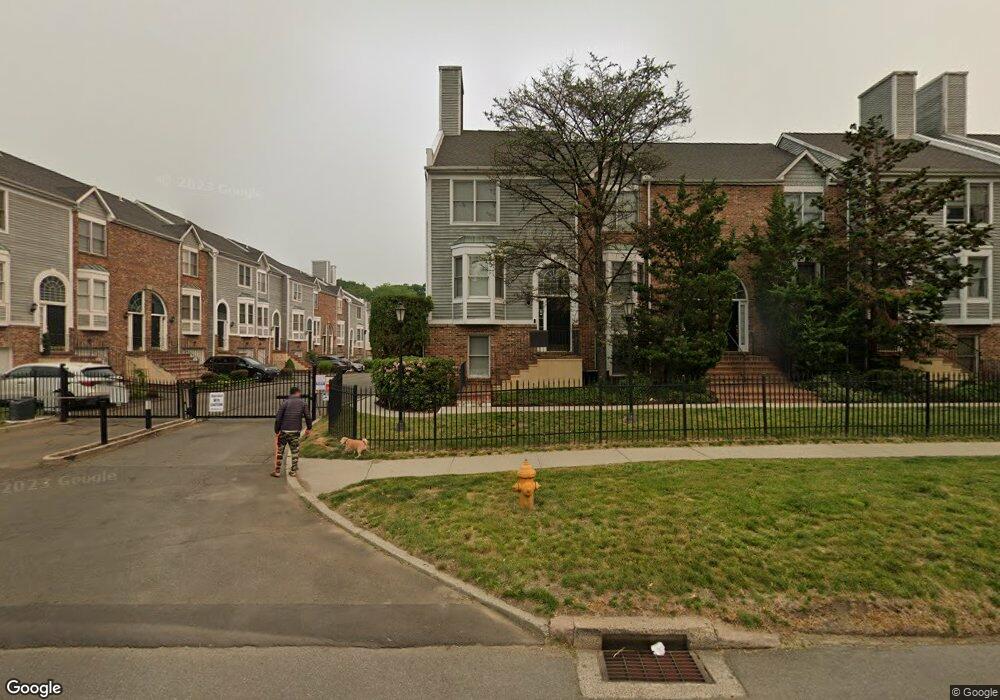

2612 North Ave Unit E16 Bridgeport, CT 06604

Brooklawn-Saint Vincent NeighborhoodEstimated Value: $297,622 - $316,000

2

Beds

2

Baths

1,040

Sq Ft

$297/Sq Ft

Est. Value

About This Home

This home is located at 2612 North Ave Unit E16, Bridgeport, CT 06604 and is currently estimated at $309,156, approximately $297 per square foot. 2612 North Ave Unit E16 is a home located in Fairfield County with nearby schools including Geraldine Johnson School, Bassick High School, and Park City Prep Charter School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 5, 2008

Sold by

Felner Brian

Bought by

Colligan Jessica and Colligan Marguerite

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$115,500

Outstanding Balance

$75,817

Interest Rate

6.08%

Estimated Equity

$233,339

Purchase Details

Closed on

Jun 13, 2007

Sold by

Felner Richard and Felner Linda

Bought by

Felner Brian

Purchase Details

Closed on

Sep 2, 2004

Sold by

Velez Santiago and Velez Marc M

Bought by

Hildago Maria

Purchase Details

Closed on

Jan 22, 2001

Sold by

Petrie Patrick and Petrie Anthony

Bought by

Velez Marcia and Velz Santiago N

Purchase Details

Closed on

Nov 18, 1996

Sold by

New Rivers Edge Dev

Bought by

Petrie Patrick and Petrie Anthony F

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Colligan Jessica | $214,000 | -- | |

| Colligan Jessica | $214,000 | -- | |

| Felner Brian | $220,000 | -- | |

| Felner Brian | $220,000 | -- | |

| Hildago Maria | $145,000 | -- | |

| Hildago Maria | $145,000 | -- | |

| Velez Marcia | $133,000 | -- | |

| Velez Marcia | $133,000 | -- | |

| Petrie Patrick | $99,000 | -- | |

| Petrie Patrick | $99,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Petrie Patrick | $115,500 | |

| Closed | Petrie Patrick | $115,500 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,534 | $104,340 | $0 | $104,340 |

| 2024 | $4,534 | $104,340 | $0 | $104,340 |

| 2023 | $4,534 | $104,340 | $0 | $104,340 |

| 2022 | $4,534 | $104,340 | $0 | $104,340 |

| 2021 | $4,534 | $104,340 | $0 | $104,340 |

| 2020 | $5,422 | $100,420 | $0 | $100,420 |

| 2019 | $5,422 | $100,420 | $0 | $100,420 |

| 2018 | $5,460 | $100,420 | $0 | $100,420 |

| 2017 | $5,460 | $100,420 | $0 | $100,420 |

| 2016 | $5,460 | $100,420 | $0 | $100,420 |

| 2015 | $5,932 | $140,570 | $0 | $140,570 |

| 2014 | $5,932 | $140,570 | $0 | $140,570 |

Source: Public Records

Map

Nearby Homes

- 25 Cartright St Unit 3K

- 25 Cartright St Unit 5D

- 80 Cartright St Unit 5D

- 80 Cartright St Unit 2F

- 80 Cartright St Unit 8B

- 80 Cartright St Unit PHA

- 2660 North Ave Unit 238

- 74 Carleton Ave

- 2370 North Ave Unit 3F

- 860 Briarwood Ave

- 64 Moody Ave

- 155 Moody Ave

- 301 Poplar St Unit 303

- 155 Brooklawn Ave

- 412 Dewey St

- 246 Lenox Ave

- 1050 Hancock Ave Unit 1052

- 203 Lenox Ave Unit 205

- 195 Lenox Ave Unit 197

- 137 Poplar St

- 2612 North Ave Unit E20

- 2612 North Ave Unit E18

- 2612 North Ave Unit E14

- 2612 North Ave Unit E12

- 2612 North Ave Unit E10

- 2612 North Ave Unit E9

- 2612 North Ave Unit E8

- 2612 North Ave Unit E7

- 2612 North Ave Unit E6

- 2612 North Ave Unit E5

- 2612 North Ave Unit E4

- 2612 North Ave Unit E3

- 2612 North Ave Unit E1

- 2612 North Ave Unit C8

- 2612 North Ave Unit C7

- 2612 North Ave Unit C6

- 2612 North Ave Unit C5

- 2612 North Ave Unit C4

- 2612 North Ave Unit C3

- 2612 North Ave Unit C2

Your Personal Tour Guide

Ask me questions while you tour the home.