgage Type

New Conventional

Purchase Details

Closed on

Aug 6, 2015

Sold by

Byam Dennis D

Bought by

Mitzelfeldt James W and Mitzelfeldt Heather

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$297,000

Interest Rate

3.97%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Camacho Juan Ramon | -- | Schreiner Title | |

| Vincenty Luis R | $309,438 | Schreiner Title Co | |

| Mitzelfeldt James W | $283,652 | Pacific Alliance Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Camacho Juan Ramon | $532,000 | |

| Previous Owner | Vincenty Luis R | $324,000 | |

| Previous Owner | Mitzelfeldt James W | $297,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,893 | $503,800 | $118,000 | $385,800 |

| 2023 | $4,704 | $397,900 | $58,200 | $339,700 |

| 2022 | $4,196 | $349,600 | $43,800 | $305,800 |

| 2021 | $3,931 | $314,800 | $39,300 | $275,500 |

| 2019 | $4,120 | $313,800 | $37,300 | $276,500 |

| 2018 | $4,261 | $292,000 | $33,300 | $258,700 |

| 2017 | $3,866 | $294,700 | $33,300 | $261,400 |

| 2016 | $0 | $290,700 | $33,100 | $257,600 |

| 2015 | $0 | $247,600 | $33,100 | $214,500 |

Source: Public Records

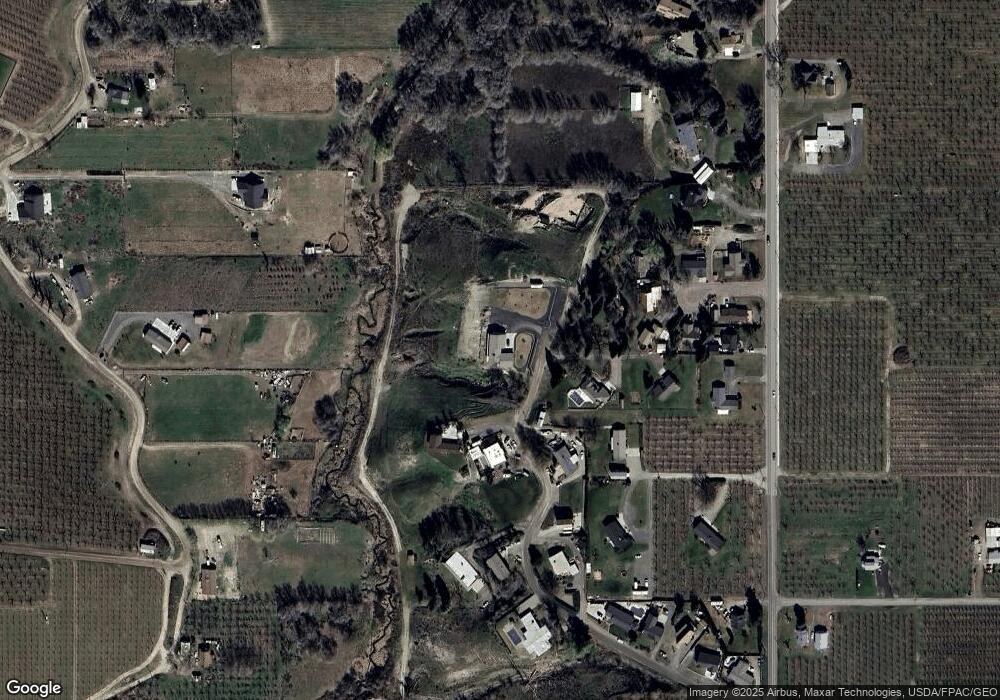

Map

Nearby Homes

- 1502 S Euclid Rd

- 402 Amberly Ave

- 400 Amberly Ave

- 408 Jade Ave

- 312 Amberly Ave

- 313 Amberly Ave

- 1606 Castlewood Ct Unit (Phase 11 Lot 310) S

- 1606 Castlewood Ct

- 401 Glenwood Ave Unit (Phase 11 Lot 315) S

- 401 Glenwood Ave

- 1608 Castlewood Ct Unit (Phase 11 Lot 309) P

- 1610 Castlewood Ct Unit (Phase 11 Lot 308) P

- 310 Amberly Ave

- 1614 Castlewood Ct Unit (Phase 11 Lot 306) P

- 1012 Coach Ct

- 309 Glenwood Ave Unit (Phase 11 Lot 314) P

- 1616 Castlewood Ct Unit (Phase 11 Lot 305) S

- 1616 Castlewood Ct

- 306 Amberly Ave

- 307 Glenwood Ave Unit (Phase 11 Lot 313) S

- 261 Sand Hill Rd Unit 3 acre 4976 Sq. Ft H

- 261 Sand Hill Rd

- 260 Sand Hill Rd

- 221 Sand Hill Rd

- 211 Sand Hill Rd

- 191 Sand Hill Rd

- 1003 Monty Python

- 1005 Monty Python

- 1662 S Euclid Rd

- 262 Sand Hill Rd

- 1007 Monty Python

- 171 Sand Hill Rd Unit MOTIVATED SELLER!!

- 171 Sand Hill Rd Unit Gorgeous Holiday Hom

- 171 Sand Hill Rd

- 1001 Monty Python

- 1009 Monty Python

- 160 Sand Hill Rd

- 1664 S Euclid Rd

- 113 Sand Hill Rd

- 170 Sand Hill Rd Unit The Shiny Penny of G