2616 Falcon Ln Unit UNSURPASSED VIEWS FR Richland, WA 99352

Estimated Value: $1,342,000 - $1,387,000

3

Beds

--

Bath

3,237

Sq Ft

$420/Sq Ft

Est. Value

About This Home

This home is located at 2616 Falcon Ln Unit UNSURPASSED VIEWS FR, Richland, WA 99352 and is currently estimated at $1,359,125, approximately $419 per square foot. 2616 Falcon Ln Unit UNSURPASSED VIEWS FR is a home located in Benton County with nearby schools including Cottonwood Elementary School, Desert Hills Middle School, and Kamiakin High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 4, 2025

Sold by

Aerowick Llc

Bought by

Kirkendall Living Trust and Kirkendall

Current Estimated Value

Purchase Details

Closed on

Dec 17, 2024

Sold by

Friends Of Badger Mountain

Bought by

City Of Richland

Purchase Details

Closed on

Jan 8, 2024

Sold by

Wickemeyer Robert H

Bought by

Wickemeyer Robert H and Wickemeyer Robert H

Purchase Details

Closed on

Dec 15, 2017

Sold by

Wickemeyer Beverly Hartley and Wickemeyer Roberth H

Bought by

Wickemeyer Beverly D Hartley and Wickemeyer Robert H

Purchase Details

Closed on

Jun 1, 2017

Sold by

Bauder Estate Llc

Bought by

Wickermeyer Beverly Hartley and Wickermeyer Robert

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Kirkendall Living Trust | $22,200 | Ticor Title | |

| City Of Richland | $313 | Cascade Title | |

| City Of Richland | $313 | Cascade Title | |

| Wickemeyer Robert H | $313 | None Listed On Document | |

| Aerowick Llc | $313 | None Listed On Document | |

| Wickemeyer Beverly D Hartley | -- | None Available | |

| Wickermeyer Beverly Hartley | $192,000 | Cascade Title Company |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $10,745 | $1,229,140 | $300,000 | $929,140 |

| 2023 | $10,745 | $1,157,660 | $300,000 | $857,660 |

| 2022 | $7,592 | $725,540 | $180,000 | $545,540 |

| 2021 | $7,917 | $689,170 | $180,000 | $509,170 |

| 2020 | $8,373 | $689,170 | $180,000 | $509,170 |

| 2019 | $7,373 | $689,170 | $180,000 | $509,170 |

| 2018 | $2,435 | $652,800 | $180,000 | $472,800 |

| 2017 | $2,912 | $180,000 | $180,000 | $0 |

| 2016 | $2,871 | $243,000 | $243,000 | $0 |

| 2015 | $2,926 | $243,000 | $243,000 | $0 |

| 2014 | -- | $243,000 | $243,000 | $0 |

| 2013 | -- | $243,000 | $243,000 | $0 |

Source: Public Records

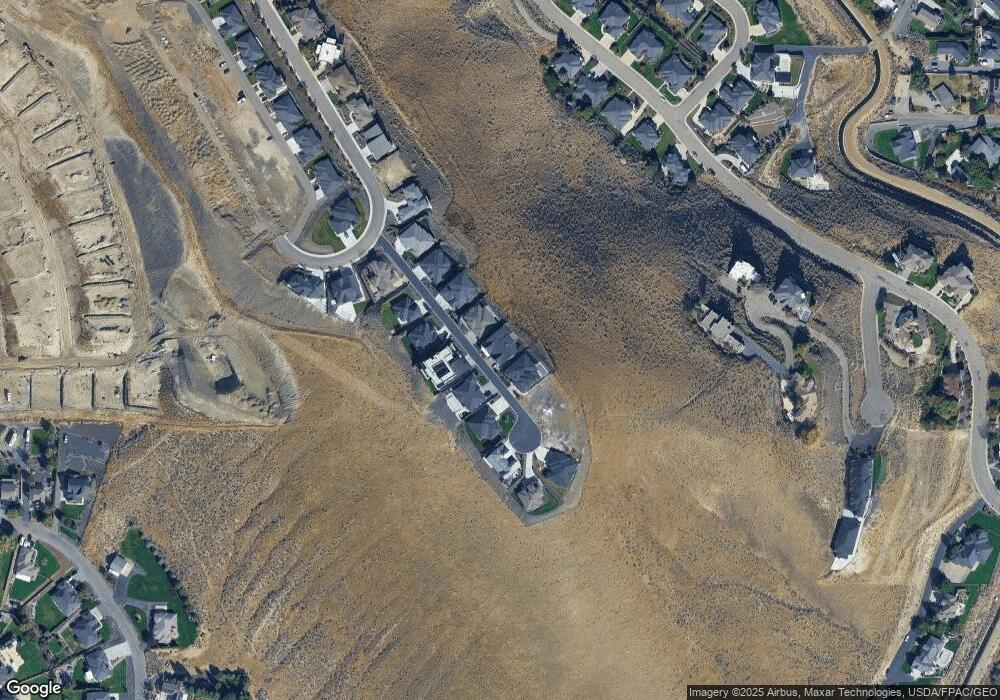

Map

Nearby Homes

- 2612 Falcon Ln

- 2612 Falcon Ln Unit UNSURPASSED VIEWS FR

- 2612 Falcon Ln Unit EXTRAORDINARY VIEWS

- 2620 Falcon Ln

- 2620 Falcon Ln Unit TOP OF THE WORLD!! C

- 2620 Falcon Ln Unit TOP OF THE WORLD VIE

- 2624 Falcon Ln

- 2608 Falcon Ln

- 2623 Falcon Ln

- 2623 Falcon Ln Unit UNSURPASSED VIEWS FR

- 2623 Falcon Ln Unit Ambience Homes - Gor

- 2619 Falcon Ln

- 2619 Falcon Ln Unit RAMBLER LOTS - TOP

- 2619 Falcon Ln Unit GATED WITH VIEWS FOR

- 2615 Falcon Ln

- 2615 Falcon Ln Unit UNSURPASSED VIEWS FR

- 2628 Falcon Ln

- 2611 Falcon Ln

- 2611 Falcon Ln Unit UNSURPASSED VIEWS FR

- 2604 Falcon Ln