2610 Summerland Way Kissimmee, FL 34746

Estimated Value: $499,000 - $535,000

4

Beds

4

Baths

3,550

Sq Ft

$144/Sq Ft

Est. Value

About This Home

This home is located at 2610 Summerland Way, Kissimmee, FL 34746 and is currently estimated at $510,633, approximately $143 per square foot. 2610 Summerland Way is a home located in Osceola County with nearby schools including Liberty High School, Mater Brighton Lakes Academy, and Bellalago Academy.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 26, 2012

Sold by

Melicor Adolfo L and Melicor Rebecca

Bought by

Melicor Adolfo L and Melicor Rebecca

Current Estimated Value

Purchase Details

Closed on

Oct 28, 2010

Sold by

Federal National Mortgage Association

Bought by

Melicor Adolfo L and Melicor Rebecca

Purchase Details

Closed on

Jan 4, 2010

Sold by

Ortiz Dagoberto and Ortiz Ugladis

Bought by

Federal National Mortgage Association

Purchase Details

Closed on

Jul 30, 2004

Sold by

Avatar Properties Inc

Bought by

Ortiz Dagoberto and Ortiz Ugladis

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$175,000

Interest Rate

4.87%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Melicor Adolfo L | -- | None Available | |

| Melicor Adolfo L | $181,000 | New House Title | |

| Federal National Mortgage Association | -- | Attorney | |

| Ortiz Dagoberto | $266,900 | Prominent Title Insurance Ag |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Ortiz Dagoberto | $175,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $5,840 | $427,900 | $90,000 | $337,900 |

| 2023 | $5,840 | $312,906 | $0 | $0 |

| 2022 | $5,129 | $319,500 | $62,500 | $257,000 |

| 2021 | $4,663 | $258,600 | $46,800 | $211,800 |

| 2020 | $4,535 | $249,300 | $44,500 | $204,800 |

| 2019 | $4,473 | $240,000 | $39,800 | $200,200 |

| 2018 | $4,113 | $219,000 | $28,100 | $190,900 |

| 2017 | $4,205 | $222,100 | $28,100 | $194,000 |

| 2016 | $4,071 | $211,400 | $28,100 | $183,300 |

| 2015 | $4,087 | $206,600 | $28,100 | $178,500 |

| 2014 | $3,906 | $198,500 | $28,100 | $170,400 |

Source: Public Records

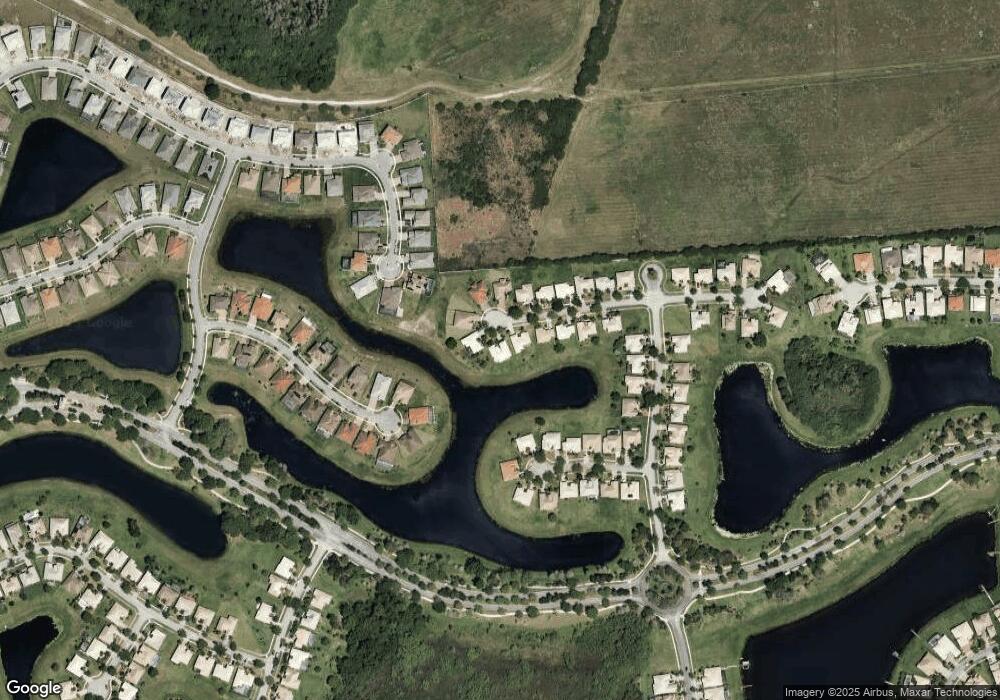

Map

Nearby Homes

- 2821 Rialto Ct

- 3505 Forest Park Dr

- 1950 Windward Oaks Ct

- 2901 Agostino Terrace

- 3210 Agostino Terrace

- 2981 Winding Trail

- 2920 Agostino Terrace

- 3509 Valleyview Dr

- 3170 Agostino Terrace

- 3010 Winding Trail

- 2991 Agostino Terrace

- 3522 Forest Park Dr

- 3030 Winding Trail

- 3101 Agostino Terrace

- 3590 Somerset Cir

- 2631 Captains Ct

- 3390 Bellezza Ct

- 3533 Valleyview Dr

- 3540 Valleyview Dr

- 3181 Winding Trail

- 2620 Summerland Way

- 2590 Summerland Way

- 2630 Summerland Way

- 2611 Summerland Way

- 2621 Summerland Way

- 2580 Summerland Way

- 2601 Summerland Way

- 2591 Summerland Way

- 2651 Meadow View Ct

- 2570 Summerland Way

- 2581 Summerland Way

- 2641 Meadow View Ct

- 2711 Agostino Terrace

- 2631 Meadow View Ct

- 2571 Summerland Way

- 2711 Rialto Ct

- 2661 Meadow View Ct

- 2700 Agostino Terrace

- 2721 Agostino Terrace