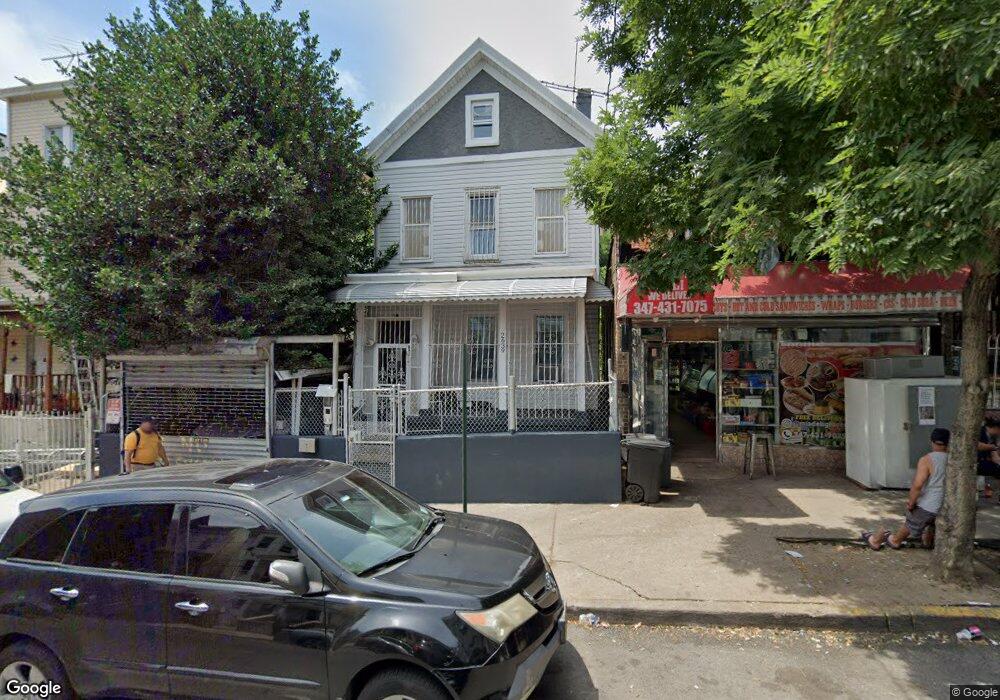

2639 Decatur Ave Unit 3 Bronx, NY 10458

Fordham Manor NeighborhoodEstimated Value: $594,000 - $842,000

2

Beds

2

Baths

900

Sq Ft

$819/Sq Ft

Est. Value

About This Home

This home is located at 2639 Decatur Ave Unit 3, Bronx, NY 10458 and is currently estimated at $737,336, approximately $819 per square foot. 2639 Decatur Ave Unit 3 is a home located in Bronx County with nearby schools including P.S. I.S. 54 and Thomas C Giordano Middleschool 45.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 21, 2022

Sold by

2639 Decatur Llc

Bought by

Rodriguez Zumilda Estevez

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$718,741

Outstanding Balance

$687,708

Interest Rate

5.78%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$49,628

Purchase Details

Closed on

Mar 13, 2020

Sold by

Rosario As Surviving Spouse Isaias

Bought by

2639 Decatur Llc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$255,000

Interest Rate

3.4%

Mortgage Type

Unknown

Purchase Details

Closed on

Mar 19, 2002

Sold by

Rosario Isaias

Bought by

Rosario Angelica and Rosario Isaias

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Rodriguez Zumilda Estevez | $732,000 | -- | |

| 2639 Decatur Llc | $285,000 | -- | |

| Rosario Angelica | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Rodriguez Zumilda Estevez | $718,741 | |

| Previous Owner | 2639 Decatur Llc | $255,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,973 | $20,098 | $4,463 | $15,635 |

| 2024 | $3,973 | $19,781 | $5,037 | $14,744 |

| 2023 | $3,790 | $18,662 | $4,598 | $14,064 |

| 2022 | $3,547 | $33,300 | $8,220 | $25,080 |

| 2021 | $3,528 | $27,060 | $8,220 | $18,840 |

| 2020 | $3,545 | $27,960 | $8,220 | $19,740 |

| 2019 | $3,155 | $25,140 | $8,220 | $16,920 |

| 2018 | $2,873 | $15,552 | $5,097 | $10,455 |

| 2017 | $2,719 | $14,808 | $5,297 | $9,511 |

| 2016 | $2,483 | $13,971 | $5,580 | $8,391 |

| 2015 | $1,465 | $13,957 | $5,116 | $8,841 |

| 2014 | $1,465 | $13,737 | $6,046 | $7,691 |

Source: Public Records

Map

Nearby Homes

- 2611 Decatur Ave

- 2640 Marion Ave Unit 4E

- 2640 Marion Ave Unit 6H

- 350 E 193rd St

- 2670 Marion Ave

- 2661 Marion Ave Unit 1H

- 2661 Marion Ave Unit 3C

- 2661 Marion Ave Unit 5A

- 2675 Marion Ave

- 2696 Marion Ave

- 2677 Marion Ave

- 2703 Bainbridge Ave

- 2655 Briggs Ave

- 2503 Marion Ave

- 2779 Marion Ave

- 2798 Pond Place

- 398 Oliver Place Unit 6G

- 398 Oliver Place Unit 1A

- 2830 Briggs Ave Unit WIA

- 2830 Briggs Ave Unit 5B

- 2639 Decatur Ave

- 373 E 194th St

- 369 E 194th St

- 365 E 194th St

- 363 E 194th St

- 2641 Decatur Ave

- 361 E 194th St

- 2649 Decatur Ave

- 2636 Decatur Ave

- 2634 Decatur Ave

- 2638-2640 Decatur Ave

- 2632 Decatur Ave

- 2638 Decatur Ave Unit 2640

- 2630 Decatur Ave

- 2613 Decatur Ave

- 2613 Decatur Ave Unit 1

- 2613 Decatur Ave Unit 2

- 368 E 194 St

- 2653 Decatur Ave

- 355 E 194th St