26183 Raintree Blvd Olmsted Falls, OH 44138

Estimated Value: $140,000 - $162,000

2

Beds

2

Baths

1,215

Sq Ft

$124/Sq Ft

Est. Value

About This Home

This home is located at 26183 Raintree Blvd, Olmsted Falls, OH 44138 and is currently estimated at $150,290, approximately $123 per square foot. 26183 Raintree Blvd is a home located in Cuyahoga County with nearby schools including Falls-Lenox Primary Elementary School, Olmsted Falls Intermediate Building, and Olmsted Falls Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 15, 2016

Sold by

Ward Mark Arthur

Bought by

Mccafferty William G and Mccafferty Loretta A

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$57,000

Outstanding Balance

$45,559

Interest Rate

3.45%

Mortgage Type

VA

Estimated Equity

$104,731

Purchase Details

Closed on

Jul 30, 1993

Sold by

Kessinger Gregory C

Bought by

Ward Mary Ann

Purchase Details

Closed on

Jan 10, 1992

Sold by

Williams Jeanne M

Bought by

Kessinger Gregory C

Purchase Details

Closed on

Mar 9, 1982

Bought by

Williams Jeanne M

Purchase Details

Closed on

Jan 1, 1981

Bought by

Flair Corp

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Mccafferty William G | $57,000 | Attorney | |

| Ward Mary Ann | $63,000 | -- | |

| Kessinger Gregory C | $63,000 | -- | |

| Williams Jeanne M | $55,600 | -- | |

| Flair Corp | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Mccafferty William G | $57,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,756 | $44,240 | $4,095 | $40,145 |

| 2023 | $2,067 | $27,160 | $2,730 | $24,430 |

| 2022 | $2,053 | $27,160 | $2,730 | $24,430 |

| 2021 | $2,033 | $27,160 | $2,730 | $24,430 |

| 2020 | $1,791 | $21,210 | $2,140 | $19,080 |

| 2019 | $1,589 | $60,600 | $6,100 | $54,500 |

| 2018 | $1,354 | $21,210 | $2,140 | $19,080 |

| 2017 | $1,972 | $22,300 | $2,240 | $20,060 |

| 2016 | $1,261 | $22,300 | $2,240 | $20,060 |

| 2015 | $1,116 | $22,300 | $2,240 | $20,060 |

| 2014 | $1,337 | $24,790 | $2,490 | $22,300 |

Source: Public Records

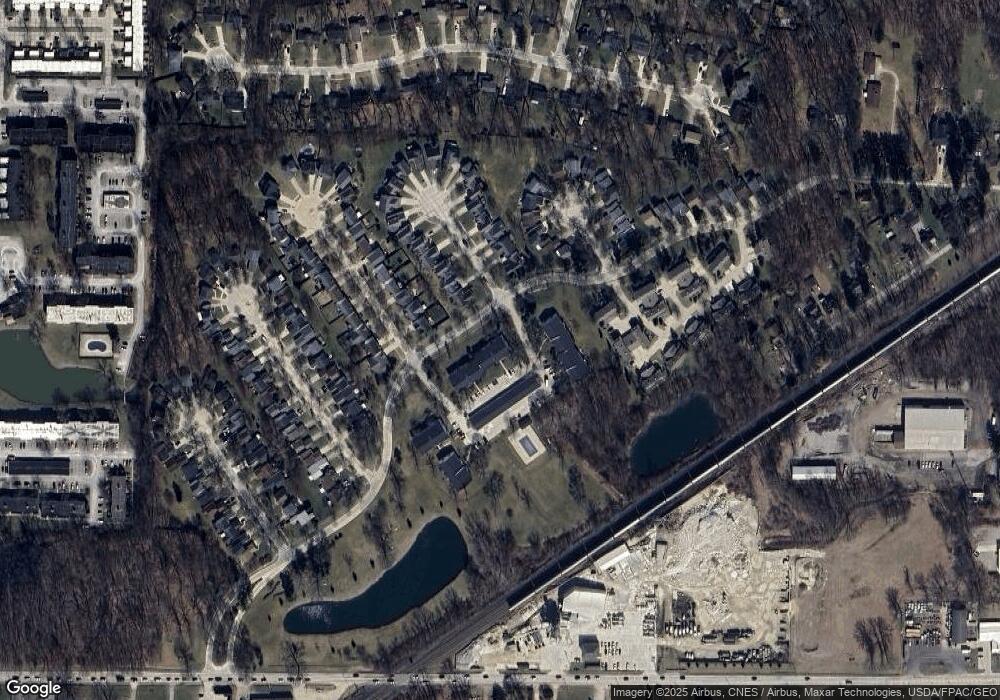

Map

Nearby Homes

- 26187 Raintree Blvd Unit C5

- 26183 Raintree Blvd Unit C-10

- 26179 Raintree Blvd Unit D8

- 9947 Magnolia Dr Unit 14

- 31100 Blooming Ln

- 26511 Locust Dr

- 26508 Redwood Dr

- 26700 Redwood Dr

- V/L Usher Rd

- Caroline Plan at Falls Landing - Villas

- Wexford Plan at Falls Landing - Villas

- Rosecliff Plan at Falls Landing - Villas

- 0 Sprague Rd

- 9159 E Windsor Dr

- 24628 Sprague Rd

- 1046 Ashford Ct

- 9112 Devonshire Dr

- Anderson Plan at Smokestack Trails

- Bramante Ranch Plan at Smokestack Trails

- Hudson Plan at Smokestack Trails

- 26183 Raintree Blvd

- 26183 Raintree Blvd Unit C16

- 26183 Raintree Blvd

- 26183 Raintree Blvd

- 26183 Raintree Blvd

- 26183 Raintree Blvd

- 26183 Raintree Blvd

- 26183 Raintree Blvd

- 26183 Raintree Blvd

- 26183 Raintree Blvd Unit C9

- 26183 Raintree Blvd Unit C-13

- 26183 Raintree Blvd Unit C15

- 26183 Raintree Blvd Unit C12

- 26183 Raintree Blvd Unit C11

- 26187 Raintree Blvd Unit C3

- 26187 Raintree Blvd

- 26187 Raintree Blvd

- 26187 Raintree Blvd

- 26187 Raintree Blvd

- 26187 Raintree Blvd Unit C1