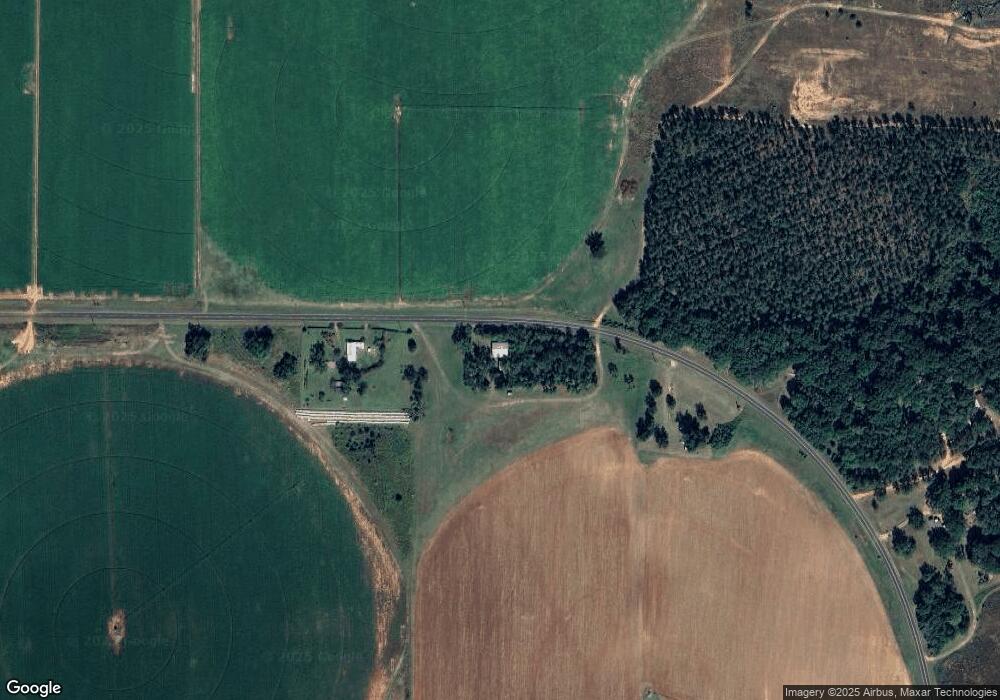

2631 Five Forks Rd Shellman, GA 39886

Estimated Value: $86,000 - $134,000

Studio

1

Bath

1,495

Sq Ft

$73/Sq Ft

Est. Value

About This Home

This home is located at 2631 Five Forks Rd, Shellman, GA 39886 and is currently estimated at $109,212, approximately $73 per square foot. 2631 Five Forks Rd is a home located in Randolph County with nearby schools including Randolph County Elementary School, Randolph Clay Middle School, and Randolph Clay High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 18, 2007

Sold by

Ps Development

Bought by

B & R Home Repair Llc

Current Estimated Value

Purchase Details

Closed on

Sep 15, 2006

Sold by

Mcdonald Donna J

Bought by

P S Development

Purchase Details

Closed on

Mar 19, 2002

Sold by

Carter Joseph L and Carter Do

Bought by

Mcdonald Donna J Car

Purchase Details

Closed on

Dec 15, 2000

Sold by

First State Bank Of

Bought by

Carter Joseph L and Carter Do

Purchase Details

Closed on

Nov 4, 1997

Sold by

Favela Juan R

Bought by

First State Bank Of

Purchase Details

Closed on

Mar 1, 1993

Bought by

Favela Juan R

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| B & R Home Repair Llc | $31,918 | -- | |

| B & R Home Repair Llc | $31,918 | -- | |

| P S Development | $28,430 | -- | |

| P S Development | $28,430 | -- | |

| Mcdonald Donna J Car | -- | -- | |

| Mcdonald Donna J Car | -- | -- | |

| Carter Joseph L | $25,000 | -- | |

| Carter Joseph L | $25,000 | -- | |

| First State Bank Of | -- | -- | |

| First State Bank Of | -- | -- | |

| Favela Juan R | $18,000 | -- | |

| Favela Juan R | $18,000 | -- |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,134 | $26,120 | $4,000 | $22,120 |

| 2023 | $984 | $26,120 | $4,000 | $22,120 |

| 2022 | $924 | $26,120 | $4,000 | $22,120 |

| 2021 | $609 | $16,956 | $4,010 | $12,946 |

| 2020 | $627 | $16,956 | $4,010 | $12,946 |

| 2019 | $625 | $16,956 | $4,010 | $12,946 |

| 2018 | $599 | $16,956 | $4,010 | $12,946 |

| 2017 | $601 | $16,956 | $4,010 | $12,946 |

| 2016 | $531 | $14,916 | $1,970 | $12,946 |

| 2015 | -- | $14,916 | $1,970 | $12,946 |

| 2014 | -- | $11,020 | $1,970 | $9,049 |

| 2013 | -- | $11,019 | $1,970 | $9,049 |

Source: Public Records

Map

Nearby Homes

- 3109 Calhoun St

- 48 Cheney St

- 0 Carver St

- 5147 Doverel Hwy

- Sam Bentley Rd

- 3418 New Hope Trail

- Pierce Rd

- 13XX Graves Hwy

- 00 Hwy 41

- 300 Five Forks Rd

- 145 Pearson Dr SW

- 361/552 NW Tenth Ave

- 229 7th Ave NW

- 226 N Main St

- 414 2nd Ave SE

- 411 E Lee St

- 527 Orange St NE

- 567 E Lee St

- 550 Orange St NE

- 707 Johnson St SE

Your Personal Tour Guide

Ask me questions while you tour the home.