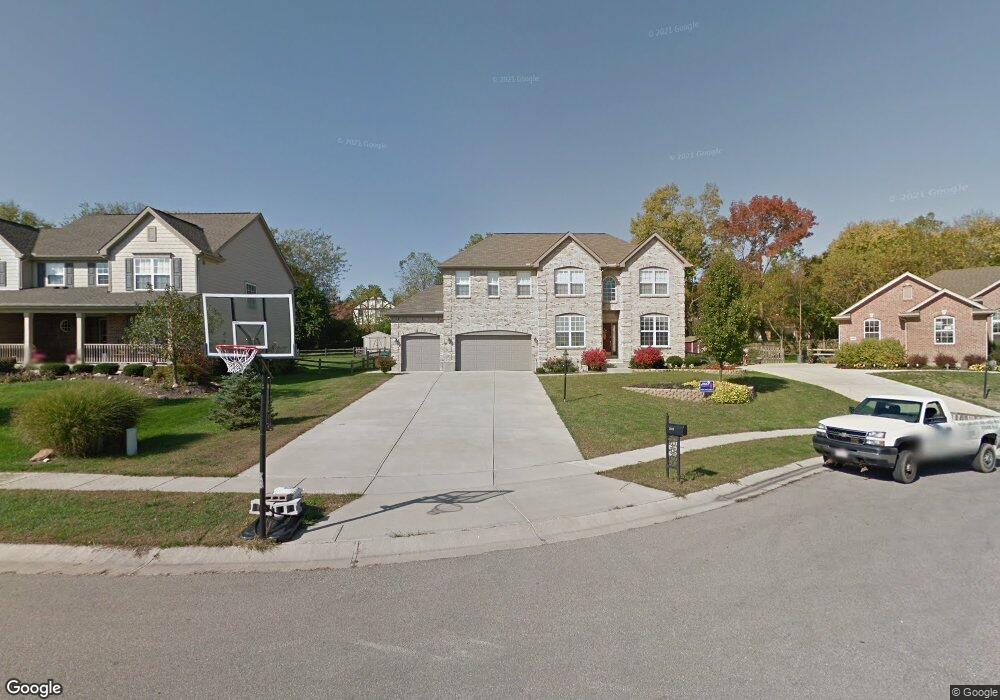

2624 Paydon Randoff Rd Beavercreek Township, OH 45434

Estimated Value: $501,133 - $578,000

4

Beds

3

Baths

2,784

Sq Ft

$190/Sq Ft

Est. Value

About This Home

This home is located at 2624 Paydon Randoff Rd, Beavercreek Township, OH 45434 and is currently estimated at $529,033, approximately $190 per square foot. 2624 Paydon Randoff Rd is a home located in Greene County with nearby schools including Trebein Elementary School, Jacob Coy Middle School, and Beavercreek High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 1, 2019

Sold by

Montgomery Michael J and Montgomery Lisa B

Bought by

Schmidt Jonathan and Schmidt Sara

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$313,500

Outstanding Balance

$274,737

Interest Rate

3.73%

Mortgage Type

New Conventional

Estimated Equity

$254,296

Purchase Details

Closed on

Jan 31, 2006

Sold by

Inverness Group Inc

Bought by

Montgomery Michael J and Montgomery Lisa B

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$253,346

Interest Rate

6.34%

Mortgage Type

Fannie Mae Freddie Mac

Purchase Details

Closed on

Sep 16, 2005

Sold by

R M Clemens Co Development

Bought by

Inverness Group Inc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$20,000,000

Interest Rate

5.93%

Mortgage Type

Unknown

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Schmidt Jonathan | $330,000 | None Available | |

| Montgomery Michael J | $316,700 | None Available | |

| Inverness Group Inc | $47,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Schmidt Jonathan | $313,500 | |

| Closed | Montgomery Michael J | $253,346 | |

| Previous Owner | Inverness Group Inc | $20,000,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $8,261 | $143,840 | $33,380 | $110,460 |

| 2023 | $8,261 | $143,840 | $33,380 | $110,460 |

| 2022 | $7,282 | $111,170 | $23,840 | $87,330 |

| 2021 | $7,355 | $111,170 | $23,840 | $87,330 |

| 2020 | $7,390 | $111,170 | $23,840 | $87,330 |

| 2019 | $7,441 | $102,800 | $20,390 | $82,410 |

| 2018 | $6,506 | $102,800 | $20,390 | $82,410 |

| 2017 | $6,438 | $102,800 | $20,390 | $82,410 |

| 2016 | $6,351 | $98,960 | $20,390 | $78,570 |

| 2015 | $6,391 | $98,960 | $20,390 | $78,570 |

| 2014 | $6,246 | $98,960 | $20,390 | $78,570 |

Source: Public Records

Map

Nearby Homes

- 2580 Paydon Randoff Rd

- 2765 Stauffer Dr

- 80 George Wythe Way

- 39 George Wythe Way

- 2847 Sky Crossing Dr

- 2847 Sky Crossing Dr Unit 48

- 2855 Sky Crossing Dr

- 2855 Sky Crossing Dr Unit 50

- 539 Goldfinch Dr Unit 135

- 539 Goldfinch Dr

- 624 Goldfinch Dr Unit 100

- 2816 Blue Jay Ct Unit 72

- 2915 Sky Crossing Dr Unit 63

- 2905 Sky Crossing Dr Unit 61

- 624 Goldfinch Dr

- 2905 Sky Crossing Dr

- 632 Goldfinch Dr

- 620 Goldfinch Dr

- 2915 Sky Crossing Dr

- 2816 Blue Jay Ct

- 2628 Paydon Randoff Rd

- 2620 Paydon Randoff Rd

- 270 Rebel Ct

- 2632 Paydon Randoff Rd

- 2616 Paydon Randoff Rd

- 2715 E Tara Trail

- 2705 E Tara Trail

- 2611 Paydon Randoff Rd

- 2636 Paydon Randoff Rd

- 2608 Paydon Randoff Rd

- 260 Rebel Ct

- 2629 Paydon Randoff Rd

- 2695 E Tara Trail

- 2598 Paydon Randoff Rd

- 2633 Paydon Randoff Rd

- 2640 Paydon Randoff Rd

- 204 James River Rd

- 265 Rebel Ct

- 2595 Paydon Randoff Rd

- 2725 E Tara Trail